Government Initiatives and Incentives

Government initiatives and incentives play a pivotal role in the Polymer Electrolyte Membrane Pem Fuel Cells Market. Various countries are implementing policies that promote the use of hydrogen fuel cells, including subsidies, tax breaks, and research funding. For instance, several nations have established hydrogen roadmaps that outline strategies for integrating fuel cell technology into their energy systems. These initiatives not only enhance the market's attractiveness but also stimulate research and development efforts. As a result, the Polymer Electrolyte Membrane Pem Fuel Cells Market is likely to witness accelerated growth, as these supportive measures encourage both manufacturers and consumers to adopt fuel cell technologies.

Rising Investment in Hydrogen Economy

The Polymer Electrolyte Membrane Pem Fuel Cells Market is benefiting from rising investments in the hydrogen economy. As industries and governments recognize the potential of hydrogen as a clean energy carrier, funding for hydrogen production, storage, and distribution is increasing. This investment is crucial for developing the necessary infrastructure to support fuel cell technologies. The market is projected to see substantial growth as more stakeholders enter the hydrogen sector, aiming to capitalize on its potential. Consequently, the Polymer Electrolyte Membrane Pem Fuel Cells Market is likely to thrive as the hydrogen economy matures and expands.

Growing Applications Across Various Sectors

The Polymer Electrolyte Membrane Pem Fuel Cells Market is witnessing a diversification of applications across various sectors. Fuel cells are increasingly being utilized in transportation, portable power, and stationary energy generation. The automotive sector, in particular, is seeing a rise in fuel cell electric vehicles, which are gaining traction as a viable alternative to traditional combustion engines. Additionally, the use of fuel cells in backup power systems for critical infrastructure is becoming more prevalent. This broadening of applications is expected to drive demand and innovation within the Polymer Electrolyte Membrane Pem Fuel Cells Market, as more industries seek to leverage the benefits of fuel cell technology.

Increasing Demand for Clean Energy Solutions

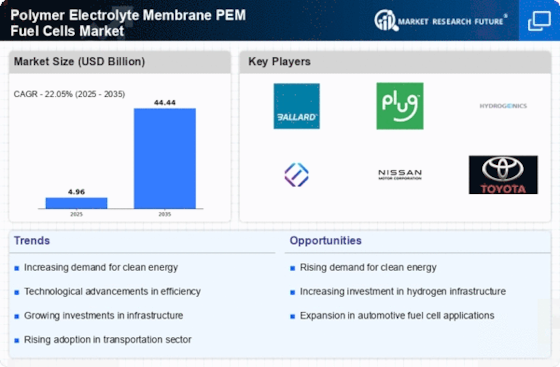

The Polymer Electrolyte Membrane Pem Fuel Cells Market is experiencing a surge in demand for clean energy solutions. As nations strive to meet stringent environmental regulations and reduce greenhouse gas emissions, the adoption of fuel cell technology is becoming increasingly attractive. The market is projected to grow at a compound annual growth rate of approximately 20% over the next five years, driven by the need for sustainable energy sources. This shift towards cleaner energy is not only a response to climate change but also aligns with the global push for energy independence. Consequently, the Polymer Electrolyte Membrane Pem Fuel Cells Market is positioned to benefit from this growing trend, as more industries and governments invest in fuel cell technologies to achieve their sustainability goals.

Technological Innovations in Fuel Cell Design

Technological innovations are transforming the Polymer Electrolyte Membrane Pem Fuel Cells Market. Recent advancements in materials science and engineering have led to the development of more efficient and durable fuel cells. Innovations such as improved membrane materials and enhanced catalyst performance are contributing to higher energy densities and lower costs. These advancements are crucial for expanding the application of fuel cells in various sectors, including transportation and stationary power generation. As technology continues to evolve, the Polymer Electrolyte Membrane Pem Fuel Cells Market is expected to expand, driven by the increasing efficiency and affordability of fuel cell systems.