Market Analysis

In-depth Analysis of Organic Food Preservatives Market Industry Landscape

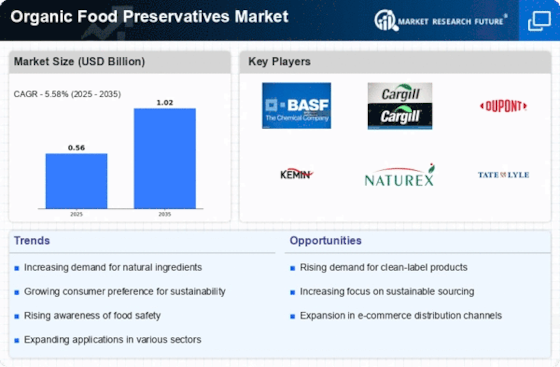

A variety of variables influence the marketplace trends in organic food preservatives market or sector, including public health worries, governmental regulations, plus developments in environmentally friendly preservation methods. The growing customer desire towards clean-label as well as natural goods constitutes one such variables driving the development within organic food preservatives market. While people grow increasingly concerned regarding the chemicals in what they eat, they have a growing need for alternatives that may increase the nutritional value of items with no using artificial chemicals. This change in buyer habits is driving organic food preservatives market or industry upward.

Sustainable development has a significant impact in the business changes regarding organic food preservatives. People are looking for more nutritious options while also emphasizing ecologically friendly as well as sustainable activities. Organic food preservatives, which are frequently produced primarily through organic materials including spices, plants, as well as extracts of plants, appeal to environmentally aware customers. The aforementioned preservatives are often produced using sustainable techniques, which eliminate the consumption regarding synthetic substances while decreasing their ecological impact. As ecology remains a more important factor in customer choice, the concerned organic food preservatives market or industry continues to grow.

International laws and approvals significantly influence market trends. Standards which include USDA Organic reassure customers about the legitimacy and caliber about organic food preservatives. Businesses that follow these guidelines have an edge over their competitors, as customers progressively choose items with verified organic certificates. The regulatory structures additionally oversee the research and distribution regarding organic food preservatives, guaranteeing their products fulfill rigorous quality and safety standards.

Regional characteristics give a new element to the marketplace landscape. Whilst North America along with Europe used to be crucial buyers of organic food preservatives because to their greater number of people who are health-conscious, rising nations throughout Asia-Pacific have observed greater interest. As knowledge of natural, organic goods rises across these locations, competitive conditions evolve, creating possibilities inside local along with foreign firms.

The concerned organic food preservatives market's rivalries are defined by discovery as well as the creation of unique compositions. Businesses make investments in R&D to find novel forms for organic stabilizers and improve the efficacy of current ones. A primary goal is to develop preservatives which not only improve the lifespan yet retain the taste and nutrient content of organic goods. Agreements as well as links with food producers also constitute frequent ways to broaden the market by integrating organic preservatives within a wide range of food items.

Considering favorable patterns, obstacles are affecting the sales structure for organic food preservatives. Certain ecological preservation' restricted availability alongside elevated costs may prevent acceptance, particularly in price conscious industries. Furthermore, teaching customers regarding the effectiveness regarding organic preservatives within contrast with artificial ones continues a problem, since opinions regarding organic ways to preserve might differ.

To summarize, customer preferences, environmental concerns, legal requirements, and geographical differences all have an impact upon organic food preservatives market or dynamics. Since the need towards clean-label & natural food products grows, the concerned organic food preservatives market or industry is poised for expansion. Businesses who handle the complexity of compliance with regulations, solve cost problems, and convey the advantages associated with organic preservatives have a good chance to succeed throughout this continuously shifting marketplace.

Leave a Comment