Cost Reduction Strategies

In the Oil And Gas Additive Manufacturing Market, the focus on cost reduction is becoming increasingly paramount. Companies are leveraging additive manufacturing to lower production costs by minimizing material waste and reducing the need for extensive tooling. This approach allows for on-demand production, which can significantly decrease inventory costs. Furthermore, the ability to produce spare parts locally reduces transportation expenses and lead times. As organizations seek to optimize their operational expenditures, the adoption of additive manufacturing is expected to rise, with estimates suggesting that it could reduce costs by up to 30% in certain applications. This trend is likely to drive further investment in additive technologies.

Technological Advancements

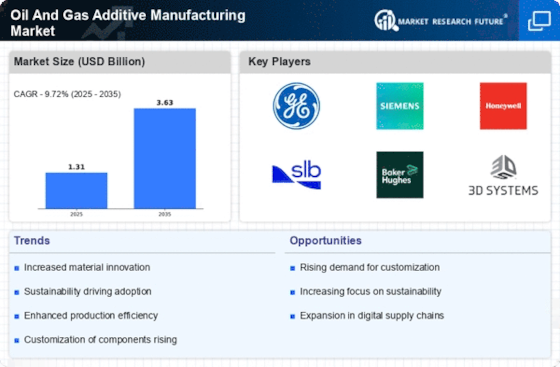

The Oil And Gas Additive Manufacturing Market is experiencing a surge in technological advancements that enhance production efficiency and reduce costs. Innovations in 3D printing technologies, materials science, and software solutions are enabling companies to produce complex components with greater precision. For instance, the introduction of metal additive manufacturing techniques allows for the creation of parts that are lighter and stronger than traditional manufacturing methods. This shift not only streamlines supply chains but also minimizes waste, aligning with the industry's sustainability goals. As a result, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years, driven by these technological improvements.

Increased Demand for Customization

Customization is a driving force in the Oil And Gas Additive Manufacturing Market, as companies seek to meet the unique needs of their operations. The ability to produce tailored components quickly and efficiently allows organizations to respond to specific project requirements without the delays associated with traditional manufacturing. This trend is particularly evident in the production of specialized tools and equipment that are essential for exploration and extraction activities. As the demand for customized solutions grows, the market is likely to expand, with projections indicating a potential increase in market size by 20% over the next few years. This adaptability is a key advantage of additive manufacturing.

Regulatory Compliance and Safety Standards

The Oil And Gas Additive Manufacturing Market is heavily influenced by the need for compliance with stringent regulatory and safety standards. As the industry faces increasing scrutiny regarding environmental impacts and operational safety, additive manufacturing offers solutions that can enhance compliance. For example, the ability to produce components that meet specific regulatory requirements without the need for extensive retooling can streamline the certification process. Moreover, additive manufacturing can facilitate the production of safety-critical parts with enhanced reliability. This focus on compliance is expected to drive market growth, as companies invest in technologies that not only meet but exceed regulatory expectations.

Sustainability and Environmental Considerations

Sustainability is becoming a central theme in the Oil And Gas Additive Manufacturing Market, as companies strive to reduce their environmental footprint. Additive manufacturing techniques inherently produce less waste compared to traditional methods, aligning with the industry's shift towards more sustainable practices. The ability to utilize recycled materials in the production process further enhances the environmental benefits. As organizations face pressure from stakeholders to adopt greener technologies, the integration of additive manufacturing is expected to rise. Market analyses suggest that sustainability initiatives could drive a 15% increase in the adoption of additive manufacturing technologies in the oil and gas sector over the next few years.

Leave a Comment