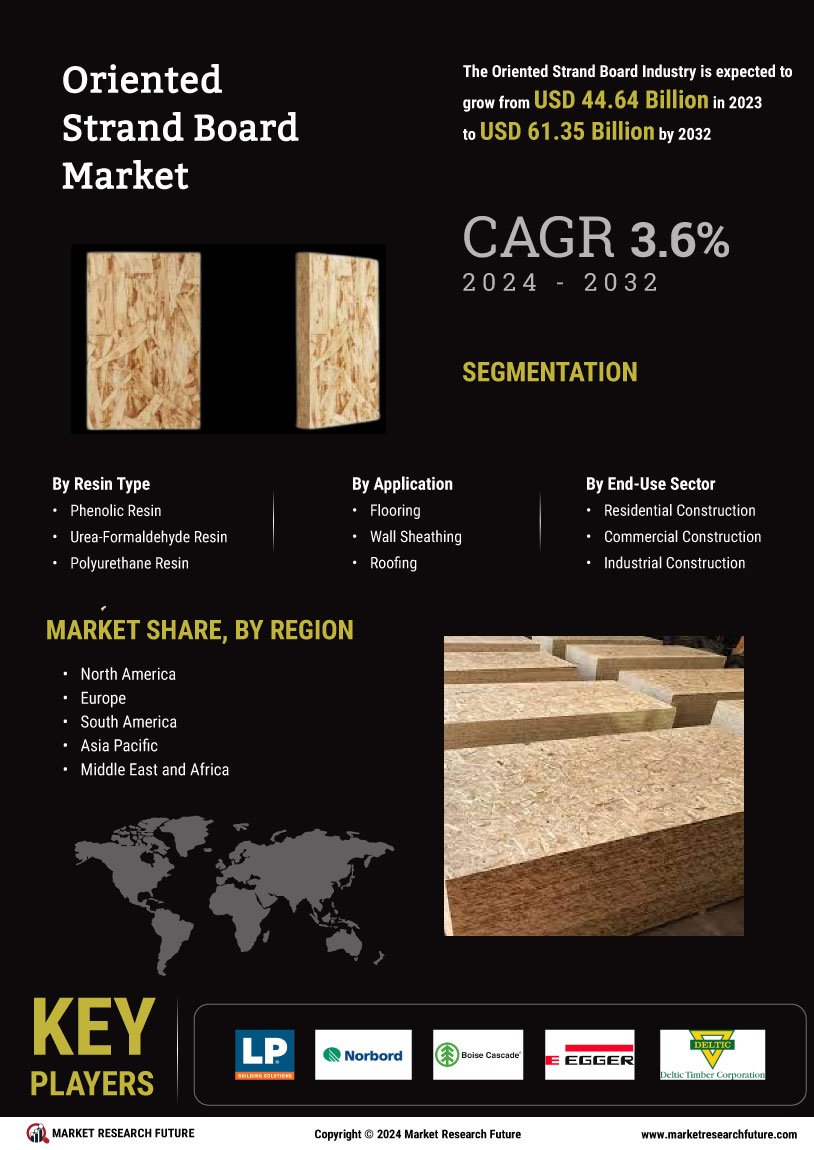

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Oriented Strand Board Market. As consumers and manufacturers alike prioritize eco-friendly materials, the demand for oriented strand board, which is made from renewable resources, is likely to rise. This material is often viewed as a sustainable alternative to traditional plywood, as it utilizes smaller trees and wood residues, thereby reducing waste. In recent years, the market has seen a notable shift, with a reported increase in the use of oriented strand board in construction and furniture applications. The sustainability initiatives adopted by various industries may further bolster the growth of the Oriented Strand Board Market, as companies seek to align with environmental regulations and consumer preferences.

Technological Advancements

Technological innovations in the production processes of oriented strand board are likely to enhance the efficiency and quality of the product. The introduction of advanced manufacturing techniques, such as improved adhesive formulations and automated production lines, has the potential to reduce costs and increase output. These advancements may also lead to the development of specialized oriented strand boards that cater to specific applications, such as fire-resistant or moisture-resistant variants. As the Oriented Strand Board Market continues to evolve, these technological improvements could play a crucial role in meeting the diverse needs of consumers and industries, thereby driving market growth.

Construction Sector Expansion

The ongoing expansion of the construction sector is a significant driver for the Oriented Strand Board Market. With urbanization trends leading to increased housing demands, the use of oriented strand board in residential and commercial construction is likely to grow. Reports indicate that the construction industry has experienced a steady increase in investment, which correlates with a rising demand for cost-effective and durable building materials. Oriented strand board, known for its strength and versatility, is often favored for structural applications, including wall sheathing and flooring. This trend suggests that the Oriented Strand Board Market is poised for growth as construction activities ramp up.

Rising Demand in Furniture Manufacturing

The furniture manufacturing sector is witnessing a growing preference for oriented strand board, which serves as a key driver for the Oriented Strand Board Market. The material's cost-effectiveness, coupled with its aesthetic appeal, makes it an attractive choice for furniture designers and manufacturers. Recent data suggests that the furniture industry has seen a shift towards using engineered wood products, including oriented strand board, due to their durability and design flexibility. This trend indicates a potential increase in the market share of oriented strand board within the furniture sector, further propelling the growth of the Oriented Strand Board Market.

Regulatory Support for Sustainable Materials

Regulatory frameworks promoting the use of sustainable materials are expected to positively influence the Oriented Strand Board Market. Governments worldwide are increasingly implementing policies that encourage the adoption of eco-friendly building materials, which may include oriented strand board. These regulations often aim to reduce carbon footprints and promote sustainable forestry practices. As a result, manufacturers in the Oriented Strand Board Market may find themselves benefiting from incentives and support for producing environmentally responsible products. This regulatory backing could enhance market competitiveness and drive further adoption of oriented strand board in various applications.