Growing Awareness of Energy Security

The Pem Water Electrolyzer Market is increasingly influenced by the growing awareness of energy security among nations. As geopolitical tensions and supply chain vulnerabilities become more pronounced, countries are recognizing the importance of diversifying their energy sources. Hydrogen, particularly when produced through PEM electrolysis, offers a pathway to energy independence. This shift is prompting investments in hydrogen production technologies, with many nations aiming to establish domestic hydrogen production capabilities. The market is likely to benefit from this trend, as energy security concerns drive demand for reliable and sustainable hydrogen solutions.

Government Incentives and Support Programs

Government incentives and support programs are playing a crucial role in the growth of the Pem Water Electrolyzer Market. Many countries are implementing financial incentives, grants, and subsidies to encourage the adoption of hydrogen technologies. These initiatives aim to lower the barriers to entry for businesses looking to invest in PEM electrolyzers. For instance, funding for research and development in hydrogen technologies has seen a significant increase, with some nations allocating millions in support. Such measures are expected to enhance market penetration and stimulate innovation within the industry, ultimately leading to a more sustainable energy landscape.

Rising Industrial Applications of Hydrogen

The Pem Water Electrolyzer Market is witnessing a surge in the industrial applications of hydrogen, particularly in sectors such as chemicals, refining, and transportation. As industries seek to decarbonize their operations, hydrogen produced via PEM electrolysis is becoming a preferred choice due to its versatility and clean-burning properties. The market for hydrogen in industrial applications is projected to reach several billion dollars by 2030, indicating a robust demand for PEM electrolyzers. This trend is further supported by the increasing adoption of hydrogen fuel cells in transportation, which is likely to drive the need for efficient hydrogen production technologies.

Increasing Focus on Renewable Energy Sources

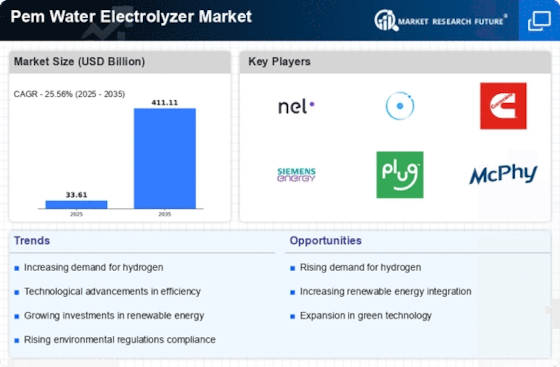

The Pem Water Electrolyzer Market is experiencing a notable shift towards renewable energy sources, driven by the urgent need to reduce carbon emissions. Governments and organizations are increasingly investing in clean energy technologies, which include hydrogen production through electrolysis. This transition is supported by various policies aimed at promoting sustainable energy solutions. As a result, the demand for PEM electrolyzers is expected to rise, with projections indicating a compound annual growth rate of over 20% in the coming years. This trend reflects a broader commitment to achieving net-zero emissions targets, thereby enhancing the market's growth potential.

Technological Innovations in Electrolyzer Design

Recent advancements in the design and efficiency of PEM electrolyzers are significantly influencing the Pem Water Electrolyzer Market. Innovations such as improved membrane materials and enhanced catalyst formulations are leading to higher efficiency and lower operational costs. These technological improvements not only increase the overall performance of electrolyzers but also make them more attractive for large-scale hydrogen production. Market data suggests that the efficiency of PEM electrolyzers has improved by approximately 15% over the past few years, which is likely to further stimulate market growth as industries seek cost-effective solutions for hydrogen generation.