Organic Drinks Market Summary

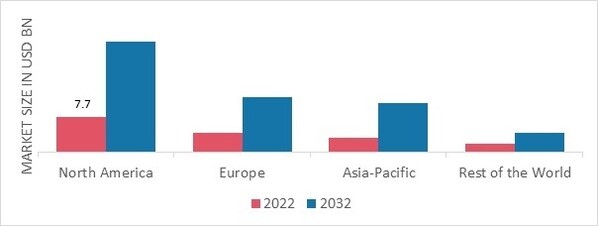

As per Market Research Future Analysis, the Global Organic Drinks Market was valued at USD 21.54 billion in 2024 and is projected to reach USD 69.95 billion by 2035, growing at a CAGR of 11.30% from 2025 to 2035. The market is driven by increasing health concerns, consumer preference for organic products, and the demand for innovative flavors. The non-alcoholic segment, particularly organic juices and teas, dominates the market, while store-based distribution channels, especially supermarkets, lead in sales. North America holds the largest market share, followed by Europe and Asia-Pacific, with significant growth in countries like the U.S., Germany, and China.

Key Market Trends & Highlights

Key trends driving the organic drinks market include health consciousness and innovative flavors.

- Organic Drinks Market Size in 2024: USD 21.54 billion.

- Projected Market Size by 2035: USD 69.95 billion.

- CAGR from 2025 to 2035: 11.30%.

- Non-Alcoholic Segment Revenue Share: 35%.

Market Size & Forecast

| 2024 Market Size | USD 21.54 billion |

| 2035 Market Size | USD 69.95 billion |

| CAGR (2024-2035) | 11.30% |

Major Players

Hain Celestial (U.S.), Suja Life LLC (U.S.), Coca-Cola Company (U.S.), Danone S.A. (France), Purity Organic LLC (U.S.), Better Drinks Co. (New Zealand), Parker's Organic Juices Pty Ltd (Australia), Bison Organic Beer (U.S.), James White Drinks Ltd. (U.K.), PepsiCo Inc. (U.S.), Nutrition & Sante Iberia S.L. (Spain), Republica Coffee (Australia), The WhiteWave Foods Company (U.S.), Alnatura Produktions & Handels GmbH (Germany).

Leave a Comment