Rising Demand for Renewable Energy

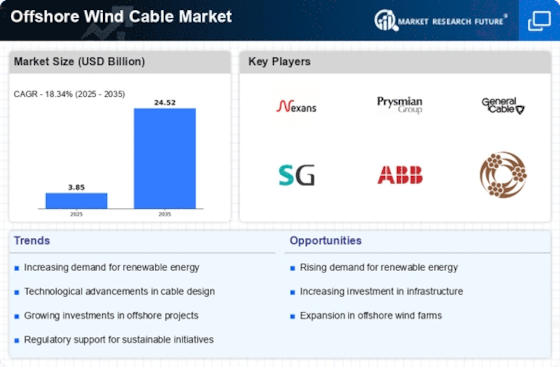

The Offshore Wind Cable Market is experiencing a surge in demand driven by the global shift towards renewable energy sources. Governments and private sectors are increasingly investing in offshore wind projects to meet energy targets and reduce carbon emissions. According to recent data, offshore wind capacity is projected to reach over 200 GW by 2030, necessitating a robust supply of specialized cables for energy transmission. This growing demand for clean energy solutions is likely to propel the Offshore Wind Cable Market, as the need for efficient and reliable cable systems becomes paramount in supporting these large-scale projects.

Growing Awareness of Energy Security

Growing awareness of energy security is emerging as a significant driver for the Offshore Wind Cable Market. As nations seek to diversify their energy sources and reduce dependence on fossil fuels, offshore wind energy is gaining traction. This shift is particularly evident in regions with limited land resources for traditional energy generation. The strategic importance of offshore wind projects in enhancing energy security is likely to lead to increased investments in the necessary infrastructure, including specialized cables. Consequently, the Offshore Wind Cable Market may experience robust growth as stakeholders prioritize energy independence and sustainability.

Investment in Offshore Wind Infrastructure

Investment in offshore wind infrastructure is a critical driver for the Offshore Wind Cable Market. With substantial financial commitments from both public and private sectors, the development of offshore wind farms is accelerating. Recent reports indicate that investments in offshore wind projects are expected to exceed 100 billion dollars by 2025. This influx of capital is likely to stimulate demand for specialized cables that are essential for connecting wind turbines to the grid. As infrastructure projects expand, the Offshore Wind Cable Market is poised for growth, driven by the need for reliable and efficient cable solutions.

Technological Innovations in Cable Manufacturing

Technological advancements in cable manufacturing are significantly influencing the Offshore Wind Cable Market. Innovations such as improved materials and enhanced manufacturing processes are leading to the production of cables that are more durable and efficient. For instance, the introduction of high-voltage direct current (HVDC) technology allows for longer transmission distances with reduced energy losses. As the industry evolves, these technological improvements are expected to enhance the performance and reliability of offshore wind cables, thereby driving market growth. The Offshore Wind Cable Market stands to benefit from these advancements, as they align with the increasing complexity of offshore wind installations.

Environmental Regulations and Sustainability Goals

The Offshore Wind Cable Market is being shaped by stringent environmental regulations and sustainability goals set by various governments. These regulations often mandate the use of eco-friendly materials and practices in the construction of offshore wind farms. As countries strive to meet their climate commitments, the demand for sustainable cable solutions is likely to increase. This trend not only supports the growth of the Offshore Wind Cable Market but also encourages manufacturers to innovate and develop environmentally friendly products. The alignment of market offerings with regulatory requirements may enhance competitiveness and market share.