Rising Demand for Eco-Friendly Products

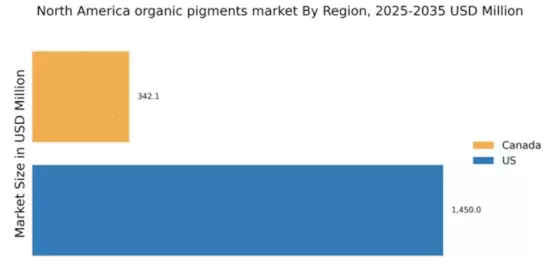

The organic pigments market in North America experiences a notable increase in demand for eco-friendly products. Consumers are becoming increasingly aware of environmental issues, leading to a shift towards sustainable alternatives. This trend is reflected in the growing preference for organic pigments, which are derived from natural sources and are less harmful to the environment compared to synthetic options. In 2025, the market for organic pigments is projected to reach approximately $1.5 billion, indicating a compound annual growth rate (CAGR) of around 5.5% from 2020 to 2025. This rising demand is driven by various industries, including paints, coatings, and plastics, which are seeking to enhance their sustainability profiles. As a result, manufacturers are investing in the development of innovative organic pigments to meet consumer expectations and regulatory requirements.

Growth in the Paints and Coatings Sector

The organic pigments market in North America is significantly influenced by the growth in the paints and coatings sector. This industry is witnessing a robust expansion, driven by increased construction activities and a rising trend in home renovations. In 2025, the North American paints and coatings market is expected to surpass $25 billion, with organic pigments playing a crucial role in providing vibrant colors and improved performance. The shift towards water-based formulations, which often utilize organic pigments, is further propelling this growth. Additionally, the demand for high-quality, durable finishes in both residential and commercial applications is likely to enhance the adoption of organic pigments. As manufacturers strive to meet these demands, the organic pigments market is poised for substantial growth, reflecting the overall health of the paints and coatings industry.

Consumer Preference for Natural Colorants

The organic pigments market in North America is significantly impacted by the growing consumer preference for natural colorants. As awareness of health and environmental issues rises, consumers are increasingly seeking products that contain natural ingredients, including organic pigments. This trend is particularly evident in the food, cosmetics, and textile industries, where the demand for safe and non-toxic colorants is on the rise. In 2025, the market for natural colorants is projected to reach $1 billion, with organic pigments capturing a substantial share. This shift towards natural alternatives is prompting manufacturers to reformulate their products, leading to an increased focus on organic pigments. As consumer preferences continue to evolve, the organic pigments market is likely to see sustained growth, driven by the demand for safer and more sustainable colorant options.

Technological Innovations in Pigment Production

Technological innovations are reshaping the organic pigments market in North America, leading to enhanced production processes and product quality. Advances in manufacturing techniques, such as nanotechnology and biotechnology, are enabling the development of more efficient and sustainable organic pigments. These innovations not only improve the performance characteristics of pigments but also reduce waste and energy consumption during production. In 2025, it is estimated that the market for technologically advanced organic pigments will account for approximately 30% of the total organic pigments market. This shift towards innovation is driven by the need for higher performance in various applications, including automotive coatings and industrial finishes. As companies invest in research and development, the organic pigments market is likely to benefit from a wave of new products that meet the evolving needs of consumers and industries alike.

Increased Regulatory Support for Sustainable Practices

The organic pigments market in North America is experiencing increased regulatory support aimed at promoting sustainable practices. Government initiatives and policies are encouraging the use of environmentally friendly materials, including organic pigments, across various industries. In 2025, it is anticipated that regulatory frameworks will become more stringent, pushing manufacturers to adopt sustainable practices in their production processes. This regulatory environment is likely to drive the growth of the organic pigments market, as companies seek to comply with new standards while also appealing to environmentally conscious consumers. The potential for financial incentives for adopting sustainable practices further enhances the attractiveness of organic pigments. As a result, the organic pigments market is expected to expand, driven by both regulatory compliance and consumer demand for greener alternatives.