Increasing Energy Demand

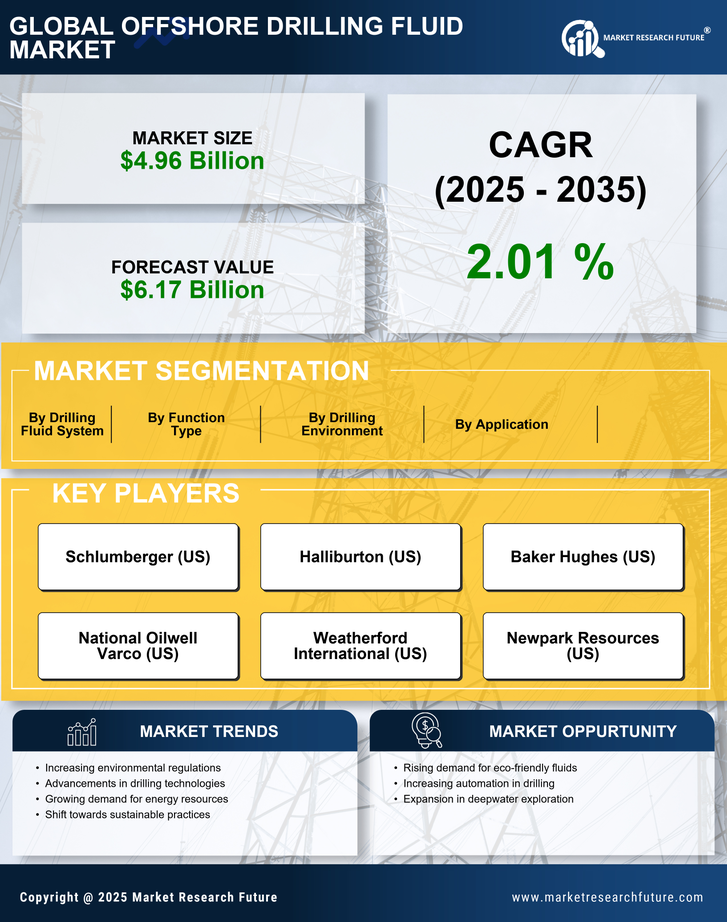

The Offshore Drilling Fluid Market is experiencing a surge in demand driven by the increasing global energy requirements. As economies expand and populations grow, the need for oil and gas continues to rise. According to recent estimates, the global energy consumption is projected to increase by approximately 30% by 2040. This escalating demand for energy resources necessitates the exploration and production of hydrocarbons in offshore environments, thereby propelling the offshore drilling fluid market. The industry is adapting to these demands by innovating drilling fluids that enhance efficiency and reduce environmental impact, which is crucial for meeting regulatory standards and public expectations.

Technological Innovations

Technological advancements play a pivotal role in shaping the Offshore Drilling Fluid Market. Innovations such as advanced drilling techniques, real-time data analytics, and improved fluid formulations are enhancing operational efficiency and safety. For instance, the introduction of synthetic-based drilling fluids has been shown to improve performance in challenging offshore conditions. Furthermore, the market is witnessing the integration of automation and artificial intelligence, which streamlines drilling operations and reduces costs. As companies invest in research and development, the offshore drilling fluid market is likely to benefit from these technological breakthroughs, leading to more effective and sustainable drilling practices.

Emerging Markets and New Discoveries

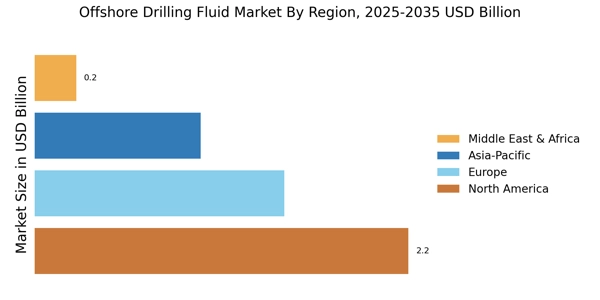

Emerging markets are becoming increasingly relevant in the Offshore Drilling Fluid Market, as new discoveries of oil and gas reserves are made in previously untapped regions. Countries in Africa, South America, and Southeast Asia are witnessing a rise in offshore drilling activities, driven by the need to diversify energy sources and reduce dependence on traditional markets. These regions are expected to attract significant foreign investment, which will likely boost the demand for specialized drilling fluids tailored to local conditions. As exploration efforts expand into these emerging markets, the offshore drilling fluid industry may experience substantial growth opportunities.

Rising Investment in Offshore Exploration

Investment in offshore exploration activities is a significant driver for the Offshore Drilling Fluid Market. As oil prices stabilize and increase, companies are more inclined to invest in offshore projects, which often require specialized drilling fluids. Recent reports indicate that offshore exploration and production investments are expected to reach over 200 billion dollars by 2026. This influx of capital is likely to stimulate demand for advanced drilling fluids that can withstand harsh offshore conditions. Consequently, the offshore drilling fluid market is poised for growth as companies seek to optimize their drilling operations and enhance recovery rates in offshore fields.

Regulatory Compliance and Environmental Concerns

The Offshore Drilling Fluid Market is increasingly influenced by stringent regulatory frameworks aimed at minimizing environmental impact. Governments and international bodies are implementing regulations that mandate the use of eco-friendly drilling fluids and practices. This shift is driven by growing public awareness and concern regarding environmental sustainability. As a result, companies are compelled to adapt their operations to comply with these regulations, which may involve investing in research to develop biodegradable and non-toxic drilling fluids. The market is likely to see a rise in demand for environmentally friendly solutions, which could reshape product offerings and operational strategies in the offshore drilling fluid sector.