Rising Oil Production Activities

The oil well-cement market in North America is experiencing growth due to the resurgence of oil production activities. Increased exploration and drilling operations, particularly in shale formations, have led to a heightened demand for cementing solutions. In 2025, North America is projected to account for approximately 40% of the global oil production, which translates to a significant increase in the need for reliable cementing materials. This trend is driven by advancements in extraction technologies and the need for enhanced well integrity. As operators seek to optimize production, the demand for high-performance oil well-cement products is likely to rise, thereby bolstering the market. Furthermore, the focus on maintaining wellbore stability and preventing fluid migration underscores the importance of quality cementing in oil extraction processes.

Increased Focus on Well Integrity

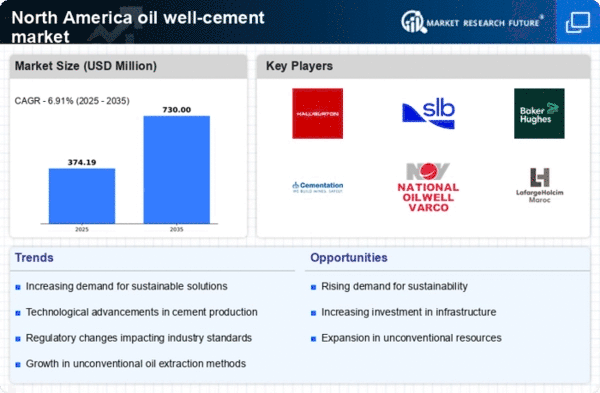

The oil well-cement market is witnessing a heightened emphasis on well integrity and safety. Operators are increasingly aware of the risks associated with well failures, which can lead to environmental hazards and financial losses. In response, there is a growing demand for advanced cementing solutions that enhance wellbore stability and prevent leaks. The market is projected to grow at a CAGR of 5% from 2025 to 2030, driven by the need for reliable cementing practices. This focus on well integrity is further supported by regulatory frameworks that mandate stringent safety standards. As companies prioritize risk management and compliance, the demand for high-performance oil well-cement products is expected to rise, thereby positively impacting the market.

Infrastructure Development Initiatives

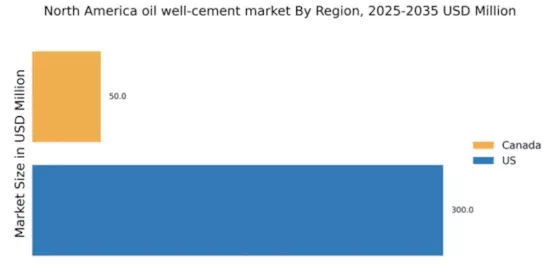

The oil well-cement market is also influenced by ongoing infrastructure development initiatives across North America. Government investments in energy infrastructure, including pipelines and refineries, are expected to create a robust demand for cementing solutions. In 2025, it is estimated that infrastructure spending in the energy sector will reach $200 billion, with a substantial portion allocated to oil and gas projects. This surge in infrastructure development necessitates the use of high-quality cement to ensure the integrity and longevity of oil wells. As new projects emerge, the demand for specialized cementing products tailored to meet specific geological and operational requirements is likely to increase, further driving the growth of the oil well-cement market.

Technological Innovations in Cementing Materials

The oil well-cement market is being shaped by technological innovations in cementing materials. The development of new formulations and additives enhances the performance of cement in challenging environments, such as high-temperature and high-pressure wells. In 2025, it is anticipated that the market for advanced cementing technologies will grow significantly, driven by the need for improved well performance and reduced operational costs. Innovations such as lightweight cement and self-healing materials are gaining traction, offering potential benefits in terms of efficiency and durability. As operators seek to optimize their cementing operations, the adoption of these advanced materials is likely to increase, thereby propelling the growth of the oil well-cement market.

Growing Demand for Enhanced Environmental Compliance

The oil well-cement market is increasingly influenced by the growing demand for enhanced environmental compliance. As regulatory bodies impose stricter environmental standards, operators are compelled to adopt cementing solutions that minimize environmental impact. In 2025, it is projected that the market for eco-friendly cementing products will expand, driven by the need for sustainable practices in the oil and gas sector. This shift towards environmentally responsible cementing solutions is likely to create opportunities for manufacturers to develop innovative products that meet both performance and sustainability criteria. As companies strive to align with environmental regulations, the demand for specialized oil well-cement products is expected to rise, contributing to the overall growth of the market.