Rising Environmental Concerns

Environmental sustainability is becoming a critical concern for the oil and gas industry, propelling the intelligent pigging market forward. As public awareness of environmental issues grows, companies are under pressure to adopt practices that minimize ecological impact. Intelligent pigging plays a vital role in this context by enabling early detection of leaks and reducing the risk of spills. In North America, the cost of environmental remediation can exceed $3 billion annually, emphasizing the financial benefits of investing in intelligent pigging solutions. By prioritizing environmental protection, companies not only comply with regulations but also enhance their corporate image, making intelligent pigging an attractive option for responsible operators.

Investment in Smart Infrastructure

The trend towards smart infrastructure is a significant driver for the intelligent pigging market. As cities and industries in North America invest in modernizing their infrastructure, the integration of intelligent pigging technology becomes essential. Smart pipelines equipped with advanced monitoring systems can provide real-time data on operational conditions, allowing for timely interventions. The North American market for smart infrastructure is projected to grow by 8% annually, creating opportunities for intelligent pigging solutions. This investment not only improves efficiency but also enhances safety and reliability, making it a crucial component of future pipeline management strategies.

Increased Focus on Safety Standards

Safety regulations in the oil and gas sector are becoming increasingly stringent, driving the intelligent pigging market. Regulatory bodies in North America are enforcing compliance with safety standards to prevent accidents and environmental disasters. The implementation of intelligent pigging technology allows operators to conduct thorough inspections and maintain safety protocols effectively. In 2025, it is estimated that compliance costs could reach $1 billion for the industry, highlighting the financial implications of non-compliance. As companies strive to meet these regulations, the demand for intelligent pigging solutions is expected to rise, ensuring that pipelines operate safely and efficiently while adhering to legal requirements.

Growing Demand for Pipeline Integrity

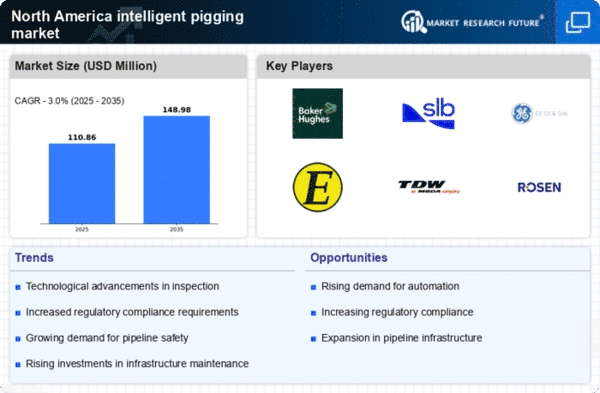

The increasing focus on pipeline integrity management is a primary driver for the intelligent pigging market. As aging infrastructure poses risks, operators are compelled to adopt advanced inspection technologies. In North America, the pipeline network spans over 2.5 million miles, necessitating regular maintenance and monitoring. Intelligent pigging offers a solution to detect anomalies, corrosion, and leaks, thereby ensuring safety and compliance. The market is projected to grow at a CAGR of 6.5% from 2025 to 2030, reflecting the rising need for effective pipeline management. This trend is further fueled by the need to minimize environmental impact and enhance operational efficiency, making intelligent pigging an essential component of pipeline operations.

Technological Innovations in Inspection Tools

Technological advancements in inspection tools are significantly influencing the intelligent pigging market. Innovations such as high-resolution imaging, real-time data analytics, and advanced sensors are enhancing the capabilities of intelligent pigs. These tools enable operators to gather detailed insights into pipeline conditions, facilitating proactive maintenance strategies. In North America, the market for intelligent pigging technology is anticipated to reach $500 million by 2027, driven by the adoption of these cutting-edge tools. The integration of artificial intelligence and machine learning into inspection processes further optimizes performance, allowing for predictive maintenance and reducing downtime. This trend underscores the importance of technology in ensuring pipeline integrity and operational efficiency.