Growth in Chemical Processing

The chemical processing industry in North America is experiencing robust growth, which significantly impacts the dosing pump market. With an estimated market value of $700 billion, the sector requires precise dosing solutions for various applications, including the production of fertilizers, plastics, and pharmaceuticals. Dosing pumps are essential for maintaining the accuracy and consistency of chemical mixtures, thereby enhancing product quality. As manufacturers seek to optimize production processes and reduce waste, the adoption of advanced dosing technologies is expected to increase, driving further demand for dosing pumps.

Expansion of Oil and Gas Sector

The oil and gas sector in North America is witnessing a resurgence, which is likely to influence the dosing pump market positively. With crude oil prices stabilizing, investments in exploration and production activities are on the rise. Dosing pumps are critical in various applications, such as chemical injection for enhanced oil recovery and pipeline maintenance. The sector's projected growth, estimated at $200 billion by 2027, suggests a sustained demand for reliable dosing solutions. As companies prioritize efficiency and safety, the role of dosing pumps in optimizing operations becomes increasingly vital.

Rising Demand in Water Treatment

The increasing focus on water quality and safety in North America drives the dosing pump market. Municipalities and industries are investing heavily in water treatment facilities to meet stringent regulations. This trend is reflected in the projected growth of the water treatment sector, which is expected to reach $100 billion by 2026. Dosing pumps play a crucial role in accurately delivering chemicals for disinfection and pH adjustment, ensuring compliance with health standards. As water scarcity becomes a pressing issue, the demand for efficient dosing solutions is likely to rise, further propelling the dosing pump market.

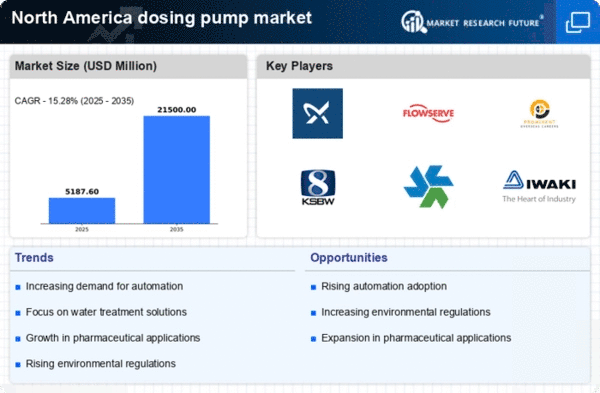

Rising Environmental Regulations

The tightening of environmental regulations in North America is a significant driver for the dosing pump market. Industries are increasingly required to minimize their environmental impact, leading to a greater emphasis on accurate chemical dosing for waste treatment and emissions control. The market for environmental compliance technologies is expected to reach $50 billion by 2025, highlighting the growing need for effective dosing solutions. Dosing pumps are essential for ensuring that industries meet these regulations while maintaining operational efficiency. As compliance becomes more stringent, the demand for reliable dosing pumps is likely to increase.

Increased Focus on Industrial Automation

The trend towards industrial automation in North America is reshaping the dosing pump market. As manufacturers adopt smart technologies and IoT solutions, the need for automated dosing systems is becoming more pronounced. These systems enhance precision, reduce human error, and improve operational efficiency. The automation market is projected to grow at a CAGR of 9% through 2028, indicating a strong potential for dosing pump integration. Companies are likely to invest in advanced dosing solutions that can seamlessly integrate with existing automated systems, thereby driving growth in the dosing pump market.