Innovative Product Development

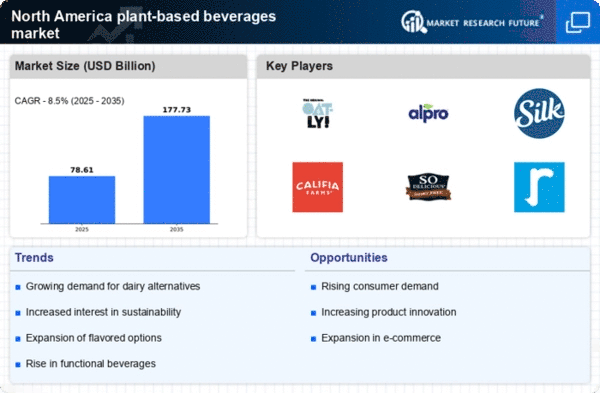

Innovation in product development is a crucial driver for the plant based-beverages market. Companies are increasingly investing in research and development to create unique formulations that appeal to a broader audience. For instance, the introduction of fortified plant-based beverages, which include added vitamins and minerals, is gaining traction. This trend is supported by data indicating that the plant based-beverages market is projected to grow at a CAGR of 10.5% from 2023 to 2028. Such innovations not only enhance the nutritional profile of beverages but also attract consumers looking for functional drinks. As competition intensifies, brands that prioritize innovation are likely to capture a larger share of the market.

Consumer Awareness and Education

Consumer awareness and education regarding the benefits of plant-based beverages are emerging as vital drivers for the market. As information about the health and environmental advantages of plant-based diets becomes more widespread, consumers are more inclined to explore these options. Educational campaigns and social media influence play a significant role in shaping consumer perceptions. Data suggests that 70% of consumers are willing to pay a premium for products that are perceived as healthier or more sustainable. This heightened awareness is likely to propel the demand for plant based-beverages, as consumers actively seek out products that align with their values and lifestyle choices.

Rising Veganism and Plant-Based Diets

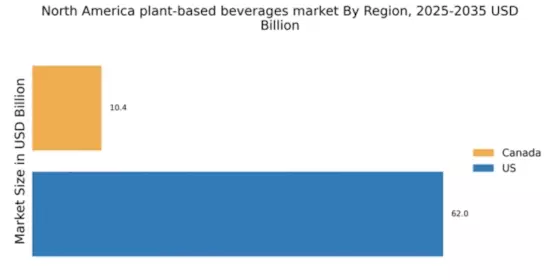

The increasing adoption of veganism and plant-based diets in North America appears to be a pivotal driver for the plant based-beverages market. As consumers become more aware of the health benefits associated with plant-based diets, the demand for beverages that align with these dietary choices is likely to surge. Reports indicate that approximately 9.7 million adults in the U.S. identify as vegan, representing a significant market segment. This demographic shift suggests that manufacturers may need to innovate and diversify their product offerings to cater to the preferences of health-conscious consumers. The plant based-beverages market is thus positioned to benefit from this trend, as more individuals seek alternatives to traditional dairy and animal-based products.

Regulatory Support for Healthier Options

Regulatory support for healthier food and beverage options is increasingly shaping the plant based-beverages market. Government initiatives aimed at promoting healthier diets and reducing the consumption of sugary drinks are likely to encourage the growth of plant-based alternatives. Policies that incentivize the production and distribution of plant-based products may further enhance market dynamics. For instance, recent guidelines from health authorities recommend increasing plant-based food consumption, which could lead to a favorable environment for the plant based-beverages market. This regulatory landscape suggests that as governments prioritize public health, the demand for plant based-beverages may continue to rise.

Increased Availability in Retail Channels

The expansion of retail channels for plant based-beverages is significantly influencing the market. Major grocery chains and health food stores are increasingly dedicating shelf space to plant-based products, making them more accessible to consumers. This trend is evident as sales of plant based-beverages have risen by 20% in the past year alone, reflecting a growing consumer preference for these alternatives. Furthermore, online retail platforms are also contributing to this growth, allowing consumers to purchase products conveniently. The increased availability of plant based-beverages in various retail formats is likely to enhance consumer awareness and drive sales, thereby positively impacting the market.