Rise of Mobile Listening

The internet radio market in North America is experiencing a notable rise in mobile listening. With the increasing penetration of smartphones, more consumers are accessing internet radio through mobile applications. As of 2025, it is estimated that over 80% of internet radio listeners utilize mobile devices for their listening experiences. This trend is particularly pronounced among younger audiences, who prefer the convenience of mobile access. The ability to listen to internet radio while commuting or engaging in other activities has contributed to this growth. Additionally, mobile applications often offer features such as offline listening and personalized playlists, enhancing user satisfaction. Consequently, the rise of mobile listening is likely to propel the internet radio market forward, as it aligns with the fast-paced lifestyles of modern consumers.

Shifts in Consumer Behavior

The internet radio market in North America is witnessing notable shifts in consumer behavior. A growing number of listeners are gravitating towards on-demand content, favoring the flexibility that internet radio offers. Recent surveys indicate that over 60% of listeners prefer streaming services that allow them to choose what they want to hear, rather than adhering to traditional radio schedules. This shift is further fueled by the increasing popularity of podcasts and niche content, which cater to diverse interests. Additionally, younger demographics, particularly millennials and Gen Z, are more inclined to engage with internet radio platforms, as they seek personalized and interactive experiences. This evolving consumer behavior is likely to reshape the landscape of the internet radio market, compelling providers to adapt their offerings to meet the demands of a more discerning audience.

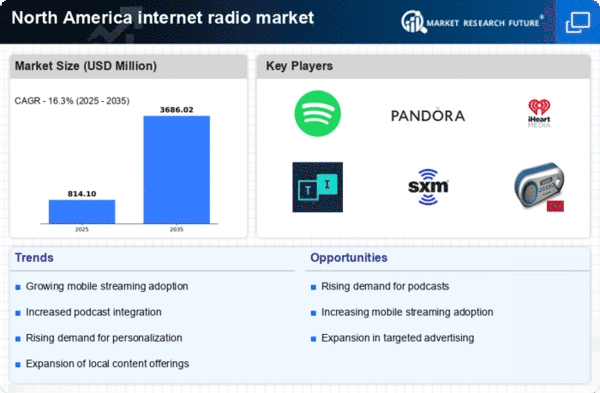

Growth of Advertising Revenue

The internet radio market in North America is benefiting from a significant increase in advertising revenue. As advertisers recognize the potential of reaching targeted audiences through internet radio, investments in this medium have surged. In 2025, advertising revenue in the internet radio sector is projected to exceed $2 billion, reflecting a growth rate of approximately 15% annually. This growth is attributed to the ability of internet radio platforms to provide advertisers with detailed listener analytics, enabling more effective targeting. Moreover, the integration of interactive advertising formats, such as clickable ads and sponsored content, enhances engagement and conversion rates. As a result, the internet radio market is becoming an attractive option for brands seeking to connect with consumers in a more meaningful way, further driving its expansion.

Expansion of Content Diversity

The internet radio market in North America is characterized by an expansion of content diversity. This diversification is driven by the emergence of independent creators and niche broadcasters who cater to specific interests and communities. As of 2025, it is estimated that over 30% of internet radio stations are independently operated, offering unique programming that appeals to various demographics. This trend not only enriches the listening experience but also fosters a sense of community among listeners. Furthermore, the availability of diverse content, including international music, talk shows, and specialized genres, attracts a broader audience. As consumers increasingly seek out unique and varied content, the internet radio market is likely to continue evolving, providing platforms for underrepresented voices and innovative programming.

Technological Advancements in Streaming

The internet radio market in North America is experiencing a surge due to rapid technological advancements. Innovations in streaming technology, such as improved bandwidth and lower latency, enhance user experiences. As of 2025, approximately 70% of households have access to high-speed internet, facilitating seamless streaming. Furthermore, the proliferation of smart devices, including smartphones and smart speakers, has made internet radio more accessible. This accessibility is crucial, as it allows users to listen to their favorite stations anytime and anywhere. The integration of artificial intelligence in content curation also plays a pivotal role, as it personalizes listening experiences, thereby attracting a broader audience. Consequently, these technological improvements are likely to drive growth in the internet radio market, as they cater to the evolving preferences of consumers.