Growth in Industrial Manufacturing

The industrial manufacturing sector in North America is witnessing robust growth, which is likely to bolster the reciprocating compressor market. With an expected annual growth rate of around 4% through 2025, manufacturing activities are increasingly reliant on advanced compression technologies. Reciprocating compressors are integral to various manufacturing processes, including refrigeration, air conditioning, and pneumatic systems. As manufacturers strive for higher productivity and energy efficiency, the demand for reliable and high-performance compressors is anticipated to rise. This trend suggests that the reciprocating compressor market will play a crucial role in supporting the evolving needs of the manufacturing landscape.

Rising Demand in Oil and Gas Sector

The oil and gas sector in North America is experiencing a notable resurgence, which appears to be driving the reciprocating compressor market. As exploration and production activities ramp up, the need for efficient and reliable compression solutions becomes paramount. In 2025, the oil and gas industry is projected to contribute approximately $200 billion to the North American economy, thereby increasing the demand for reciprocating compressors. These compressors are essential for various applications, including gas processing and transportation, which further underscores their importance in this sector. The reciprocating compressor market is likely to benefit from this trend, as companies seek to enhance operational efficiency and reduce costs.

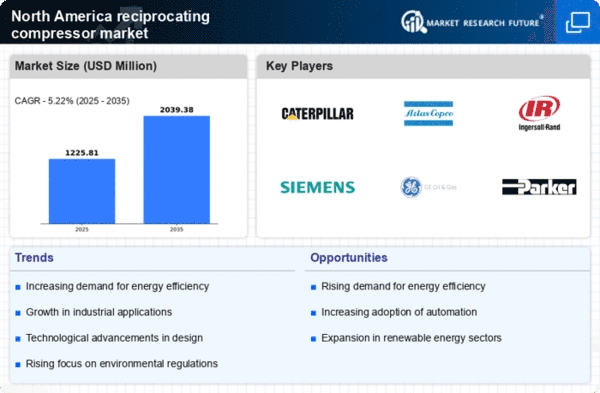

Increased Focus on Energy Efficiency

Energy efficiency has become a critical focus for industries across North America, influencing the reciprocating compressor market. Regulatory frameworks and incentives aimed at reducing energy consumption are prompting companies to invest in more efficient compressor technologies. The U.S. Department of Energy has set ambitious targets for energy savings, which could lead to a 30% reduction in energy use in industrial applications by 2030. This shift towards energy-efficient solutions is likely to drive demand for advanced reciprocating compressors that offer improved performance and lower operational costs. Consequently, the reciprocating compressor market is expected to adapt to these evolving standards and consumer preferences.

Expansion of Refrigeration and HVAC Systems

The expansion of refrigeration and HVAC systems in North America is significantly impacting the reciprocating compressor market. With the growing emphasis on climate control in residential, commercial, and industrial settings, the demand for effective cooling solutions is on the rise. The HVAC market is projected to reach $100 billion by 2026, indicating a substantial opportunity for reciprocating compressors, which are widely used in these applications. As consumers and businesses prioritize comfort and energy efficiency, the reciprocating compressor market is likely to see increased adoption of these systems, further driving market growth.

Technological Innovations in Compressor Design

Technological innovations in compressor design are reshaping the landscape of the reciprocating compressor market. Advances in materials, control systems, and manufacturing processes are leading to the development of more efficient and durable compressors. For instance, the integration of smart technologies and IoT capabilities is enhancing operational monitoring and predictive maintenance, which can reduce downtime and improve reliability. As industries in North America increasingly adopt these innovations, the reciprocating compressor market is expected to benefit from enhanced product offerings that meet the evolving demands of various sectors.