Rising Energy Demand

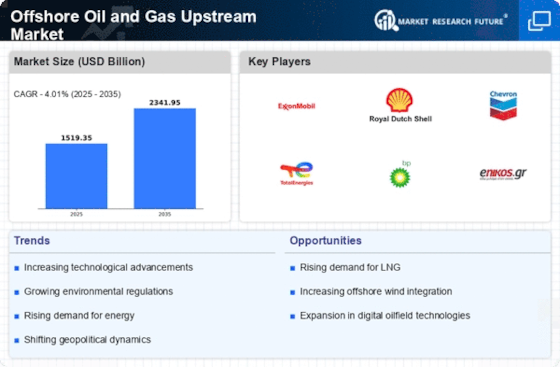

The Offshore Oil and Gas Upstream Market is currently experiencing a surge in energy demand, driven by increasing industrial activities and population growth. As economies expand, the need for reliable energy sources intensifies, prompting investments in offshore exploration and production. According to recent data, global energy consumption is projected to rise by approximately 30% by 2040, necessitating enhanced offshore oil and gas production capabilities. This trend indicates a robust market potential for offshore operations, as companies seek to capitalize on the growing demand for hydrocarbons. Furthermore, the transition towards cleaner energy sources may not diminish the need for oil and gas in the short to medium term, thereby sustaining interest in offshore projects.

Regulatory Frameworks

The Offshore Oil and Gas Upstream Market is influenced by evolving regulatory frameworks that govern exploration and production activities. Governments are increasingly implementing stringent environmental regulations to mitigate the ecological impact of offshore operations. While these regulations may pose challenges, they also create opportunities for companies to innovate and adopt sustainable practices. For example, compliance with new regulations often necessitates investment in cleaner technologies and processes, which can enhance operational efficiency. Moreover, favorable regulatory environments in certain regions may encourage foreign investments, thereby stimulating growth in the offshore sector. The balance between regulation and operational freedom remains a critical factor for market participants.

Geopolitical Stability

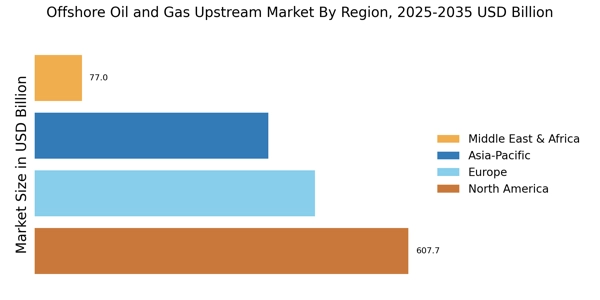

Geopolitical factors significantly impact the Offshore Oil and Gas Upstream Market, as stability in oil-producing regions is crucial for uninterrupted supply chains. Political tensions or conflicts can disrupt production and lead to fluctuations in oil prices, affecting investment decisions. Conversely, regions with stable governance and favorable relations often attract more investments in offshore exploration. For instance, countries that maintain strong diplomatic ties and stable political environments are likely to see increased offshore activities. This geopolitical landscape suggests that companies must remain vigilant and adaptable to changes in international relations, as these dynamics can directly influence market conditions and operational strategies.

Technological Innovations

Technological advancements play a pivotal role in shaping the Offshore Oil and Gas Upstream Market. Innovations such as advanced drilling techniques, subsea technologies, and digitalization are enhancing operational efficiency and reducing costs. For instance, the adoption of automated drilling systems has reportedly improved drilling performance by up to 20%, allowing companies to extract resources more effectively. Additionally, the integration of data analytics and artificial intelligence is optimizing production processes and enabling predictive maintenance, which can significantly lower operational risks. As these technologies continue to evolve, they are likely to attract further investments in offshore projects, thereby bolstering the market's growth trajectory.

Investment in Renewable Integration

The Offshore Oil and Gas Upstream Market is witnessing a trend towards integrating renewable energy sources into traditional oil and gas operations. As the energy landscape evolves, companies are exploring hybrid models that combine offshore oil production with renewable technologies such as wind and solar. This integration not only diversifies energy portfolios but also aligns with global sustainability goals. Recent studies indicate that investments in offshore wind farms are expected to reach USD 100 billion by 2030, highlighting the potential for synergy between oil and gas and renewable sectors. This trend may reshape the offshore market, encouraging companies to innovate and adapt to changing energy demands.