Rising Energy Demand

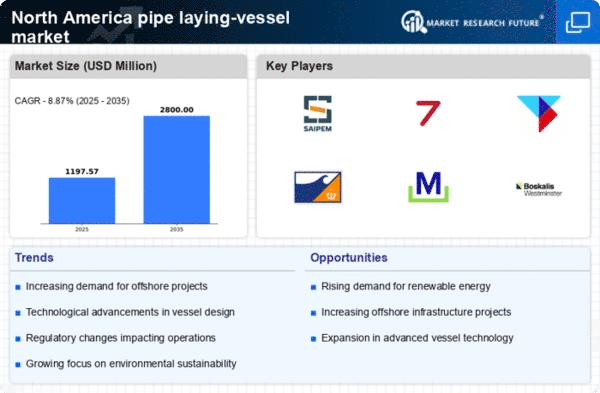

The growing energy demand in North America is a significant driver for the pipe laying-vessel market. As the population increases and industrial activities expand, the need for efficient energy transportation systems becomes critical. The U.S. Energy Information Administration projects that energy consumption will rise by approximately 10% by 2030. This surge necessitates the development of new pipelines, particularly for natural gas and renewable energy sources. Consequently, the pipe laying-vessel market is likely to experience heightened activity as companies seek to deploy advanced vessels capable of laying extensive pipeline networks. The industry's response to this demand may shape its future trajectory, emphasizing the importance of innovation and efficiency in vessel design.

Expansion of Offshore Activities

The expansion of offshore activities in North America is a crucial driver for the pipe laying-vessel market. As exploration and production activities move further offshore, the need for specialized vessels capable of operating in deepwater environments is increasing. The offshore oil and gas sector is projected to grow, with investments in new projects expected to reach $200 billion by 2027. This growth necessitates the deployment of advanced pipe laying vessels designed for harsh marine conditions. The industry's focus on offshore developments may lead to increased demand for vessels equipped with cutting-edge technology, thereby driving market growth. Companies that can provide reliable and efficient solutions for offshore pipe laying are likely to thrive in this evolving landscape.

Increasing Infrastructure Investments

The ongoing investments in infrastructure development across North America are likely to drive the pipe laying-vessel market. With the U.S. government allocating approximately $1 trillion for infrastructure projects, including transportation and energy, the demand for efficient pipe laying solutions is expected to rise. This investment is anticipated to enhance the construction of pipelines for oil, gas, and water distribution, thereby creating a robust market for pipe laying vessels. These initiatives benefit the industry by necessitating advanced vessels capable of handling complex installations. Furthermore, the focus on modernizing aging infrastructure may lead to increased procurement of specialized vessels, which could further stimulate growth in the pipe laying-vessel market.

Environmental Regulations and Standards

Stringent environmental regulations in North America are influencing the pipe laying-vessel market. Regulatory bodies are increasingly mandating compliance with environmental standards, particularly concerning emissions and ecological impact. This trend compels companies to invest in modern vessels equipped with advanced technologies that minimize environmental footprints. The industry may see a shift towards vessels that utilize cleaner energy sources and innovative designs to meet these regulations. As a result, the demand for eco-friendly pipe laying vessels is likely to increase, driving market growth. Companies that adapt to these regulations may gain a competitive edge, positioning themselves favorably within the evolving landscape of the pipe laying-vessel market.

Technological Innovations in Vessel Design

Technological innovations in vessel design are reshaping the pipe laying-vessel market. The introduction of automation, advanced materials, and enhanced navigation systems is enabling vessels to operate more efficiently and safely. Innovations such as dynamic positioning systems and remotely operated vehicles are becoming increasingly prevalent, allowing for precise pipe laying in challenging environments. This technological evolution is expected to attract investments, as companies seek to enhance operational efficiency and reduce costs. The industry appears poised for growth as these advancements not only improve productivity but also expand the capabilities of pipe laying vessels. Consequently, the market may witness a surge in demand for technologically advanced vessels that can meet the evolving needs of the energy and infrastructure sectors.