Rising Demand for Energy Efficiency

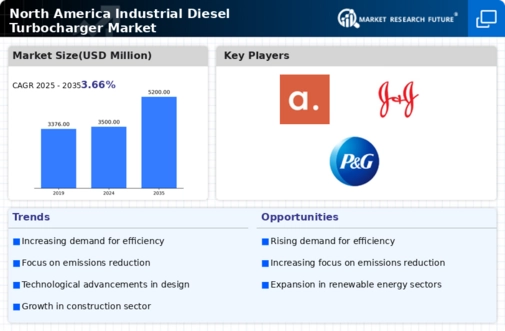

The industrial diesel-turbocharger market in North America is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and enhance productivity, the adoption of advanced turbocharging technologies becomes increasingly critical. This trend is driven by regulatory pressures and the need for compliance with stringent emissions standards. In 2025, the market is projected to grow by approximately 8% annually, reflecting the industry's commitment to optimizing fuel consumption. Companies are investing in research and development to create turbochargers that not only improve engine performance but also minimize environmental impact. This focus on energy efficiency is likely to propel the industrial diesel-turbocharger market forward, as businesses seek to balance profitability with sustainability.

Expansion of Industrial Applications

The industrial diesel-turbocharger market is witnessing an expansion in its applications across various sectors, including construction, mining, and agriculture. This diversification is largely attributed to the increasing need for high-performance engines that can operate efficiently under demanding conditions. For instance, the construction industry in North America is projected to grow by 5% in 2025, driving the demand for robust diesel engines equipped with advanced turbochargers. Furthermore, the agricultural sector is also evolving, with a shift towards mechanization and the use of powerful machinery. As these industries continue to expand, the industrial diesel-turbocharger market is likely to benefit from the heightened need for reliable and efficient power solutions.

Growing Focus on Emission Regulations

The industrial diesel-turbocharger market is significantly impacted by the growing focus on emission regulations in North America. Stricter environmental policies are compelling manufacturers to develop turbocharging solutions that meet or exceed regulatory standards. This shift is evident as industries face mounting pressure to reduce their carbon footprint and comply with emissions targets. In 2025, it is anticipated that the market will see a 6% increase in demand for turbochargers designed specifically for low-emission applications. This trend not only drives innovation but also encourages collaboration between manufacturers and regulatory bodies to ensure compliance while maintaining performance. As a result, the industrial diesel-turbocharger market is poised for growth in response to these evolving regulatory landscapes.

Government Incentives for Clean Technology

In North America, government initiatives aimed at promoting clean technology are significantly influencing the industrial diesel-turbocharger market. Various federal and state programs offer financial incentives for companies that invest in cleaner, more efficient technologies. These incentives may include tax credits, grants, and subsidies, which encourage manufacturers to adopt advanced turbocharging systems that reduce emissions. As a result, the market is expected to see a shift towards more environmentally friendly solutions, with a projected increase in the adoption of turbochargers that comply with the latest emissions regulations. This trend not only supports the growth of the industrial diesel-turbocharger market but also aligns with broader sustainability goals.

Technological Innovations in Turbocharging

Technological innovations are playing a pivotal role in shaping the industrial diesel-turbocharger market in North America. The introduction of variable geometry turbochargers (VGT) and twin-scroll turbochargers has revolutionized engine performance, allowing for better power delivery and reduced turbo lag. These advancements are particularly relevant in sectors where engine responsiveness is crucial, such as transportation and heavy machinery. The market is expected to grow by 7% in the coming years, driven by the increasing adoption of these innovative technologies. As manufacturers continue to invest in R&D, the industrial diesel-turbocharger market is likely to witness further enhancements in efficiency and performance, catering to the evolving needs of various industries.