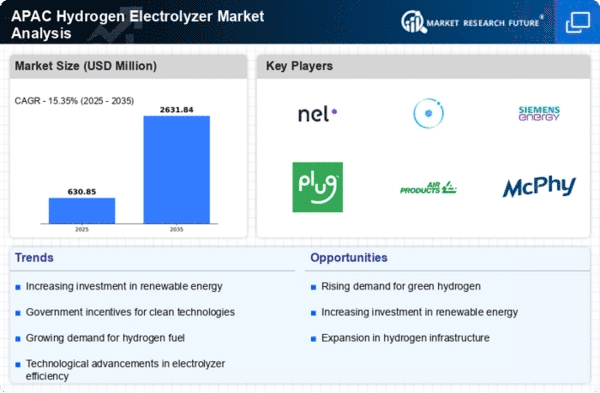

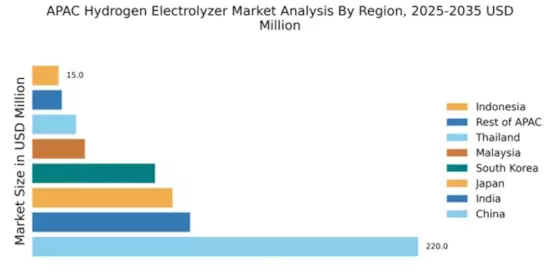

China : Robust Growth Driven by Policy Support

Key markets include cities like Shanghai, Beijing, and Shenzhen, where industrial clusters are rapidly adopting hydrogen technologies. The competitive landscape features major players like Nel Hydrogen and Siemens Energy, which are establishing local partnerships. The business environment is favorable, with increasing collaboration between public and private sectors. Applications span across energy storage, fuel cells, and industrial processes, positioning China as a leader in the hydrogen economy.

India : Government Initiatives Fueling Growth

Key markets include states like Gujarat and Maharashtra, where industrial hubs are focusing on hydrogen applications. The competitive landscape features players like ITM Power and Air Products, which are exploring joint ventures. The business environment is becoming increasingly conducive, with favorable policies attracting investments. Applications in sectors such as steel manufacturing and public transport are gaining traction, enhancing India's hydrogen landscape.

Japan : Pioneering Technology and Infrastructure

Key markets include Tokyo and Fukuoka, where hydrogen initiatives are being implemented. The competitive landscape features major players like Plug Power and McPhy Energy, which are advancing hydrogen technologies. The business environment is characterized by collaboration between government and industry, fostering innovation. Applications in public transport and residential energy systems are expanding, positioning Japan as a leader in hydrogen technology.

South Korea : Strong Government Support and Investment

Key markets include Ulsan and Seoul, where hydrogen projects are being prioritized. The competitive landscape includes players like Siemens Energy and Hydrogenics, which are actively participating in local projects. The business environment is favorable, with increasing public-private partnerships. Applications in transportation and industrial processes are expanding, contributing to South Korea's hydrogen ambitions.

Malaysia : Strategic Initiatives for Development

Key markets include Kuala Lumpur and Penang, where pilot projects are being launched. The competitive landscape is still developing, with players like Nel Hydrogen beginning to establish a presence. The business environment is evolving, with government support attracting investments. Applications in public transport and energy generation are being explored, positioning Malaysia as a future player in the hydrogen market.

Thailand : Focus on Renewable Energy Integration

Key markets include Bangkok and Chonburi, where hydrogen projects are being initiated. The competitive landscape is emerging, with companies like Air Products exploring opportunities. The business environment is becoming more favorable, with government incentives attracting investments. Applications in energy storage and transportation are being prioritized, enhancing Thailand's hydrogen landscape.

Indonesia : Exploring Renewable Energy Solutions

Key markets include Jakarta and Surabaya, where interest in hydrogen projects is emerging. The competitive landscape is limited, with few players currently active. The business environment is evolving, with government interest attracting initial investments. Applications in energy generation and industrial processes are being explored, setting the stage for future growth in Indonesia's hydrogen market.

Rest of APAC : Emerging Markets and Innovations

Key markets include Vietnam and the Philippines, where initial hydrogen projects are being launched. The competitive landscape is varied, with local and international players exploring opportunities. The business environment is becoming more conducive, with government support attracting investments. Applications in renewable energy and industrial processes are being prioritized, contributing to the overall growth of the hydrogen market in the region.