Supportive Regulatory Frameworks

The Hydrogen Electrolyzers Market benefits from supportive regulatory frameworks that promote the adoption of hydrogen technologies. Governments worldwide are implementing policies and incentives aimed at reducing greenhouse gas emissions and fostering the development of hydrogen infrastructure. For instance, several countries have introduced subsidies and tax incentives for hydrogen production, which directly impacts the growth of the electrolyzer market. The European Union's Hydrogen Strategy, which aims to produce up to 10 million tons of renewable hydrogen by 2030, exemplifies such initiatives. These regulatory measures not only enhance the economic viability of hydrogen projects but also stimulate investments in the Hydrogen Electrolyzers Market, thereby accelerating the transition to a low-carbon economy.

Increased Focus on Energy Security

The Hydrogen Electrolyzers Market is increasingly influenced by the global focus on energy security, as nations seek to diversify their energy sources. The volatility of fossil fuel markets has prompted governments to explore alternative energy solutions, with hydrogen emerging as a viable option. By investing in hydrogen production through electrolyzers, countries can reduce their dependence on imported fuels and enhance their energy resilience. This strategic shift is reflected in various national energy policies that prioritize hydrogen development. As a result, the Hydrogen Electrolyzers Market is likely to witness accelerated growth, driven by the need for energy independence and the desire to create a more sustainable energy landscape.

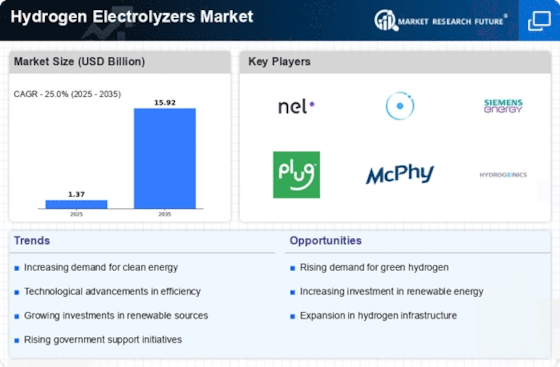

Rising Demand for Clean Energy Solutions

The Hydrogen Electrolyzers Market is experiencing a surge in demand for clean energy solutions, driven by the global shift towards sustainability. As countries strive to meet their carbon neutrality goals, the need for hydrogen as a clean fuel source becomes increasingly apparent. According to recent estimates, the hydrogen market could reach a value of over 200 billion by 2030, with electrolyzers playing a crucial role in this transition. This rising demand is not only fostering innovation within the Hydrogen Electrolyzers Market but also encouraging investments in research and development. Companies are focusing on enhancing the efficiency and reducing the costs of electrolyzers, which could potentially lead to wider adoption across various sectors, including transportation, industrial processes, and energy storage.

Growing Investment in Hydrogen Infrastructure

Investment in hydrogen infrastructure is a key driver for the Hydrogen Electrolyzers Market, as it lays the groundwork for widespread hydrogen adoption. As countries recognize the potential of hydrogen as a clean energy carrier, significant funding is being allocated to develop production, storage, and distribution networks. For instance, the establishment of hydrogen refueling stations and pipelines is essential for facilitating the use of hydrogen in transportation and industrial applications. Reports indicate that investments in hydrogen infrastructure could exceed 300 billion by 2030, which would significantly enhance the market landscape for electrolyzers. This influx of capital not only supports the growth of the Hydrogen Electrolyzers Market but also encourages collaboration among stakeholders, including governments, private companies, and research institutions.

Technological Innovations in Electrolyzer Design

Technological innovations are reshaping the Hydrogen Electrolyzers Market, with advancements in electrolyzer design leading to improved efficiency and lower operational costs. Recent developments in proton exchange membrane (PEM) and alkaline electrolyzers have shown promising results, with efficiencies exceeding 80%. These innovations are crucial as they enhance the competitiveness of hydrogen production against traditional fossil fuel methods. Furthermore, the integration of advanced materials and automation technologies is expected to streamline production processes, potentially reducing the cost of electrolyzers by up to 30% in the coming years. Such advancements not only bolster the Hydrogen Electrolyzers Market but also pave the way for increased adoption in various applications, including energy storage and industrial hydrogen production.