Technological Integration

The submarine power-cable market is witnessing a surge in technological integration, which enhances the efficiency and reliability of power transmission. Innovations in cable design, materials, and installation techniques are transforming the landscape of underwater energy infrastructure. Advanced monitoring systems and smart grid technologies are being integrated into submarine cables, allowing for real-time data collection and management. This integration not only improves operational efficiency but also reduces maintenance costs. As a result, the market is projected to expand significantly, with estimates suggesting a valuation of $8 billion by 2028. The adoption of these technologies is crucial for meeting the increasing energy demands in North America while ensuring the sustainability of energy systems.

Increasing Energy Security

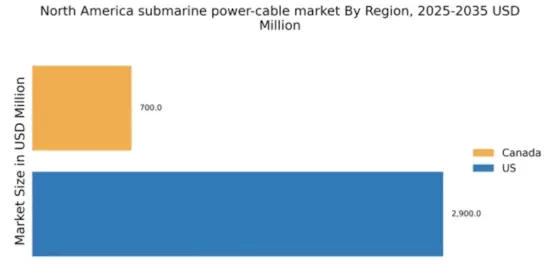

The submarine power-cable market is experiencing a notable shift towards enhancing energy security in North America. As energy demands rise, the need for reliable and resilient energy infrastructure becomes paramount. Submarine cables facilitate the interconnection of diverse energy sources, including offshore wind and solar farms, thereby reducing dependency on traditional energy sources. This diversification is crucial for mitigating risks associated with energy supply disruptions. According to recent data, investments in submarine power cables are projected to reach approximately $5 billion by 2027, reflecting a growing recognition of their role in ensuring energy security. Furthermore, the integration of these cables into the energy grid enhances the overall stability and reliability of power supply, which is essential for both consumers and industries alike.

Environmental Considerations

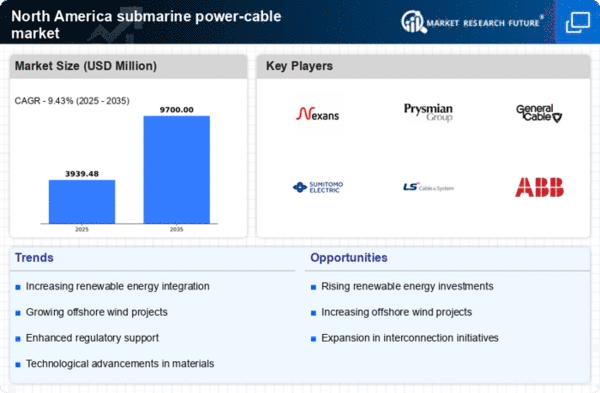

The submarine power-cable market is increasingly influenced by environmental considerations, as stakeholders prioritize sustainable energy solutions. The shift towards cleaner energy sources necessitates the development of infrastructure that minimizes ecological impact. Submarine cables, which facilitate the transmission of renewable energy from offshore installations, are seen as a viable solution to reduce carbon footprints. In North America, regulatory frameworks are evolving to support projects that align with environmental goals. For instance, the U.S. government has set ambitious targets to reduce greenhouse gas emissions by 50-52% by 2030. This regulatory environment encourages investments in submarine power cables, which are essential for connecting renewable energy sources to the grid. The market is expected to grow at a CAGR of 10% over the next five years, driven by these environmental imperatives.

Growing Offshore Wind Projects

The submarine power-cable market is closely linked to the expansion of offshore wind projects in North America. As the region seeks to diversify its energy portfolio, offshore wind energy has emerged as a key player in the renewable energy landscape. The development of these projects necessitates robust submarine cable infrastructure to transmit generated power to onshore grids. Current estimates suggest that offshore wind capacity in North America could reach 30 GW by 2030, driving demand for submarine cables. This growth is supported by favorable government policies and incentives aimed at promoting renewable energy. Consequently, the submarine power-cable market is poised for growth, with projections indicating a market size of $6 billion by 2029, largely fueled by the offshore wind sector.

Investment in Infrastructure Development

The submarine power-cable market is benefiting from substantial investments in infrastructure development across North America. Governments and private entities are recognizing the importance of modernizing energy transmission systems to accommodate the growing demand for electricity. This investment trend is particularly evident in projects aimed at enhancing interconnectivity between regions, which is vital for balancing supply and demand. Recent reports indicate that infrastructure spending in the energy sector is expected to exceed $100 billion by 2026, with a significant portion allocated to submarine cable projects. This influx of capital is likely to accelerate the deployment of submarine cables, thereby facilitating the transition to a more integrated and efficient energy grid.