Increasing Health Awareness

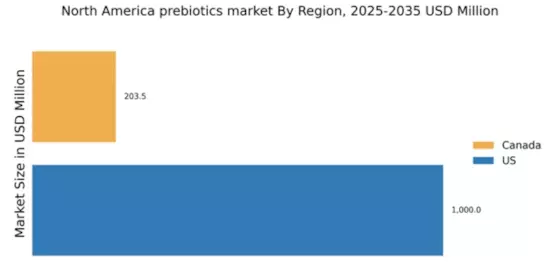

The growing awareness of health and wellness among consumers is a pivotal driver for the prebiotics market. As individuals become more informed about the benefits of gut health, there is a noticeable shift towards products that promote digestive wellness. This trend is reflected in the increasing sales of prebiotic supplements and functional foods, which are projected to reach approximately $1.5 billion by 2026 in North America. Consumers are actively seeking products that contain prebiotics, as they are associated with improved gut microbiota and overall health. This heightened focus on health is likely to propel the prebiotics market forward, as manufacturers respond to consumer demands by innovating and expanding their product lines to include prebiotic ingredients.

Innovation in Product Development

Innovation plays a crucial role in driving the prebiotics market, as manufacturers continuously develop new and improved products to meet consumer preferences. The introduction of novel prebiotic ingredients, such as resistant starch and inulin, has expanded the range of available options for consumers. Additionally, advancements in technology allow for better extraction and formulation processes, enhancing the efficacy of prebiotic products. This innovative spirit is reflected in the increasing number of new product launches, which have surged by approximately 20% in the last year alone. As companies strive to differentiate themselves in a competitive landscape, the focus on innovation is likely to sustain growth in the prebiotics market.

Regulatory Support for Health Claims

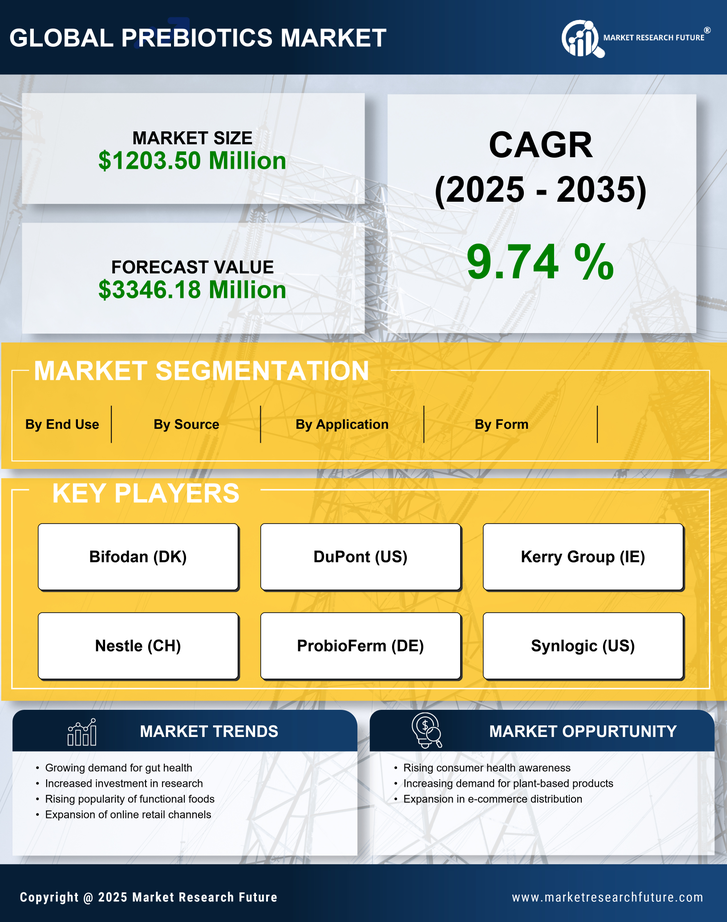

Regulatory bodies in North America are increasingly recognizing the health benefits associated with prebiotics, which is fostering growth in the prebiotics market. The approval of health claims related to prebiotic ingredients by organizations such as the FDA is encouraging manufacturers to promote their products more effectively. This regulatory support not only enhances consumer trust but also stimulates market expansion as companies leverage these claims in their marketing strategies. The potential for prebiotics to be included in health-focused dietary guidelines further solidifies their position in the market. As regulations evolve to support the health benefits of prebiotics, the market is likely to experience accelerated growth, with projections indicating a compound annual growth rate (CAGR) of around 8% over the next five years.

Growing Interest in Plant-Based Diets

The rising trend towards plant-based diets is significantly influencing the prebiotics market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-derived prebiotics is increasing. Ingredients such as chicory root, garlic, and onions, which are rich in prebiotic fibers, are becoming staples in many households. This shift is not only driven by health considerations but also by environmental concerns, as consumers seek sustainable food sources. The plant-based segment is projected to capture a substantial share of the prebiotics market, with estimates suggesting it could reach $800 million by 2027. This growing interest in plant-based nutrition is likely to encourage further investment in prebiotic research and product development.

Rising Incidence of Digestive Disorders

The prevalence of digestive disorders in North America is a significant driver for the prebiotics market. Conditions such as irritable bowel syndrome (IBS), constipation, and other gastrointestinal issues are becoming increasingly common, prompting consumers to seek dietary solutions. Prebiotics are recognized for their ability to enhance gut health and alleviate symptoms associated with these disorders. The market for prebiotics is expected to grow as healthcare professionals recommend dietary changes that include prebiotic-rich foods. This trend is underscored by the fact that the digestive health segment is anticipated to account for over 30% of the total prebiotics market by 2025, indicating a robust demand for these products.