Research Methodology on Wind Turbine Composites Market

1. Introduction

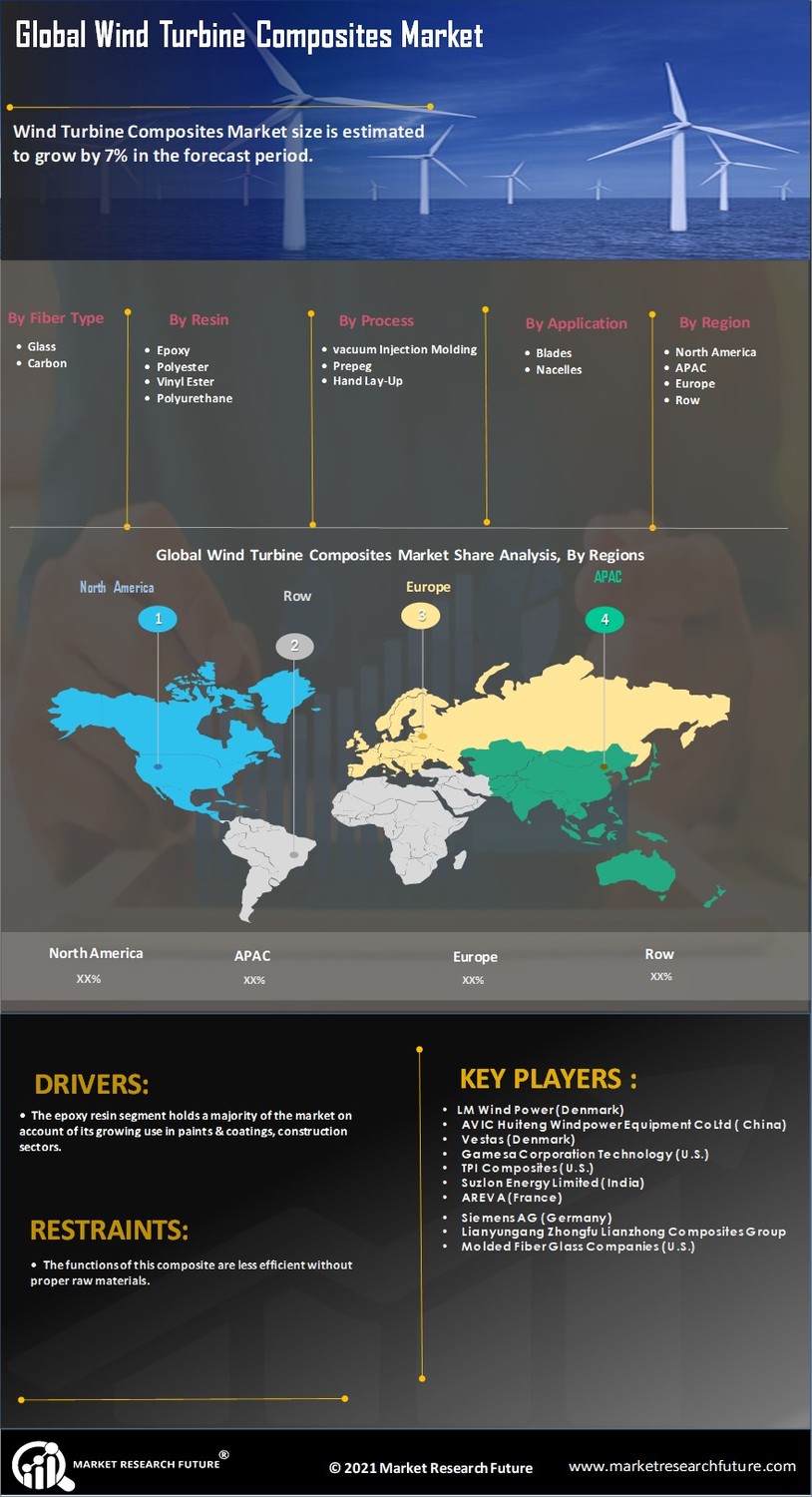

Wind turbines are increasingly being used to generate electricity from renewable sources such as wind. The growth in the demand for wind turbines has opened up an opportunity for the use of composite materials for the fabrication of turbine blades. There is a surge in the use of composites in wind turbine applications, as they offer higher strength, durability, and resistance to corrosion and extreme weathering, among other benefits.

Market Research Future recently published the Wind Turbine Composites Market - Global Forecast Till 2030 report, which provides an in-depth analysis of the global wind turbine composites market. This report presents a research methodology used to develop the report.

2. Scope of the Study

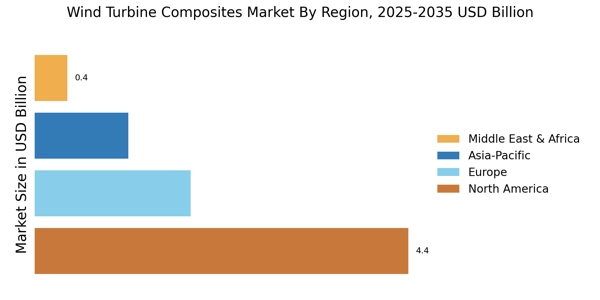

This research was conducted to understand the global wind turbine composites market landscape; identify market opportunities and trends; and forecast the market size, production, consumption, and opportunities up to 2030.

The scope of the study includes the study of market trends, market sizing, value chain analysis, country-wise analysis, brand-wise comparison, regulations and government initiatives, technology trends, and competition.

3. Sources of Data

Secondary sources such as industry magazines, reports, online databases, and recent news articles were used in formulating the research data. Primary data was also collected through interviews and surveys of key industry players.

4. Research Methodology

The market research process was structured in three phases. The first phase involved secondary research, which included market survey reports, publications, press releases, and other literature. This phase was followed by primary research, which included interviews with industry experts, market participants, and end-users. The final phase was the data analysis and market sizing phase.

5. Data Sizing and Analysis

Data sizing and analysis were done in this stage by collecting, validating, and analyzing secondary data. This phase also included data validation, which involved verifying the accuracy and precision of the data collected.

Several analytical tools, such as Porter's Five Force Model, supply and demand analysis, and SWOT analysis, were used in this phase to draw insights and make informed decisions. This phase concluded with market sizing and estimation of the global wind turbine composites market.

6. Market Validations

To ensure the accuracy and credibility of the data and insights obtained from the research methodology, the data obtained was cross-checked and corroborated. The data was also validated through triangulation. The triangulation process included consultation from industry experts and in-depth control sessions.

7. Report Structure

The structure of the final report is based on the insights obtained from the research and includes market insight, executive summary, market overview, market trends and dynamics, competitive landscape, market segmentation and analysis, regional analysis and demand and production analysis.

8. Conclusion

Market Research Future employed a comprehensive research methodology to develop its ˜Wind Turbine Composites Market“ Global Forecast Till 2030 report. This research methodology was designed to collect, validate, and analyze data, enabling the development of a market outlook report. The insights and data provided in the report will enable the reader to gain a better understanding of the current wind turbine composites market landscape and plan appropriate strategies to capitalize on the available opportunities.