Corporate Sustainability Goals

Many corporations in North America are adopting ambitious sustainability goals, which is positively impacting the hydrogen electrolyzer market. Companies are increasingly recognizing the importance of reducing their carbon footprints and transitioning to cleaner energy sources. As a result, there is a growing demand for hydrogen as a clean fuel alternative. In 2025, it is estimated that over 60% of Fortune 500 companies will have set specific targets for carbon neutrality, driving the need for hydrogen production through electrolyzers. This trend not only supports the growth of the hydrogen electrolyzer market but also encourages innovation in electrolyzer technology to meet corporate sustainability objectives.

Rising Investment in Renewable Energy

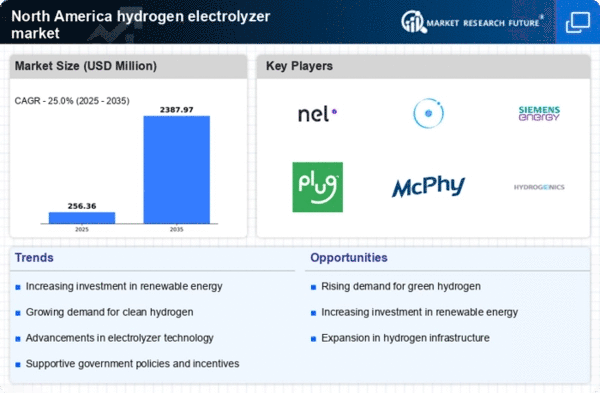

The hydrogen electrolyzer market in North America is experiencing a surge in investment driven by the increasing focus on renewable energy sources. As governments and private entities allocate substantial funds towards clean energy initiatives, the market is projected to grow significantly. In 2025, investments in renewable energy technologies are expected to reach approximately $100 billion, with a notable portion directed towards hydrogen production. This influx of capital not only enhances research and development efforts but also facilitates the deployment of advanced electrolyzer technologies. Consequently, the hydrogen electrolyzer market is poised to benefit from enhanced production capabilities and reduced costs, making hydrogen a more viable alternative to fossil fuels.

Infrastructure Development Initiatives

The hydrogen electrolyzer market is benefiting from ongoing infrastructure development initiatives across North America. Governments are investing in the necessary infrastructure to support hydrogen production, storage, and distribution. In 2025, it is anticipated that federal and state governments will allocate over $15 billion towards hydrogen infrastructure projects. This investment is expected to enhance the accessibility and reliability of hydrogen as an energy source, thereby stimulating demand for electrolyzers. As infrastructure improves, the hydrogen electrolyzer market is likely to see increased adoption rates, as businesses and consumers gain confidence in the availability of hydrogen fuel.

Technological Innovations in Electrolyzer Design

Technological innovations are playing a crucial role in shaping the hydrogen electrolyzer market in North America. Recent advancements in electrolyzer design, such as the development of more efficient and cost-effective systems, are driving market growth. For instance, new materials and designs are being explored to enhance the efficiency of proton exchange membrane (PEM) electrolyzers. In 2025, it is projected that the efficiency of electrolyzers will improve by approximately 20%, making hydrogen production more economically viable. These innovations not only lower production costs but also increase the competitiveness of hydrogen as a clean energy source, further propelling the hydrogen electrolyzer market.

Regulatory Frameworks Promoting Hydrogen Adoption

The regulatory landscape in North America is evolving to promote the adoption of hydrogen technologies, significantly impacting the hydrogen electrolyzer market. New policies and regulations are being introduced to incentivize the use of hydrogen as a clean energy source. For example, tax credits and subsidies for hydrogen production are becoming more common, encouraging investment in electrolyzer technologies. By 2025, it is expected that regulatory frameworks will lead to a 30% increase in hydrogen production capacity, thereby enhancing the market for electrolyzers. This supportive regulatory environment is likely to foster innovation and drive down costs, making hydrogen a more attractive option for energy production.