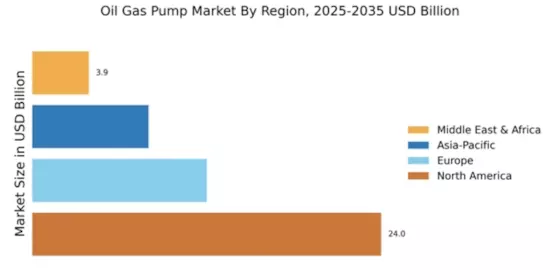

North America : Market Leader in Oil Pumps

North America continues to lead the Oil Gas Pump market, holding a significant share of 24.0 in 2024. The region's growth is driven by increasing oil production, technological advancements, and supportive regulatory frameworks. The demand for efficient and reliable pumping solutions is on the rise, fueled by the expansion of shale oil and gas exploration. Regulatory support for energy independence further catalyzes market growth, making it a focal point for investments in the oil and gas sector.

The competitive landscape in North America is robust, featuring key players such as Schlumberger, Halliburton, and Baker Hughes. These companies are at the forefront of innovation, providing advanced pumping solutions tailored to meet the evolving needs of the industry. The presence of established firms, coupled with a strong supply chain, positions North America as a critical hub for oil and gas pump manufacturing and distribution. The region's market dynamics are expected to remain favorable, driven by ongoing investments and technological advancements.

Europe : Emerging Market with Growth Potential

Europe's Oil Gas Pump market is characterized by a growing demand, with a market size of 12.0 in 2024. The region is witnessing a shift towards sustainable energy solutions, prompting investments in modern pumping technologies. Regulatory initiatives aimed at reducing carbon emissions are driving innovation in the sector, encouraging companies to adopt more efficient and environmentally friendly pumping systems. This regulatory push is expected to enhance market growth and attract new investments.

Leading countries in Europe, such as Germany and the UK, are home to key players like KSB SE & Co. KGaA and Flowserve Corporation. The competitive landscape is evolving, with companies focusing on R&D to develop advanced pumping solutions. The presence of established firms, along with a growing number of startups, is fostering a dynamic market environment. As Europe transitions towards greener energy, the Oil Gas Pump market is poised for significant growth, driven by innovation and regulatory support.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region is emerging as a significant player in the Oil Gas Pump market, with a market size of 8.0 in 2024. The growth is primarily driven by increasing energy demands, urbanization, and industrialization across countries like China and India. Regulatory frameworks promoting energy efficiency and sustainability are also contributing to the market's expansion. The region's focus on enhancing oil production capabilities is expected to further boost demand for advanced pumping solutions.

China and India are leading the charge in the Asia-Pacific market, with major investments in oil and gas infrastructure. Key players such as Eaton Corporation and Pentair plc are actively participating in this growth, providing innovative pumping solutions tailored to local needs. The competitive landscape is becoming increasingly dynamic, with both established companies and new entrants vying for market share. As the region continues to develop its energy sector, the Oil Gas Pump market is set for substantial growth, driven by technological advancements and regulatory support.

Middle East and Africa : Resource-Rich Market Opportunities

The Middle East and Africa region, with a market size of 3.89 in 2024, presents unique opportunities in the Oil Gas Pump market. The region is rich in oil reserves, and the demand for efficient pumping solutions is on the rise due to ongoing exploration and production activities. Regulatory frameworks are increasingly focusing on enhancing operational efficiency and sustainability, which is expected to drive market growth. The region's strategic importance in The Oil Gas Pump potential.

Leading countries such as Saudi Arabia and the UAE are pivotal in shaping the competitive landscape, with major players like National Oilwell Varco and Weatherford International establishing a strong presence. The market is characterized by a mix of established firms and local players, fostering a competitive environment. As investments in oil and gas infrastructure continue, the Oil Gas Pump market in the Middle East and Africa is poised for growth, driven by resource availability and regulatory support.