Rising Energy Demand

The Floating Offshore Wind Energy Market is experiencing a surge in demand for renewable energy sources, driven by increasing global energy consumption. As populations grow and economies expand, the need for sustainable energy solutions becomes more pressing. According to recent estimates, energy demand is projected to rise by approximately 30% by 2040. This trend compels nations to explore alternative energy sources, with floating offshore wind energy emerging as a viable option. The ability to harness wind energy in deeper waters, where winds are typically stronger and more consistent, positions this sector as a key player in meeting future energy needs. Consequently, the Floating Offshore Wind Energy Market is likely to see substantial growth as it aligns with the global shift towards cleaner energy solutions.

Technological Innovations

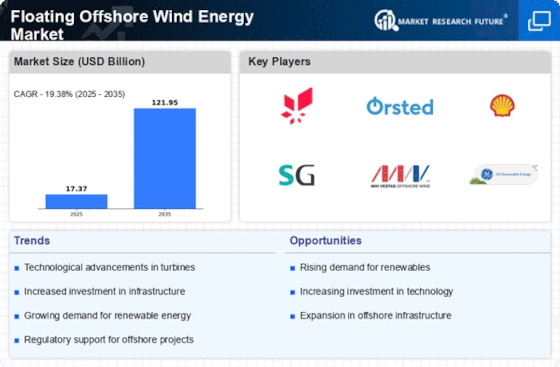

Technological advancements are pivotal in shaping the Floating Offshore Wind Energy Market. Innovations in turbine design, floating platform technology, and installation techniques have significantly enhanced the efficiency and feasibility of offshore wind projects. For instance, the development of larger, more efficient turbines has increased energy output while reducing costs. Furthermore, advancements in materials and engineering have improved the durability and stability of floating platforms, allowing them to operate in harsher marine environments. As a result, the industry is witnessing a reduction in the levelized cost of energy (LCOE), making floating offshore wind projects more competitive with traditional energy sources. This technological evolution not only boosts investor confidence but also accelerates the deployment of floating offshore wind farms, thereby propelling the market forward.

Government Incentives and Policies

Supportive government policies and incentives play a crucial role in the growth of the Floating Offshore Wind Energy Market. Many countries are implementing favorable regulatory frameworks to encourage investment in renewable energy projects. These policies often include tax credits, grants, and streamlined permitting processes, which lower the barriers to entry for developers. For instance, some regions have established feed-in tariffs or power purchase agreements that guarantee fixed prices for energy produced from floating offshore wind farms. Such measures not only stimulate investment but also provide a stable revenue stream for project developers. As governments continue to prioritize renewable energy in their energy strategies, the Floating Offshore Wind Energy Market is poised for robust growth, attracting both domestic and international investors.

Increased Private Sector Investment

The Floating Offshore Wind Energy Market is witnessing a notable increase in private sector investment, driven by the growing recognition of the potential returns associated with renewable energy projects. Institutional investors, venture capitalists, and energy companies are increasingly allocating funds to floating offshore wind initiatives, attracted by the long-term growth prospects and the shift towards sustainable energy. Recent reports indicate that investments in offshore wind projects have surged, with billions of dollars committed to new developments. This influx of capital not only accelerates project deployment but also fosters innovation within the industry. As private sector involvement expands, the Floating Offshore Wind Energy Market is likely to benefit from enhanced technological advancements and operational efficiencies, further solidifying its position in the energy landscape.

Environmental Sustainability Initiatives

The Floating Offshore Wind Energy Market is significantly influenced by the growing emphasis on environmental sustainability. Governments and organizations worldwide are increasingly recognizing the urgent need to reduce carbon emissions and combat climate change. This recognition has led to the implementation of ambitious renewable energy targets, with many countries aiming for net-zero emissions by mid-century. Floating offshore wind energy, with its minimal environmental footprint and ability to generate clean energy, aligns perfectly with these sustainability goals. As a result, investments in this sector are likely to increase, driven by both public and private sector initiatives. The commitment to environmental sustainability not only enhances the attractiveness of the Floating Offshore Wind Energy Market but also fosters innovation and collaboration among stakeholders.