Research Methodology on Direct Drive Wind Turbine Market

1. Summary

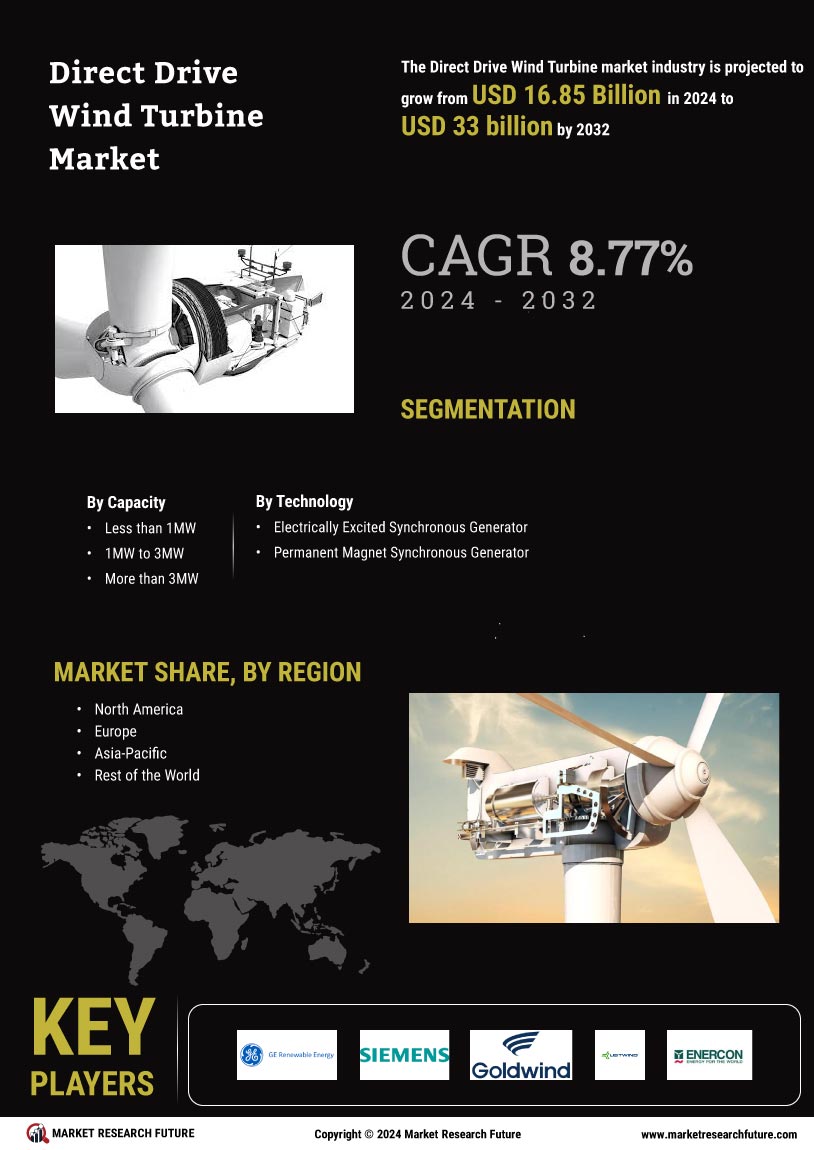

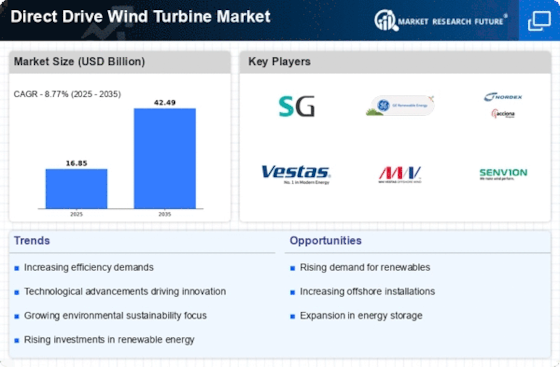

This research methodology outlines the procedures, instruments and analytical methods that will be used to conduct a market research study to assess the global Direct Drive Wind Turbine Market. The main objective of this study is to provide a comprehensive overview of the global market focused on key market dynamics, such as market Drivers, Restraints, Opportunities, and Challenges. It also seeks to provide an in-depth analysis of the current and future trends in the industry and assess the potential size of the global market for the forecast period from 2023 to 2030. Data and information collected about the market from primary and secondary sources will be used in the development of the research methodology and will be compared and contrasted to provide accurate and reliable insights into the market. This research revises the findings of various market analysis reports published by reputed industry experts in order to evaluate a more precise estimate of the market size.

