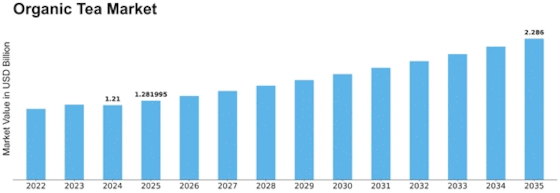

Organic Tea Size

Organic Tea Market Growth Projections and Opportunities

The Organic Tea Market is experiencing notable growth, fueled by a convergence of factors that reflect shifting consumer preferences towards healthier and more sustainable beverage choices. One significant driving force is the increasing awareness of the health benefits associated with organic tea consumption. Organic tea, cultivated without synthetic pesticides or fertilizers, is perceived as a cleaner and more natural option. Consumers are drawn to the potential health-promoting properties of organic tea, which is often rich in antioxidants and free from harmful residues, aligning with the broader trend of health-conscious living.

Environmental sustainability is a key factor shaping the Organic Tea Market. Organic farming practices prioritize soil health, biodiversity, and ecosystem preservation. By avoiding the use of synthetic chemicals, organic tea cultivation minimizes environmental impact, including soil and water contamination. As eco-conscious consumers seek products with a reduced carbon footprint, the sustainability aspect of organic tea production contributes significantly to its market growth.

Cultural and lifestyle factors also play a substantial role in influencing the Organic Tea Market. Tea has a deep-rooted cultural significance in various societies, and the demand for organic tea reflects a desire for a more authentic and traditional experience. Additionally, the ritualistic nature of tea consumption aligns with a growing interest in mindfulness and wellness practices. As consumers seek beverages that offer a moment of tranquility and a connection to nature, the demand for organic tea as a holistic and mindful choice is on the rise.

The regulatory environment is a critical factor shaping the Organic Tea Market. Certification bodies and government regulations ensure that products labeled as organic meet specific standards. The adherence to these standards is vital for maintaining consumer trust and ensuring the integrity of the organic label. Regulatory compliance encompasses various aspects, including organic farming practices, labeling requirements, and the absence of synthetic additives, influencing market practices and consumer perceptions.

Economic factors, including consumer purchasing power and pricing dynamics, impact the Organic Tea Market. Organic tea products are often positioned as premium offerings due to the costs associated with organic farming practices and certification processes. Consumer willingness to pay a premium for organic products is influenced by factors such as perceived health benefits, environmental concerns, and overall lifestyle choices. Economic conditions, pricing strategies, and market accessibility are integral components that shape the market's trajectory.

Competitive factors and industry dynamics contribute to the Organic Tea Market's evolution. The market is characterized by the presence of established tea producers as well as new entrants focusing exclusively on organic offerings. Branding, marketing strategies, and product differentiation are essential elements for companies aiming to capture a share of the growing organic tea market. Partnerships with ethical and sustainable suppliers, transparent sourcing practices, and certifications play a crucial role in building consumer trust in a competitive landscape.

Innovation in product development and tea varieties is another factor influencing the Organic Tea Market. Manufacturers continually strive to introduce new organic tea blends, flavors, and formats to cater to diverse consumer preferences. The availability of unique and innovative organic tea options contributes to market differentiation and captures the interest of consumers seeking novel and flavorful experiences.

Leave a Comment