Focus on Preventive Healthcare

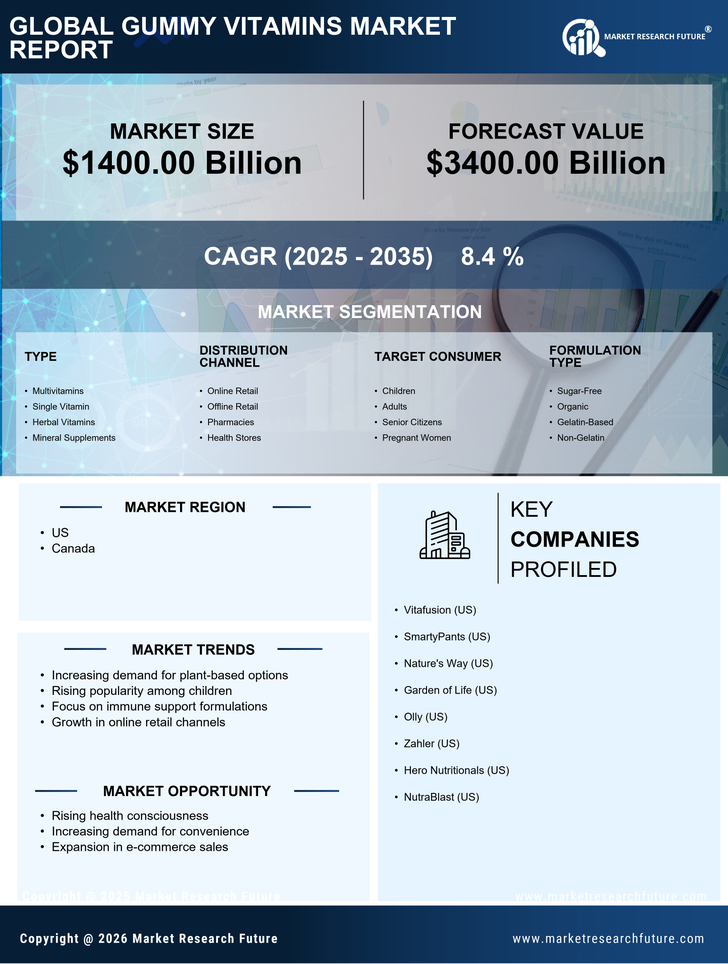

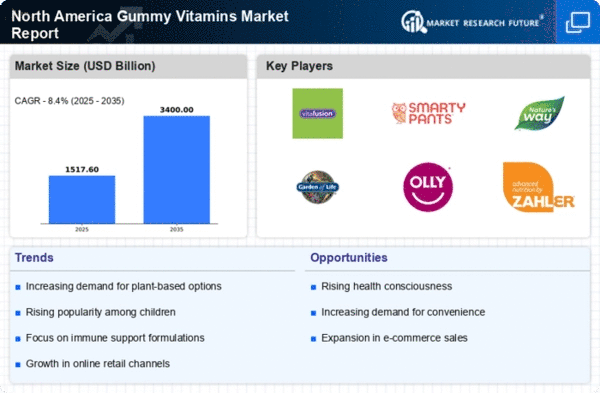

The growing focus on preventive healthcare is emerging as a significant driver for the gummy vitamins market in North America. Consumers are increasingly prioritizing wellness and preventive measures to avoid health issues before they arise. This proactive approach to health is reflected in the rising demand for supplements that support immune function, energy levels, and overall well-being. The gummy vitamins market is responding to this trend by developing products that cater to these preventive health needs. Recent market analysis suggests that the demand for immune-boosting gummy vitamins has surged by 25% in the past year, indicating a strong consumer preference for products that promote health maintenance rather than just treatment.

Health Consciousness Among Consumers

The increasing health consciousness among consumers in North America appears to be a primary driver for the gummy vitamins market. As individuals become more aware of the importance of nutrition and wellness, they are actively seeking convenient and enjoyable ways to supplement their diets. This trend is reflected in the growing sales of gummy vitamins, which have seen a rise of approximately 20% in the last year alone. Consumers are gravitating towards products that not only provide essential vitamins and minerals but also align with their lifestyle choices, such as organic and non-GMO options. The gummy vitamins market is thus benefiting from this shift, as manufacturers innovate to meet the demands of health-focused consumers.

Aging Population and Nutritional Needs

The aging population in North America is contributing significantly to the growth of the gummy vitamins market. As individuals age, their nutritional needs evolve, often requiring additional vitamins and minerals to maintain health. Gummy vitamins offer a palatable alternative to traditional supplements, making them particularly appealing to older adults who may have difficulty swallowing pills. Recent data indicates that the segment of consumers aged 50 and above has increased their consumption of gummy vitamins by 15% over the past year. This demographic shift suggests that the gummy vitamins market is well-positioned to cater to the specific health requirements of an aging population, thereby driving further growth.

Rise of E-commerce and Online Shopping

The rise of e-commerce and online shopping platforms is transforming the gummy vitamins market in North America. With the convenience of purchasing products from home, consumers are increasingly turning to online retailers for their vitamin needs. This shift has led to a notable increase in sales, with online sales of gummy vitamins growing by approximately 30% in the last year. E-commerce platforms provide consumers with access to a wider variety of products, including niche and specialty gummy vitamins that may not be available in traditional retail stores. As online shopping continues to gain traction, the gummy vitamins market is likely to experience sustained growth, driven by the ease of access and the ability to compare products.

Influence of Social Media and Health Trends

The influence of social media and health trends is playing a crucial role in shaping consumer preferences within the gummy vitamins market. Platforms such as Instagram and TikTok are inundated with health influencers promoting various gummy vitamin products, which has led to increased visibility and consumer interest. This trend is particularly evident among younger demographics, who are more likely to engage with health-related content online. Recent surveys indicate that nearly 40% of consumers aged 18-34 have purchased gummy vitamins based on social media recommendations. As social media continues to drive health trends, the gummy vitamins market is expected to capitalize on this phenomenon, potentially leading to increased sales and brand loyalty.