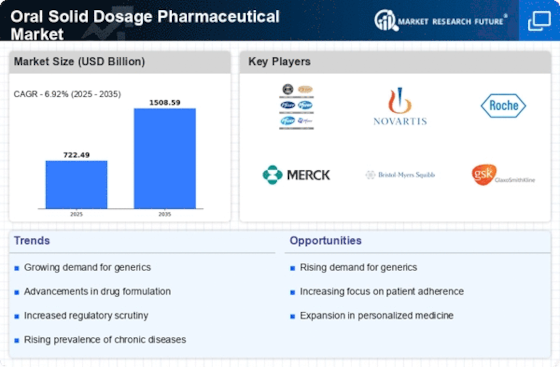

Expansion of Generic Drug Market

The Oral Solid Dosage Pharmaceutical Market is experiencing a notable shift with the expansion of the generic drug market. As patents for several blockbuster drugs expire, generic alternatives are becoming increasingly available. This transition not only enhances accessibility for patients but also drives competition among manufacturers, leading to reduced prices. In 2023, generic drugs accounted for nearly 90% of all prescriptions dispensed in certain regions, indicating a strong preference for cost-effective treatment options. Consequently, pharmaceutical companies are investing in the development of generic oral solid dosage forms, which is likely to bolster market growth and improve patient access to essential medications.

Regulatory Support for Drug Development

The Oral Solid Dosage Pharmaceutical Market benefits from favorable regulatory frameworks that facilitate drug development and approval processes. Regulatory agencies are increasingly adopting streamlined pathways for the approval of new oral solid dosage forms, particularly for innovative therapies. This support is crucial for pharmaceutical companies aiming to bring new products to market efficiently. Recent initiatives have indicated a reduction in approval timelines, which can enhance the competitiveness of companies within the industry. As a result, the likelihood of successful product launches increases, potentially leading to a surge in the availability of novel oral solid dosage medications.

Rising Focus on Patient-Centric Formulations

The Oral Solid Dosage Pharmaceutical Market is witnessing a paradigm shift towards patient-centric formulations. This trend emphasizes the importance of tailoring medications to meet individual patient needs, thereby enhancing adherence and therapeutic outcomes. Pharmaceutical companies are increasingly investing in research to develop oral solid dosage forms that are easier to swallow, have improved taste masking, and offer flexible dosing options. Data suggests that patient adherence can increase by up to 30% with more user-friendly formulations. This focus on patient-centricity is likely to drive innovation within the industry, as companies strive to create oral solid dosage forms that align with patient preferences and lifestyles.

Increasing Demand for Chronic Disease Management

The rising prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders is driving the Oral Solid Dosage Pharmaceutical Market. As the population ages, the need for effective long-term treatment options becomes paramount. Oral solid dosage forms, including tablets and capsules, are preferred due to their ease of administration and patient compliance. According to recent data, chronic diseases account for approximately 70% of all deaths, highlighting the urgent need for effective pharmaceutical interventions. This trend suggests that pharmaceutical companies are likely to focus on developing innovative oral solid dosage forms to cater to this growing demand, thereby expanding their market presence.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are significantly impacting the Oral Solid Dosage Pharmaceutical Market. Innovations such as continuous manufacturing and 3D printing are revolutionizing the way oral solid dosage forms are produced. These technologies not only enhance production efficiency but also allow for greater customization of dosage forms. For instance, continuous manufacturing can reduce production times by up to 50%, thereby lowering costs and improving supply chain dynamics. As pharmaceutical companies adopt these cutting-edge technologies, the market is likely to see an influx of novel oral solid dosage products that meet diverse patient needs and preferences.