Expansion of Retail Channels

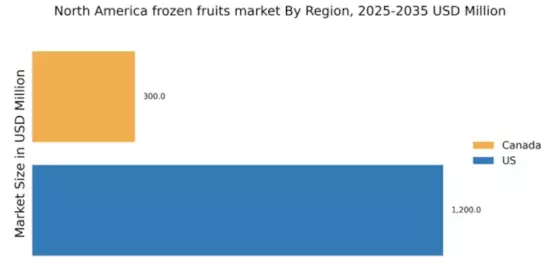

The frozen fruits market benefits from the expansion of retail channels, particularly in North America. Traditional grocery stores, specialty health food stores, and online platforms are increasingly offering a diverse range of frozen fruit products. This expansion enhances accessibility for consumers, allowing them to easily find and purchase frozen fruits. Recent statistics reveal that online grocery sales have surged, with e-commerce accounting for nearly 20% of total grocery sales in 2025. This shift towards online shopping presents a significant opportunity for the frozen fruits market to reach a broader audience and cater to changing consumer preferences.

Innovative Product Development

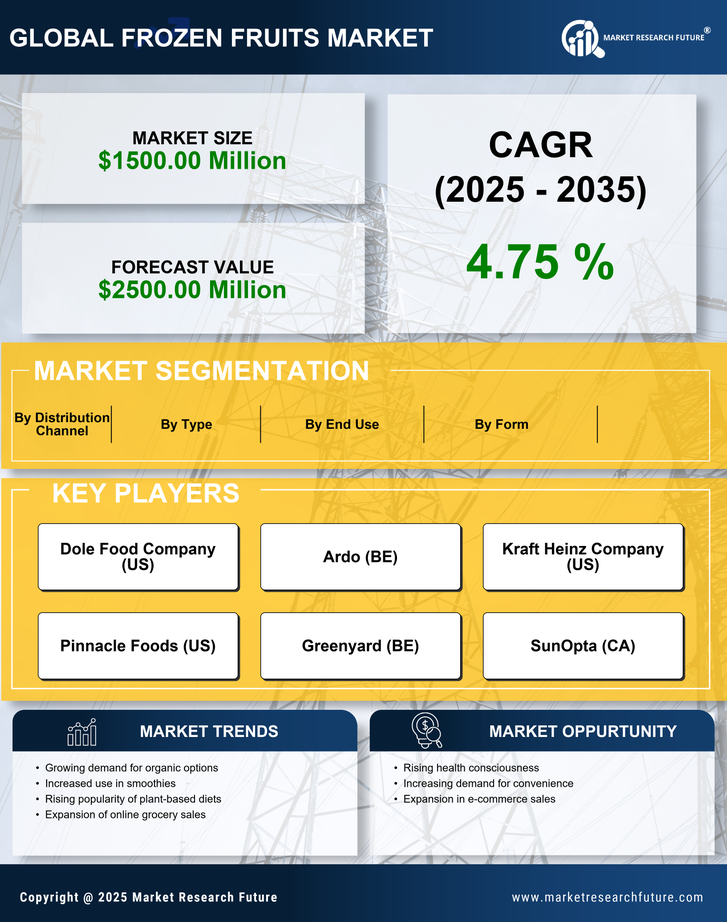

Innovation plays a pivotal role in the frozen fruits market, as companies continuously seek to develop new and exciting products. This includes the introduction of unique fruit blends, organic options, and value-added products such as frozen fruit bars and smoothies. The market for frozen fruits is projected to grow at a CAGR of around 5% over the next five years, driven by consumer interest in novel offerings. Additionally, the incorporation of superfoods and functional ingredients into frozen fruit products aligns with the growing trend of health and wellness. As a result, innovative product development is likely to remain a key driver for the frozen fruits market.

Growing Popularity of Plant-Based Diets

The frozen fruits market is significantly influenced by the rising popularity of plant-based diets. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-based ingredients, including frozen fruits, continues to grow. Data suggests that the plant-based food market is expected to reach approximately $74 billion by 2027, indicating a robust trend towards plant-based consumption. Frozen fruits serve as a versatile ingredient in various plant-based recipes, appealing to health-conscious consumers. This trend not only supports the growth of the frozen fruits market but also aligns with the broader movement towards healthier eating habits.

Increased Focus on Sustainable Practices

Sustainability has emerged as a critical driver within the frozen fruits market. Consumers are increasingly concerned about environmental impacts, prompting brands to adopt eco-friendly practices. This includes sourcing fruits from sustainable farms and utilizing environmentally friendly packaging. Recent surveys indicate that around 60% of consumers are willing to pay a premium for products that are sustainably sourced. This shift towards sustainability not only enhances brand loyalty but also attracts environmentally conscious consumers. As a result, companies within the frozen fruits market are likely to invest in sustainable practices, which could lead to a competitive advantage in the marketplace.

Rising Demand for Convenient Food Options

The frozen fruits market experiences a notable surge in demand for convenient food options. As lifestyles become increasingly fast-paced, consumers in North America seek quick and easy meal solutions. Frozen fruits offer a practical alternative, allowing for effortless incorporation into smoothies, desserts, and snacks. According to recent data, the convenience food sector is projected to grow at a CAGR of approximately 4.5% over the next five years. This trend indicates a strong preference for ready-to-use products, which aligns with the offerings of the frozen fruits market. Additionally, the growing awareness of the nutritional benefits of fruits further drives this demand, as consumers prioritize health without sacrificing convenience.