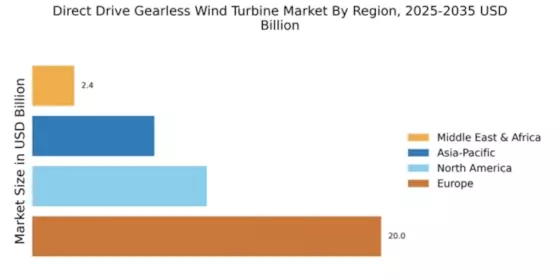

North America : Growing Renewable Energy Sector

The North American market for Direct Drive Gearless Wind Turbines is projected to reach $10.0 billion by December 2025. Key growth drivers include increasing investments in renewable energy, favorable government policies, and a growing emphasis on reducing carbon emissions. The region is witnessing a surge in demand for efficient wind energy solutions, supported by incentives and subsidies aimed at promoting clean energy technologies.

The United States is the leading country in this market, with significant contributions from states like Texas and California. Major players such as GE Renewable Energy and Siemens Gamesa are actively involved in expanding their operations. The competitive landscape is characterized by technological advancements and strategic partnerships, positioning North America as a pivotal player in the global wind energy sector.

Europe : Market Leader in Wind Technology

Europe is the largest market for Direct Drive Gearless Wind Turbines, with a market size of $20.0 billion anticipated by December 2025. The region benefits from strong regulatory support, ambitious renewable energy targets, and a commitment to sustainability. Countries are increasingly investing in wind energy to meet EU climate goals, driving demand for innovative turbine technologies and solutions.

Germany, Denmark, and Spain are at the forefront of this market, hosting key players like Vestas Wind Systems and Nordex. The competitive landscape is robust, with a focus on R&D and technological advancements. The European market is characterized by a high level of collaboration between governments and private sectors, ensuring continued growth and innovation in wind energy technologies.

Asia-Pacific : Emerging Market for Wind Energy

The Asia-Pacific region is emerging as a significant player in the Direct Drive Gearless Wind Turbine market, with a projected size of $7.0 billion by December 2025. Key growth drivers include increasing energy demands, government initiatives to promote renewable energy, and advancements in wind technology. Countries in this region are focusing on diversifying their energy sources to enhance energy security and sustainability.

China is the leading country in this market, with major companies like Goldwind driving innovation and expansion. India is also making strides in wind energy, supported by government policies and investments. The competitive landscape is evolving, with both domestic and international players vying for market share, indicating a promising future for wind energy in Asia-Pacific.

Middle East and Africa : Untapped Renewable Potential

The Middle East and Africa region is gradually recognizing the potential of Direct Drive Gearless Wind Turbines, with a market size of $2.41 billion expected by December 2025. The growth is driven by increasing energy needs, government initiatives to diversify energy sources, and a growing awareness of climate change. Countries are beginning to invest in renewable energy projects, although the market is still in its nascent stages compared to other regions.

South Africa and the UAE are leading the way in wind energy investments, with several projects underway. The competitive landscape is characterized by a mix of local and international players, including companies like Suzlon Energy. As the region continues to develop its renewable energy infrastructure, the wind energy market is poised for significant growth in the coming years.