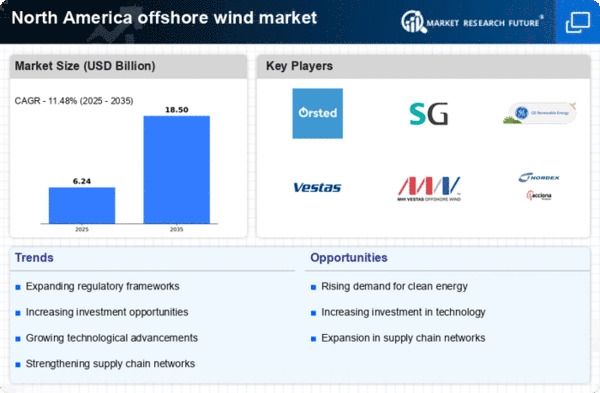

The offshore wind market in North America is currently characterized by a dynamic competitive landscape, driven by increasing demand for renewable energy and supportive government policies. Key players such as Ørsted (DK), Siemens Gamesa (ES), and GE Renewable Energy (US) are strategically positioning themselves to capitalize on this growth. Ørsted (DK) has focused on expanding its project portfolio, particularly in the U.S. East Coast, while Siemens Gamesa (ES) emphasizes innovation in turbine technology to enhance efficiency. GE Renewable Energy (US) is leveraging its extensive experience in the region to optimize its supply chain and reduce costs, thereby enhancing its competitive edge. Collectively, these strategies contribute to a robust competitive environment, fostering innovation and collaboration among industry players.

In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players vying for market share. This fragmentation allows for a diverse range of strategies, as companies seek to differentiate themselves through technological advancements and operational efficiencies. The collective influence of these players shapes the market dynamics, driving competition and innovation.

In October 2025, Ørsted (DK) announced the completion of its latest offshore wind project off the coast of New Jersey, which is expected to generate approximately 1.5 GW of renewable energy. This strategic move not only reinforces Ørsted's commitment to expanding its footprint in North America but also positions the company as a leader in the transition to sustainable energy. The successful execution of this project may enhance Ørsted's reputation and attract further investment in future projects.

In September 2025, Siemens Gamesa (ES) unveiled its next-generation offshore wind turbine, designed to increase energy output by 20% compared to previous models. This innovation is likely to strengthen Siemens Gamesa's competitive position, as it addresses the growing demand for more efficient and cost-effective renewable energy solutions. The introduction of this turbine could potentially reshape market expectations regarding performance and efficiency in offshore wind technology.

In August 2025, GE Renewable Energy (US) entered into a partnership with a leading technology firm to develop AI-driven predictive maintenance solutions for offshore wind farms. This collaboration aims to enhance operational efficiency and reduce downtime, which is critical for maximizing energy production. The integration of AI into maintenance practices may set a new standard in the industry, emphasizing the importance of technology in driving competitive advantage.

As of November 2025, current trends in the offshore wind market indicate a strong focus on digitalization, sustainability, and technological integration. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the value of collaboration in achieving common goals. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, advanced technology, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in navigating the complexities of the offshore wind market.