Growth in Construction Activities

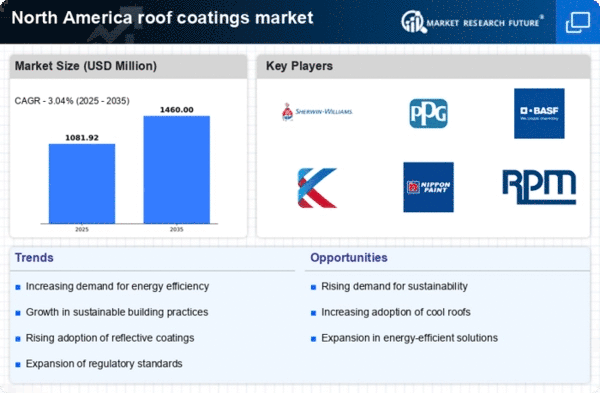

The robust growth in construction activities across North America serves as a substantial driver for the roof coatings market. With the construction sector experiencing a resurgence, particularly in urban areas, the demand for high-performance roofing solutions is on the rise. In 2025, the construction industry in North America is expected to reach a valuation of over $1 trillion, with a significant portion allocated to roofing projects. This surge in construction not only increases the need for durable and efficient roof coatings but also fosters innovation in product development, as manufacturers strive to meet the evolving needs of builders and architects.

Rising Awareness of Roof Maintenance

There is a growing awareness among property owners regarding the importance of roof maintenance, which is driving the roof coatings market. Regular maintenance and protective coatings can extend the lifespan of roofs, thereby reducing long-term costs associated with repairs and replacements. In North America, it is estimated that nearly 30% of property owners are now investing in roof maintenance solutions, including coatings, to enhance durability and performance. This trend is likely to continue as more individuals recognize the financial benefits of proactive roof care, leading to increased sales of roof coatings in both residential and commercial sectors.

Increased Demand for Energy Efficiency

The rising emphasis on energy efficiency in building designs is a pivotal driver for the roof coatings market. As energy costs continue to escalate, property owners are increasingly seeking solutions that can reduce energy consumption. Roof coatings, particularly reflective and cool roof technologies, can significantly lower cooling costs by reflecting solar radiation. In North America, the market for energy-efficient roofing solutions is projected to grow at a CAGR of approximately 7% over the next five years. This trend is further supported by various energy efficiency programs and incentives offered by government agencies, which encourage the adoption of energy-saving technologies in residential and commercial buildings.

Environmental Regulations and Standards

The implementation of stringent environmental regulations and standards is a critical driver for the roof coatings market. In North America, regulatory bodies are increasingly mandating the use of eco-friendly materials and practices in construction and renovation projects. These regulations often promote the use of low-VOC (volatile organic compounds) and sustainable roofing solutions, which align with the growing demand for environmentally responsible products. As a result, manufacturers are compelled to adapt their offerings to comply with these regulations, thereby expanding the market for eco-friendly roof coatings. This shift not only benefits the environment but also enhances the market's appeal to environmentally conscious consumers.

Technological Innovations in Coating Materials

Technological innovations in coating materials are significantly influencing the roof coatings market. Advances in polymer chemistry and material science have led to the development of high-performance coatings that offer superior durability, weather resistance, and energy efficiency. For instance, the introduction of elastomeric coatings has transformed the market by providing enhanced flexibility and crack resistance. As manufacturers continue to invest in research and development, the availability of innovative products is expected to expand, catering to diverse customer needs. This trend is anticipated to drive market growth, as more consumers seek advanced solutions for their roofing needs.