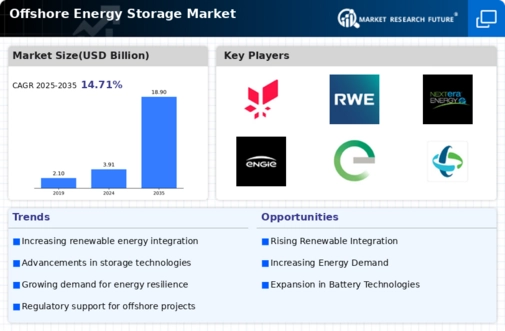

Market Growth Projections

The Global Offshore Energy Storage Market Industry is poised for substantial growth, with projections indicating a significant increase in market size. By 2024, the market is expected to reach 3.91 USD Billion, with further expansion anticipated to 18.9 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 15.38% from 2025 to 2035. Such projections underscore the increasing recognition of offshore energy storage as a critical component of the global energy landscape, driven by technological advancements, regulatory support, and rising demand for renewable energy solutions.

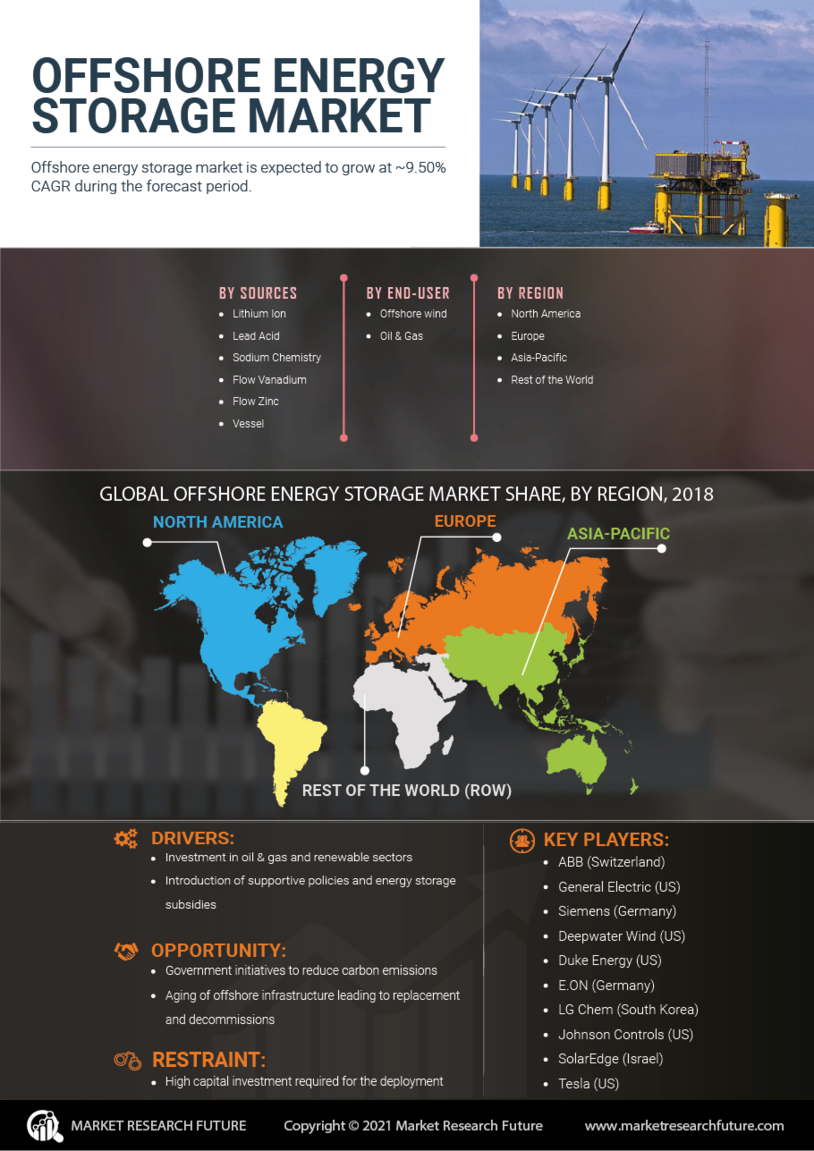

Government Policies and Incentives

Government policies play a crucial role in shaping the Global Offshore Energy Storage Market Industry. Many countries are implementing favorable regulations and financial incentives to promote offshore energy storage projects. For instance, the European Union has established funding mechanisms to support renewable energy initiatives, which include offshore storage solutions. Such policies not only encourage investment but also facilitate research and development in the sector. As governments prioritize energy security and sustainability, the regulatory environment is expected to become increasingly supportive, thereby driving market growth and attracting new players into the industry.

Rising Demand for Renewable Energy

The Global Offshore Energy Storage Market Industry is experiencing a surge in demand for renewable energy solutions. As countries strive to meet their climate goals, the integration of offshore energy storage systems becomes increasingly vital. For instance, nations like the United Kingdom and Germany are investing heavily in offshore wind farms, which necessitate effective energy storage solutions to manage intermittent supply. This trend is projected to drive the market's growth, with the industry expected to reach 3.91 USD Billion in 2024 and potentially expand to 18.9 USD Billion by 2035, reflecting a compound annual growth rate of 15.38% from 2025 to 2035.

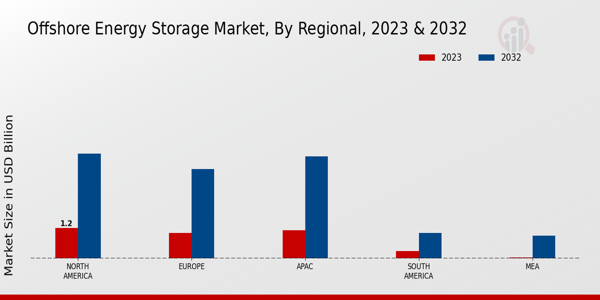

Growing Awareness of Energy Security

The growing awareness of energy security is influencing the Global Offshore Energy Storage Market Industry. As geopolitical tensions and climate change concerns escalate, nations are increasingly recognizing the importance of diversifying their energy sources. Offshore energy storage systems provide a reliable solution to mitigate risks associated with energy supply disruptions. Countries like Japan and South Korea are actively exploring offshore storage options to enhance their energy resilience. This heightened focus on energy security is likely to drive investments and innovations in the offshore energy storage sector, ensuring a sustainable and secure energy future.

Increased Investment in Infrastructure

Investment in infrastructure is a key driver for the Global Offshore Energy Storage Market Industry. As the demand for renewable energy rises, there is a corresponding need for robust infrastructure to support offshore energy storage systems. Countries are allocating substantial funds to develop ports, grid connections, and other necessary facilities. For example, the United States has announced plans to enhance its offshore wind infrastructure, which includes integrating energy storage solutions. This investment not only boosts the market but also creates job opportunities and stimulates economic growth in coastal regions, thereby reinforcing the industry's overall viability.

Technological Advancements in Energy Storage

Technological innovations are propelling the Global Offshore Energy Storage Market Industry forward. Advances in battery technologies, such as lithium-ion and flow batteries, enhance the efficiency and capacity of energy storage systems. These innovations enable offshore facilities to store excess energy generated during peak production times, thereby ensuring a stable energy supply. For example, the development of floating battery storage systems allows for the deployment of energy storage solutions in deeper waters, where traditional methods may be impractical. This evolution in technology is likely to attract further investments and partnerships, fostering a competitive landscape within the industry.