Rising Energy Demand

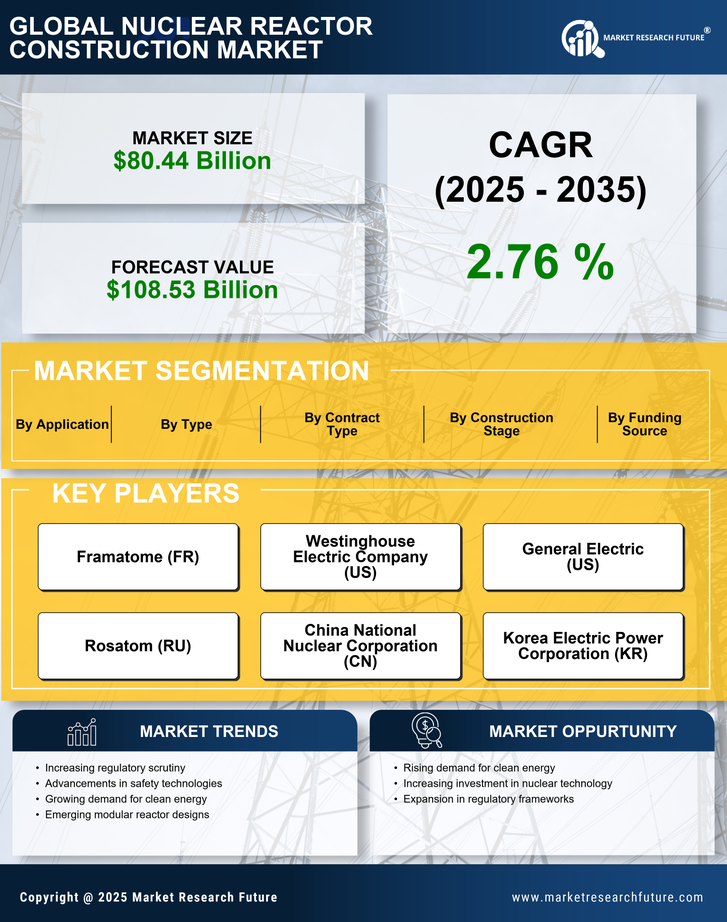

The increasing The Nuclear Reactor Construction Industry. As populations grow and economies expand, the need for reliable and sustainable energy sources intensifies. Nuclear energy, known for its low greenhouse gas emissions, is becoming a preferred option for many countries aiming to meet their energy needs while adhering to environmental regulations. According to recent estimates, the demand for electricity is projected to rise by approximately 30% by 2040, necessitating the construction of new nuclear reactors. This trend indicates a robust market potential for nuclear reactor construction, as nations seek to diversify their energy portfolios and reduce reliance on fossil fuels.

Technological Innovations

Technological innovations are significantly influencing the Nuclear Reactor Construction Market. Advances in reactor design, safety features, and construction techniques are making nuclear power more attractive. For example, the development of small modular reactors (SMRs) offers a flexible and cost-effective solution for energy generation. These innovations not only enhance safety but also reduce construction time and costs, making nuclear projects more feasible. The market for SMRs is expected to grow substantially, with projections indicating that they could account for a significant share of new nuclear capacity by 2030. This trend suggests a dynamic shift in how nuclear energy is perceived and utilized.

Energy Security and Independence

Energy security and independence are increasingly becoming focal points for many nations, driving the Nuclear Reactor Construction Market. Countries are seeking to reduce their dependence on imported fossil fuels, which can be subject to price volatility and geopolitical tensions. Nuclear energy offers a stable and domestically sourced alternative, contributing to national energy security. As a result, several nations are prioritizing the development of nuclear infrastructure to ensure a reliable energy supply. Reports suggest that countries with robust nuclear programs are better positioned to withstand energy crises, further underscoring the importance of nuclear reactor construction in achieving energy independence.

Government Initiatives and Policies

Government initiatives and policies play a crucial role in shaping the Nuclear Reactor Construction Market. Many governments are implementing favorable policies to promote nuclear energy as a viable alternative to fossil fuels. These initiatives often include financial incentives, streamlined regulatory processes, and investments in research and development. For instance, several countries have set ambitious targets for reducing carbon emissions, which has led to increased funding for nuclear projects. The International Atomic Energy Agency reports that over 50 reactors are currently under construction worldwide, reflecting the commitment of various governments to enhance their nuclear capabilities and ensure energy security.

Environmental Concerns and Climate Change

Environmental concerns and the urgency of addressing climate change are pivotal drivers for the Nuclear Reactor Construction Market. As nations grapple with the impacts of climate change, there is a growing recognition of the need for low-carbon energy sources. Nuclear power presents a viable solution, as it generates electricity with minimal carbon emissions. The Intergovernmental Panel on Climate Change emphasizes the importance of nuclear energy in achieving global climate goals. Consequently, many countries are revisiting their nuclear policies and investing in new reactor construction to meet their climate commitments. This shift indicates a potential surge in nuclear projects aimed at mitigating climate change effects.