Rising Energy Demand

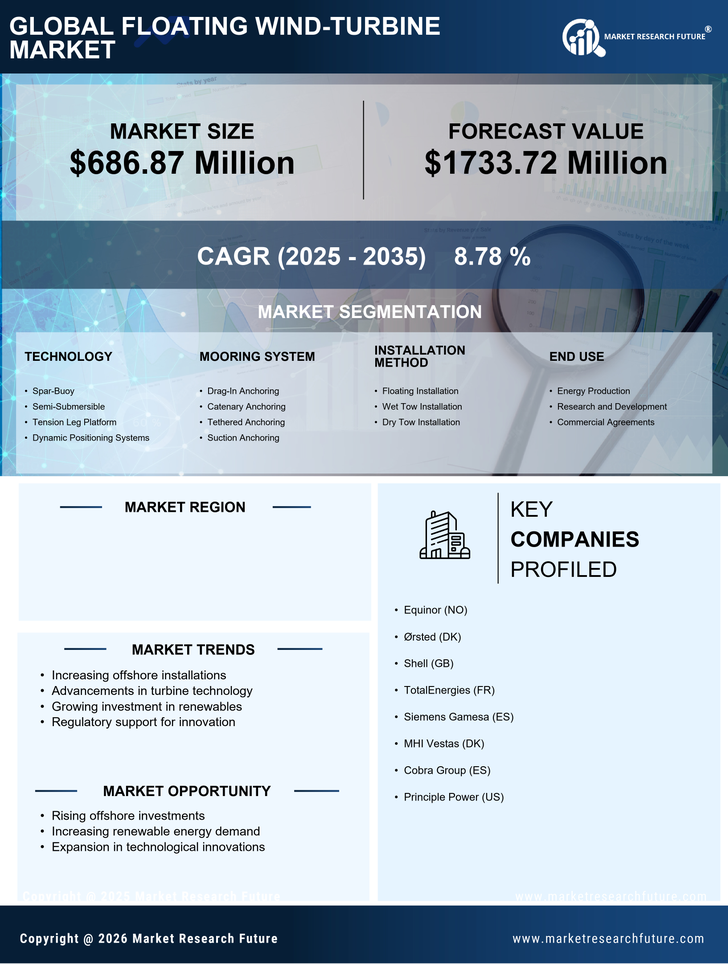

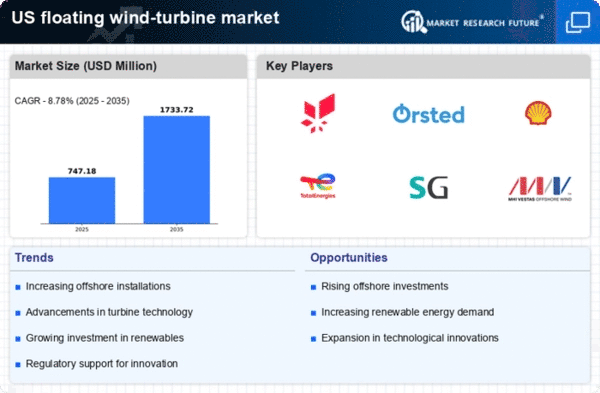

The floating wind-turbine market is poised to benefit from the increasing energy demand in the United States. As the population grows and industrial activities expand, the need for sustainable energy sources becomes more pressing. The U.S. Energy Information Administration projects that electricity consumption will rise by approximately 1.5% annually through 2030. This trend necessitates the exploration of alternative energy solutions, with floating wind turbines offering a viable option. These systems can be deployed in deeper waters, where wind resources are often more abundant, thus potentially increasing energy generation capacity. The floating wind-turbine market is likely to see significant investments as utilities and private companies seek to meet this rising demand while adhering to environmental standards.

Investment in Renewable Energy

The floating wind-turbine market is experiencing a surge in investment as stakeholders recognize the potential of renewable energy sources. In recent years, there has been a notable increase in funding for offshore wind projects, with investments reaching approximately $20 billion in 2021 alone. This trend is expected to continue, driven by both public and private sector initiatives aimed at transitioning to cleaner energy. The floating wind-turbine market stands to gain from this influx of capital, as it enables the development of new technologies and the expansion of existing projects. As financial support for renewable energy grows, the floating wind-turbine market is likely to flourish.

Technological Innovation and Research

The floating wind-turbine market is significantly influenced by ongoing technological innovation and research efforts. Universities, research institutions, and private companies are actively exploring new designs and materials that enhance the efficiency and durability of floating wind turbines. For instance, advancements in turbine blade design and energy storage solutions are expected to improve overall performance. The U.S. Department of Energy has allocated substantial funding for research initiatives aimed at reducing the cost of offshore wind energy, which could lead to a more competitive floating wind-turbine market. As these innovations emerge, they may drive down costs and increase the attractiveness of floating wind energy as a viable alternative.

Advancements in Offshore Infrastructure

The floating wind-turbine market is benefiting from advancements in offshore infrastructure, which enhance the feasibility and efficiency of wind energy projects. Recent developments in floating platform technology and mooring systems have improved the stability and performance of floating turbines in challenging marine environments. According to the U.S. Department of Energy, the offshore wind capacity is expected to reach 22 GW by 2030, with floating technologies playing a crucial role in this expansion. The floating wind-turbine market is likely to see increased activity as companies invest in innovative solutions that facilitate the deployment of floating wind farms, thereby unlocking new areas for energy generation.

Environmental Sustainability Initiatives

The floating wind-turbine market is increasingly influenced by the growing emphasis on environmental sustainability. With climate change concerns at the forefront, the U.S. government and various organizations are advocating for cleaner energy solutions. The Biden administration has set ambitious targets to achieve a 50-52% reduction in greenhouse gas emissions by 2030, which aligns with the deployment of renewable energy technologies. Floating wind turbines, which have a lower environmental footprint compared to traditional energy sources, are seen as a key component in achieving these goals. The floating wind-turbine market is likely to experience growth as stakeholders prioritize investments in sustainable technologies that contribute to a greener future.