Aging Population

The increasing proportion of elderly individuals worldwide is a primary driver for the Orthopedic Support System Market. As people age, they often experience musculoskeletal disorders, leading to a higher demand for orthopedic support products. According to recent statistics, the population aged 65 and older is projected to reach 1.5 billion by 2050, which suggests a substantial market for orthopedic solutions. This demographic shift necessitates the development of innovative orthopedic support systems tailored to the needs of older adults, thereby propelling market growth. Furthermore, the prevalence of conditions such as arthritis and osteoporosis among the elderly population underscores the importance of effective orthopedic support systems in enhancing mobility and quality of life.

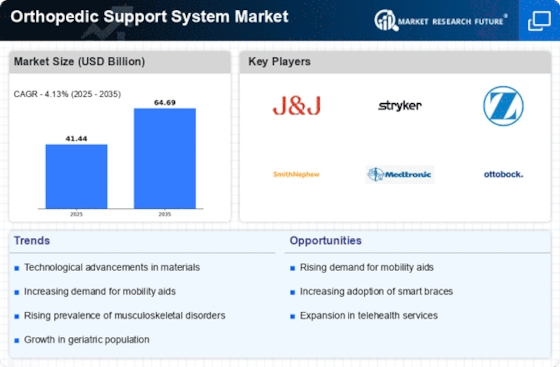

Technological Innovations

Technological advancements in materials and design are revolutionizing the Orthopedic Support System Market. Innovations such as 3D printing, smart materials, and biomechanical engineering are enabling the development of more effective and comfortable orthopedic supports. For instance, the introduction of lightweight, breathable materials enhances user comfort, while smart technologies allow for real-time monitoring of recovery progress. The market for orthopedic devices is expected to grow at a compound annual growth rate of around 6% over the next five years, driven by these technological innovations. As manufacturers continue to invest in research and development, the availability of cutting-edge orthopedic support systems is likely to expand, catering to diverse consumer needs.

Rising Sports Participation

The growing interest in sports and physical activities among various age groups is significantly influencing the Orthopedic Support System Market. Increased participation in sports leads to a higher incidence of injuries, which in turn drives the demand for orthopedic support products. Recent data indicates that approximately 30 million children and teens participate in organized sports in the United States alone, highlighting a substantial market potential. As awareness of injury prevention and recovery strategies rises, athletes and active individuals are increasingly seeking advanced orthopedic support systems to enhance performance and ensure safety. This trend is likely to continue, further stimulating market growth as more individuals engage in physical activities.

Increased Healthcare Expenditure

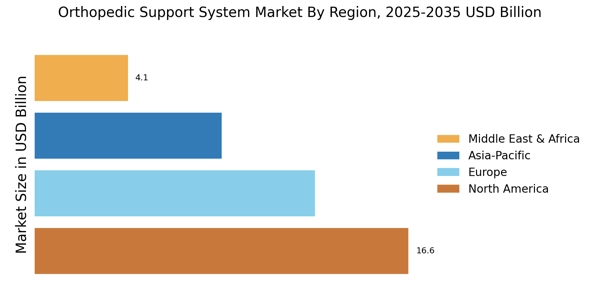

Rising healthcare expenditure across various regions is a significant driver for the Orthopedic Support System Market. As governments and private sectors allocate more resources to healthcare, the accessibility and affordability of orthopedic support products improve. Recent reports indicate that healthcare spending is expected to reach 10 trillion USD by 2025, which could enhance the market for orthopedic solutions. This increase in expenditure allows for better healthcare infrastructure, leading to more effective treatment options and rehabilitation services. Consequently, patients are more likely to invest in orthopedic support systems, thereby driving market growth. The correlation between healthcare spending and the demand for orthopedic products is becoming increasingly evident.

Growing Awareness of Preventive Care

The rising awareness of preventive care and the importance of maintaining musculoskeletal health is a key driver for the Orthopedic Support System Market. As individuals become more informed about the benefits of preventive measures, there is a growing inclination towards using orthopedic supports to prevent injuries and manage existing conditions. Educational campaigns and health initiatives are promoting the use of orthopedic support systems as part of a proactive approach to health. This trend is likely to result in an increased demand for various orthopedic products, as consumers seek to enhance their overall well-being. The emphasis on preventive care is expected to shape the future landscape of the orthopedic support market.