2. Research Objectives

2.1 Primary Objective

- To provide a comprehensive overview of the global Direct Drive Wind Turbine Market, in terms of market drivers, restraints, opportunities, current market trends and future outlook.

2.2 Secondary Objects

- To conduct an in-depth analysis of the global Direct Drive Wind Turbine Market with a focus on its impact on the market over the forecast period from 2023 to 2030.

- To evaluate the potential size of the global Direct Drive Wind Turbine Market over the forecast period 2023-2030.

- To develop a comprehensive research methodology and compare and contrast different market analysis reports providing an accurate and reliable market size estimate.

3. Research Design

3.1 Scope of the Study

The scope of this study is to provide answers to the above-stated research objectives while assessing the global Direct Drive Wind Turbine Market over the forecast period, from 2023 to 2030.

3.2 Data Collection

Data and information required to conduct this market research study will be collected through primary (interviews and surveys) and secondary (published reports and industry databases) sources. The data collected from primary and secondary sources will be compared and contrasted to ensure accuracy and reliability.

3.3 Data Analysis

Data and information collected from primary and secondary sources will be subjected to quantitative and qualitative analysis. The analysis will be performed at both the macro and micro levels to gain a thorough understanding of the global Direct Drive Wind Turbine Market.

3.4 Market Estimation

The market estimates produced through this study for the forecast period from 2023 to 2030 will be based on statistical and analytical techniques. These techniques are applied to market figures to arrive at the final market estimate.

3.5 Market Segmentation

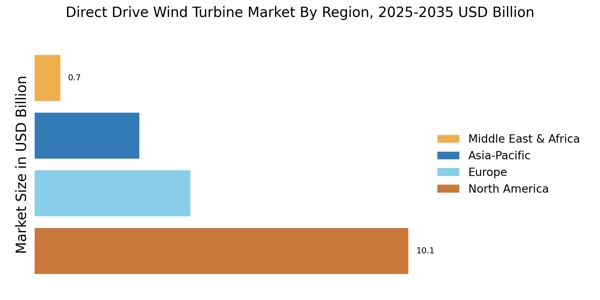

To gain an accurate understanding of the global Direct Drive Wind Turbine Market, it will be segmented based on region, technology, components, and application.

4. Research Method

This research will be conducted using both qualitative and quantitative research methods. Primary and secondary sources of data will be used to collect the necessary data and information, which will then be analyzed and used to draw valid inferences about the market.

4.1 Primary Research

Primary research often involves direct interaction with target respondents, or informants, such as industry professionals, industry experts, and opinion leaders, to collect data and valuable insights about the global Direct Drive Wind Turbine Market. Primary research also involves conducting surveys, interviews, and focus group discussions (FGDs) with experts in the field.

4.2 Secondary Research

Secondary research involves gaining information from published industry expert sources, including market reports, industry reports, and other publicly available secondary sources. It is the most important source of data in the market and provides the opportunity to draw insights from other industry experts.

5. Sampling

5.1 Sample Size

The sample size used for this research will depend on the scope of the research and the number of target informants required. Taking into account the requirements of the project, an appropriate sample size of target respondent groups will be identified.

5.2 Sampling Method

The sampling method chosen for this research will be based on the stratified random sampling technique. This method will enable the researchers to obtain a representative sample of the global Direct Drive Wind Turbine Market while taking into account key factors such as market size, demographic characteristics, and geographical location.

6. Research Instruments

The primary research instruments that will be utilized include, but are not limited to, surveys, personal interviews, structured questionnaires, FGDs, and other types of data-gathering methods.

7. Data Analysis

Data and information collected from primary and secondary sources will be subjected to quantitative and qualitative analysis. Quantitative analyses will include descriptive statistics, such as mean, median, and mode. Qualitative analyses will utilize theories and models from various fields such as economics, finance, and management to assess the key factors driving the market.

8. Data Validation

Data and information collected through primary and secondary sources will be verified and validated by the research team. The validation process will ensure the accuracy and consistency of the data and prevent any misrepresentation of the market’s dynamics.

9. Conclusion

This research methodology outlines the procedures, instruments and analytical methods that will be utilized to conduct a market research study to assess the global Direct Drive Wind Turbine Market. It is intended to provide a comprehensive overview of the market, while also providing accurate and reliable insights into the market’s size over the forecast period from 2023 to 2030. Data and information collected about the market from primary and secondary sources will be compared and contrasted to develop a more precise estimation of the overall market size.