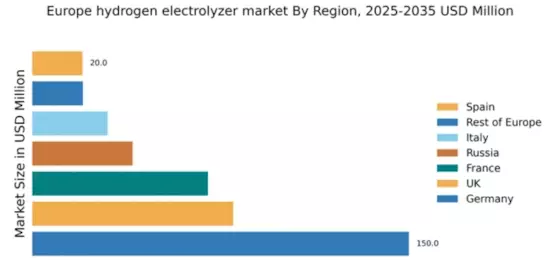

Germany : Strong Infrastructure and Innovation Hub

Germany holds a commanding market share of 150.0, representing a significant portion of Europe's hydrogen electrolyzer market. Key growth drivers include robust government policies promoting green hydrogen, substantial investments in renewable energy, and a strong industrial base. Demand is surging due to the automotive sector's shift towards hydrogen fuel cells and the push for decarbonization. The German government has implemented initiatives like the National Hydrogen Strategy, aiming to establish a comprehensive hydrogen economy, supported by advanced infrastructure and technology development.

UK : Government Support Fuels Growth

The UK holds a market share of 80.0, driven by government initiatives such as the Hydrogen Strategy, which aims to produce 5 GW of low carbon hydrogen by 2030. Demand is increasing in sectors like transportation and energy, with a focus on decarbonizing heavy industries. The UK is also witnessing a rise in public-private partnerships to enhance hydrogen infrastructure, particularly in regions like Scotland and the North East, where renewable energy resources are abundant.

France : Innovative Policies and Investments

With a market share of 70.0, France is rapidly advancing in the hydrogen electrolyzer market. The French government has set ambitious targets to produce 6.5 GW of green hydrogen by 2030, supported by significant funding and regulatory frameworks. Demand is particularly strong in the transport and industrial sectors, with cities like Marseille and Lyon leading the charge. The competitive landscape includes key players like McPhy Energy and Air Liquide, fostering a vibrant ecosystem for hydrogen technologies.

Russia : Strategic Resources and Development Plans

Russia's hydrogen electrolyzer market, valued at 40.0, is gaining traction as the government explores hydrogen as a key export commodity. The country is rich in natural resources, providing a unique opportunity for hydrogen production. Demand is expected to rise in energy-intensive industries, with regions like Siberia and the Far East being focal points for development. The competitive landscape is evolving, with local players beginning to invest in hydrogen technologies to meet both domestic and international needs.

Italy : Focus on Renewable Energy Integration

Italy's market share stands at 30.0, driven by a strong commitment to renewable energy integration. The Italian government has launched initiatives to promote hydrogen production, particularly in regions like Lombardy and Sicily, where solar and wind resources are abundant. Demand is growing in the transportation and industrial sectors, with companies like Enel Green Power leading the charge. The competitive landscape is characterized by collaborations between local firms and international players to enhance technology and infrastructure.

Spain : Renewable Energy and Innovation Focus

Spain's hydrogen electrolyzer market, valued at 20.0, is on the rise, supported by the government's commitment to renewable energy. The country aims to produce 4 GW of green hydrogen by 2030, with key regions like Andalusia and Catalonia emerging as hubs for development. Demand is increasing in sectors such as transportation and energy storage. The competitive landscape includes local firms and international players, fostering innovation and collaboration to meet market needs.

Rest of Europe : Regional Variations and Opportunities

The Rest of Europe holds a market share of 20.18, showcasing diverse hydrogen market dynamics across various countries. Growth is driven by regional policies promoting renewable energy and hydrogen technologies. Demand patterns vary, with countries like the Netherlands and Belgium investing heavily in hydrogen infrastructure. The competitive landscape includes a mix of local and international players, creating opportunities for collaboration and innovation in sectors such as energy and transportation.