Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the Wind Turbine Gearbox and Direct Drive Systems Industry Market. Many countries are implementing supportive frameworks to promote renewable energy adoption, including tax credits, subsidies, and feed-in tariffs. These initiatives not only encourage investment in wind energy projects but also stimulate demand for wind turbine components, including gearboxes and direct drive systems. In 2025, it is anticipated that such policies will continue to evolve, further enhancing the attractiveness of wind energy as a viable alternative to fossil fuels. The commitment of governments to reduce greenhouse gas emissions and transition to sustainable energy sources is likely to create a favorable environment for the Wind Turbine Gearbox and Direct Drive Systems Industry Market, driving growth and innovation in the sector.

Increasing Demand for Renewable Energy

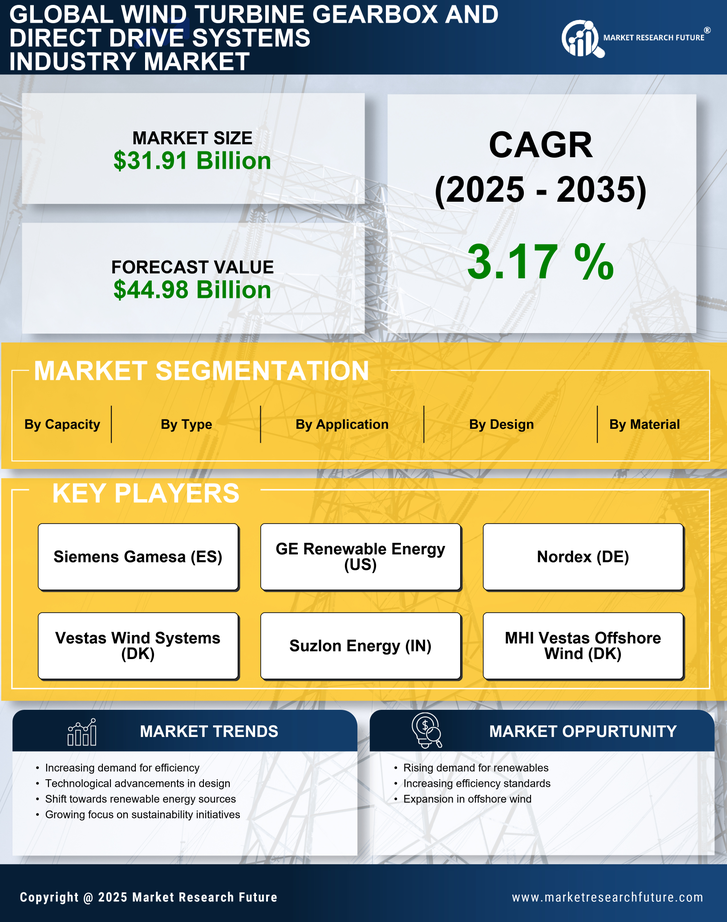

The escalating demand for renewable energy sources is a primary driver for the The escalating demand for renewable energy sources is a primary driver for this market.. As nations strive to meet ambitious carbon reduction targets, investments in wind energy infrastructure are surging. In 2025, the wind energy sector is projected to account for a substantial share of the global energy mix, with wind turbine installations expected to reach unprecedented levels. This trend is likely to bolster the demand for both gearboxes and direct drive systems, as they are essential components in harnessing wind energy efficiently. Furthermore, the transition towards cleaner energy sources is supported by favorable government policies and incentives, which further stimulate market growth. The Wind Turbine Gearbox and Direct Drive Systems Industry Market is thus positioned to benefit significantly from this increasing demand for sustainable energy solutions.

Technological Advancements in Turbine Design

Technological advancements in turbine design are reshaping the Wind Turbine Gearbox and Direct Drive Systems Industry Market. Innovations such as larger rotor diameters and enhanced blade designs are leading to improved energy capture and efficiency. These advancements necessitate the development of more sophisticated gearboxes and direct drive systems that can handle increased loads and optimize performance. For instance, the integration of variable speed technology allows turbines to operate more efficiently across a range of wind conditions, thereby enhancing energy output. As manufacturers continue to invest in research and development, the market is likely to witness a proliferation of advanced systems that cater to the evolving needs of the wind energy sector. This focus on innovation is expected to drive the Wind Turbine Gearbox and Direct Drive Systems Industry Market forward, creating opportunities for growth and expansion.

Growing Awareness of Environmental Sustainability

Growing awareness of environmental sustainability is a significant driver for the Wind Turbine Gearbox and Direct Drive Systems Industry Market. As public consciousness regarding climate change and environmental degradation increases, there is a heightened demand for clean energy solutions. Wind energy is recognized as a key player in reducing carbon footprints and promoting sustainable development. This awareness is translating into increased investments in wind energy projects, which in turn drives the need for efficient wind turbine components, including gearboxes and direct drive systems. In 2025, the emphasis on sustainability is expected to continue influencing energy policies and corporate strategies, further propelling the Wind Turbine Gearbox and Direct Drive Systems Industry Market. Stakeholders are likely to prioritize investments in technologies that align with sustainability goals, fostering growth in this sector.

Rising Energy Prices and Energy Security Concerns

Rising energy prices and energy security concerns are increasingly influencing the Wind Turbine Gearbox and Direct Drive Systems Industry Market. As traditional energy sources become more volatile and expensive, there is a growing impetus to invest in renewable energy solutions. Wind energy, being one of the most cost-effective forms of renewable energy, is gaining traction as a reliable alternative. The need for energy independence is prompting countries to diversify their energy portfolios, leading to increased investments in wind power infrastructure. This shift is likely to drive demand for both gearboxes and direct drive systems, as they are integral to the efficient operation of wind turbines. The Wind Turbine Gearbox and Direct Drive Systems Industry Market is thus expected to benefit from this trend, as stakeholders seek to enhance energy security while mitigating the impacts of fluctuating energy prices.