Increasing Demand for Oil and Gas

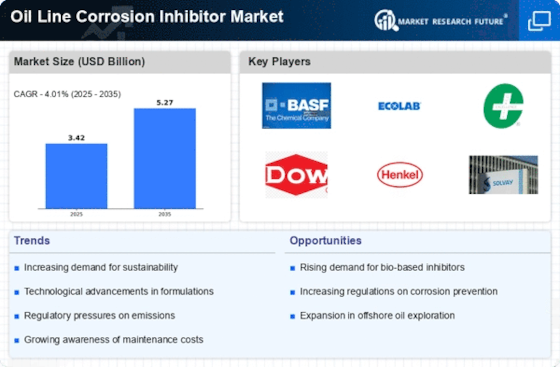

The Oil Line Corrosion Inhibitor Market is experiencing a surge in demand due to the rising consumption of oil and gas. As economies expand, the need for energy resources escalates, leading to increased exploration and production activities. This heightened demand necessitates the use of effective corrosion inhibitors to protect pipelines and equipment from degradation. According to recent data, the oil and gas sector is projected to grow at a compound annual growth rate of approximately 3.5% over the next few years. Consequently, the Oil Line Corrosion Inhibitor Market is likely to benefit from this growth, as operators seek to enhance the longevity and reliability of their infrastructure.

Growing Awareness of Environmental Impact

The Oil Line Corrosion Inhibitor Market is increasingly shaped by the growing awareness of environmental issues associated with corrosion and its management. Stakeholders are becoming more conscious of the ecological consequences of corrosion-related failures, which can lead to significant environmental damage. This awareness is driving the adoption of eco-friendly corrosion inhibitors that minimize environmental impact while maintaining performance. As companies strive to enhance their sustainability profiles, the demand for environmentally responsible solutions is expected to rise. This trend is likely to propel the Oil Line Corrosion Inhibitor Market forward, as businesses seek to align their operations with environmental stewardship.

Aging Infrastructure and Maintenance Needs

The Oil Line Corrosion Inhibitor Market is significantly impacted by the aging infrastructure prevalent in many regions. As pipelines and storage facilities age, the risk of corrosion increases, necessitating the use of effective inhibitors to maintain operational integrity. Many existing oil and gas infrastructures were built decades ago and are now facing deterioration. This situation creates a pressing need for corrosion management solutions to extend the lifespan of these assets. Consequently, the Oil Line Corrosion Inhibitor Market is likely to see increased demand as operators prioritize maintenance and rehabilitation efforts to mitigate corrosion-related risks.

Regulatory Compliance and Safety Standards

The Oil Line Corrosion Inhibitor Market is significantly influenced by stringent regulatory frameworks aimed at ensuring safety and environmental protection. Governments and regulatory bodies impose regulations that mandate the use of corrosion inhibitors to prevent leaks and spills, which can have catastrophic consequences. Compliance with these regulations is not only a legal obligation but also a critical aspect of corporate responsibility. As a result, companies are increasingly investing in corrosion management solutions, thereby driving the demand for inhibitors. The market is expected to expand as organizations prioritize adherence to safety standards, which in turn bolsters the Oil Line Corrosion Inhibitor Market.

Technological Innovations in Corrosion Inhibition

The Oil Line Corrosion Inhibitor Market is witnessing a wave of technological innovations that enhance the effectiveness of corrosion inhibitors. Advances in chemical formulations and application techniques are leading to the development of more efficient and environmentally friendly products. For instance, the introduction of nanotechnology in inhibitor formulations has shown promising results in improving performance and reducing environmental impact. This trend is likely to attract investments and research initiatives aimed at further enhancing inhibitor efficacy. As technology continues to evolve, the Oil Line Corrosion Inhibitor Market is poised for growth, driven by the demand for cutting-edge solutions.