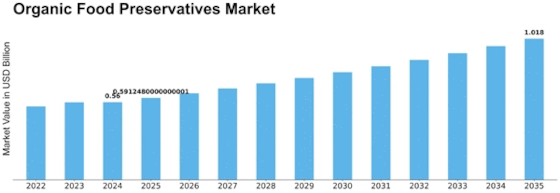

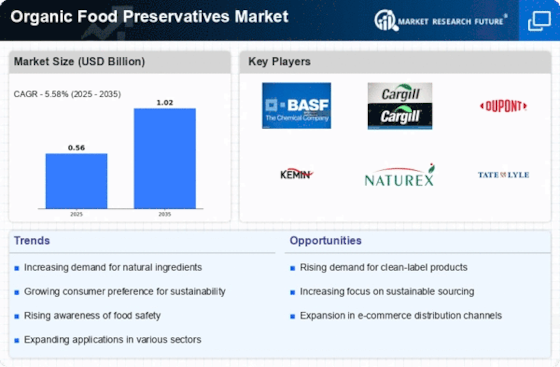

Organic Food Preservatives Size

Organic Food Preservatives Market Growth Projections and Opportunities

The Organic Food Preservatives Market has been influenced through a variety of variables, including the evolving environment of client preferences & the larger food manufacturing industry. The sector is being driven by increasing customer preference towards clean-label as well as organic food items. As people become more cognizant regarding the possible health dangers connected with artificial preservation agents, they are making an effort to find alternative methods that provide secure food while maintaining their item's basic character. Organic food preservatives, which are created through organic compounds with no additions of artificial ingredients, match with the trend favoring clean-label items, promoting their acceptance throughout the food and beverages business.

A further major marketing driver is the growing trend of health-conscious consumers. Considering an increased emphasis towards general health and preventative medical care, individuals pay greater consideration to the nutrients inside what they eat. Organic food preservatives, which are generally produced through spices, herbicides, and various other renewable resources, are thought to be healthier than artificial alternatives. This increased knowledge of the effects of additives on wellness is increasing popularity of organic alternatives which adhere to the nutritional ideals of a meal which is well-balanced and nutritious.

External influences have an important influence in driving market conditions. Organic food preservatives frequently have a link with ecologically and environmentally beneficial techniques. Organic substances, ecologically responsible recruiting, and little processing are all designed to reduce their ecological imprint, making it tempting to environmental consciousness users. As ecology grows increasingly important in buying choices, the demand of organic food preservatives will continue to expand.

The marketplace is also impacted through the general increase towards organic and natural eating. Since people adopt a natural way of life & want goods devoid of chemicals, the need of organic food preservatives keeps increasing. The need spans a wide range of food-related sectors, especially bread, milk products, drinks, as well as manufactured goods, as producers adjust to customer choices by integrating organic preservatives inside their formulas.

Improving eating habits as well as desire towards less junk food are also helping to drive expansion Organic Food Preservatives Market. Buyers choose meals that are seen to be greater healthy and similar in flavor to their genuine nature. Organic food preservatives, which have been criticized as conventional techniques of food conservation, align to the need for less-processed solutions, enabling customers to get the advantages of conservation while sacrificing the nutritious integrity of the item.

Financial variables, such as increased money to spend, contribute to the marketplace's growth. As consumer buying power grows, many are prepared to spend money on luxury and sustainable products. Organic food preservatives, marketed because outstanding components on account of its organic along with herbal identification, attract to customers seeking more superior and more nutritious food.

Regulations also help to shape the market environment. To create legitimacy and acquire customer confidence, players in the market have to stick to certified organic criteria and follow food hygiene rules. Since authorities prioritize openness and excellence in the production of food, acquiring and keeping organic certifications grows increasingly important for the commercial achievement regarding organic food preservatives.

To summarize, the concerned Organic Food Preservatives Market has been influenced via a number of variables, comprising consumer tastes towards clean-label & organic goods, healthy actions, ecological issues, diet changes, economic circumstances, and laws and regulations. While consumer preference of organic food preservation solutions rises, the industry is set to expand. Organic food preservatives are distinctive in their posture as secure, organic, along with ecologically friendly options, making them significant actors in the growing preserve food scene.

Leave a Comment