Aging Population

The demographic shift towards an older population in North America significantly influences the vitamins minerals-supplement market. As the baby boomer generation ages, there is a heightened focus on maintaining health and vitality, which drives the demand for dietary supplements. Research indicates that individuals aged 50 and above are more likely to use vitamins and minerals to address age-related health concerns, such as bone density and cognitive function. This demographic is projected to grow, with estimates suggesting that by 2030, nearly 20% of the U.S. population will be over 65 years old. Consequently, companies are increasingly developing products specifically designed for older adults, thereby capitalizing on this expanding market segment.

E-commerce Expansion

The rapid growth of e-commerce platforms is reshaping the vitamins minerals-supplement market in North America. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase their supplements. Data shows that online sales of dietary supplements have surged, accounting for over 30% of total sales in recent years. This shift is driven by factors such as competitive pricing, ease of access to product information, and the ability to compare different brands. Additionally, the COVID-19 pandemic has accelerated this trend, as more consumers seek to avoid crowded retail environments. As a result, companies are investing in their online presence and digital marketing strategies to capture this growing segment of health-conscious consumers.

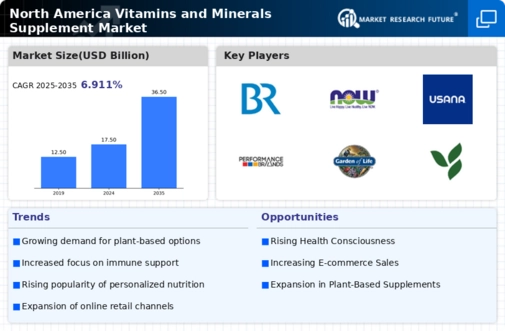

Growing Health Consciousness

The increasing awareness of health and wellness among consumers is a pivotal driver in the vitamins minerals-supplement market. As individuals become more informed about the benefits of vitamins and minerals, they are more inclined to incorporate these supplements into their daily routines. This trend is particularly pronounced in North America, where surveys indicate that approximately 70% of adults regularly consume dietary supplements. The shift towards preventive health measures has led to a surge in demand for products that support immune function, energy levels, and overall well-being. Consequently, manufacturers are responding by expanding their product lines to include a diverse range of vitamins and minerals tailored to specific health needs, thereby enhancing their market presence and appeal to health-conscious consumers.

Innovative Product Development

Innovation in product formulation and delivery methods is a key driver in the vitamins minerals-supplement market. Companies are increasingly focusing on developing unique products that cater to specific health needs and preferences. For instance, the introduction of gummy vitamins, liquid supplements, and personalized vitamin packs has gained popularity among consumers seeking more palatable and convenient options. Furthermore, advancements in technology allow for enhanced bioavailability of nutrients, making supplements more effective. This trend is reflected in market data, which indicates that the segment for innovative delivery formats is expected to grow by approximately 15% annually. As consumer preferences evolve, manufacturers are compelled to invest in research and development to stay competitive in this dynamic market.

Regulatory Support and Standards

The regulatory environment surrounding dietary supplements plays a crucial role in shaping the vitamins minerals-supplement market. In North America, agencies such as the FDA provide guidelines that ensure product safety and efficacy. This regulatory framework fosters consumer trust and encourages manufacturers to adhere to high-quality standards. As consumers become more discerning about the supplements they choose, the presence of stringent regulations can enhance market credibility. Moreover, the push for transparency in labeling and ingredient sourcing is gaining traction, with consumers increasingly demanding clean label products. This trend is likely to drive companies to invest in compliance and quality assurance, thereby positively impacting the overall market landscape.