Rising Fitness Culture

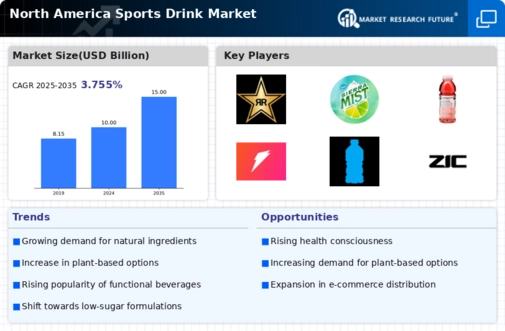

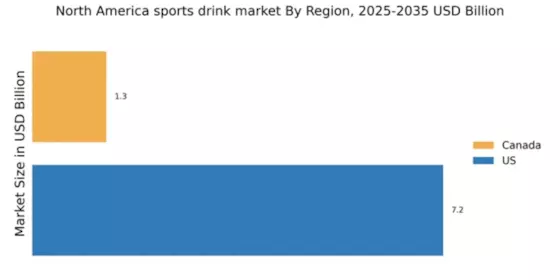

The increasing emphasis on fitness and wellness in North America appears to be a primary driver for the sports drink market. As more individuals engage in regular physical activities, the demand for hydration solutions that support performance and recovery is likely to rise. According to recent data, approximately 60% of adults in North America participate in some form of exercise, which correlates with a growing consumption of sports drinks. This trend suggests that consumers are seeking products that not only quench thirst but also replenish electrolytes and provide energy. Consequently, brands are innovating to cater to this fitness-oriented demographic, enhancing their product offerings to include functional ingredients that appeal to health-conscious consumers. The sports drink market is thus positioned to benefit from this cultural shift towards active lifestyles.

Focus on Functional Ingredients

The sports drink market is increasingly focusing on the incorporation of functional ingredients that cater to specific consumer needs. This trend is driven by a growing demand for beverages that offer more than just hydration. Ingredients such as BCAAs, vitamins, and natural sweeteners are becoming more prevalent, appealing to health-conscious consumers who seek performance-enhancing benefits. Data indicates that nearly 40% of consumers are willing to pay a premium for sports drinks that contain added functional benefits. This shift towards functional formulations suggests that brands are responding to consumer preferences for transparency and health-oriented products. As the market evolves, the emphasis on innovative ingredients is likely to shape the future landscape of the sports drink market, attracting a diverse range of consumers.

Innovative Marketing Strategies

The sports drink market is experiencing a transformation driven by innovative marketing strategies that resonate with younger consumers. Brands are increasingly leveraging social media platforms and influencer partnerships to engage with their target audience. This approach appears to be effective, as data suggests that over 50% of millennials and Gen Z consumers are influenced by social media when making beverage choices. By creating compelling narratives around their products, companies are able to highlight the benefits of sports drinks in enhancing athletic performance and recovery. Additionally, experiential marketing events, such as fitness challenges and sponsored sports events, are becoming more prevalent, further solidifying brand loyalty. As these marketing tactics evolve, they are likely to attract a broader consumer base, thereby propelling growth within the sports drink market.

Expansion of Distribution Channels

The expansion of distribution channels is a notable driver for the sports drink market in North America. Retailers are increasingly recognizing the demand for sports drinks and are enhancing their product offerings in convenience stores, gyms, and supermarkets. Recent statistics indicate that sales through e-commerce platforms have surged by approximately 30% in the past year, reflecting a shift in consumer purchasing behavior. This trend suggests that consumers prefer the convenience of online shopping, particularly for health and wellness products. Furthermore, partnerships with fitness centers and sports teams are facilitating direct access to target consumers, thereby increasing brand visibility. As distribution channels continue to diversify, the sports drink market is likely to experience sustained growth, catering to the evolving preferences of consumers.

Increased Awareness of Hydration Needs

There is a growing awareness among consumers regarding the importance of hydration, particularly during physical exertion. This heightened consciousness is driving the sports drink market as individuals recognize that water alone may not suffice for optimal performance. Research indicates that nearly 70% of athletes and fitness enthusiasts in North America prefer sports drinks over water for hydration during workouts. This preference is attributed to the added benefits of electrolytes and carbohydrates found in these beverages, which aid in maintaining energy levels and preventing dehydration. As educational campaigns and health initiatives continue to promote the significance of proper hydration, the demand for specialized sports drinks is expected to increase. This trend underscores the potential for growth within the sports drink market as consumers become more informed about their hydration choices.