North America Industrial Labels Market Summary

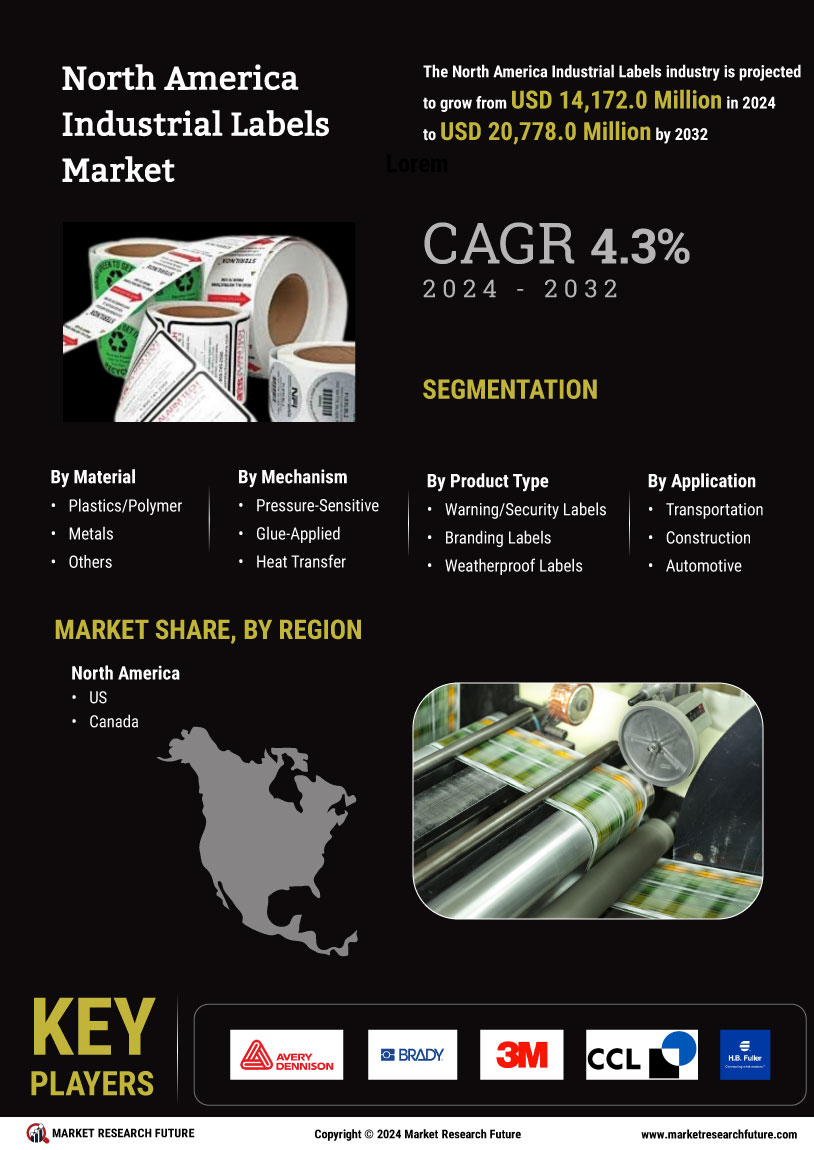

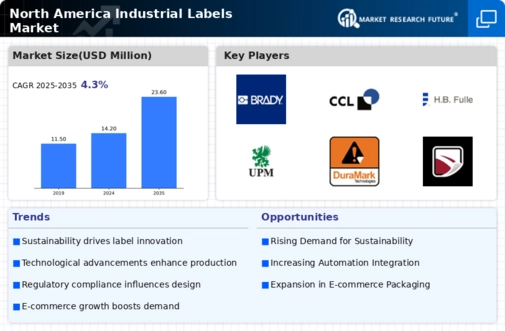

As per Market Research Future analysis, the North America industrial labels market Size was estimated at 17000.0 USD Million in 2024. The North America industrial labels market is projected to grow from 18246.1 USD Million in 2025 to 37000.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The North America industrial labels market is experiencing a dynamic shift towards sustainability and technological integration.

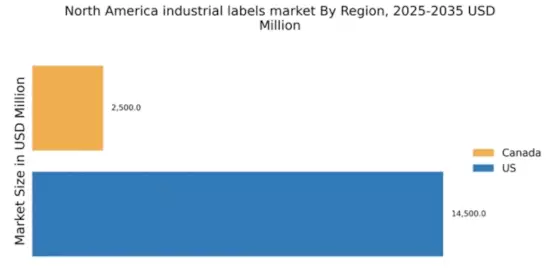

- The US remains the largest market for industrial labels, driven by robust manufacturing and logistics sectors.

- Canada is emerging as the fastest-growing region, reflecting increasing investments in sustainable practices and innovative technologies.

- Customization and personalization of labels are becoming essential as brands seek to enhance their identity and consumer engagement.

- Regulatory compliance pressure and the growth in e-commerce and logistics are key drivers propelling the demand for durable labels.

Market Size & Forecast

| 2024 Market Size | 17000.0 (USD Million) |

| 2035 Market Size | 37000.0 (USD Million) |

| CAGR (2025 - 2035) | 7.33% |

Major Players

Avery Dennison (US), Brady Corporation (US), CCL Industries (CA), SATO Holdings Corporation (JP), UPM Raflatac (FI), Mactac (US), Labelmakers (AU), Schreiner Group (DE), Multi-Color Corporation (US)