Diverse Content Offerings

The OTT TV and Video Market is characterized by an increasing diversity of content offerings, catering to a wide range of audience preferences. Streaming platforms are investing heavily in original programming, with expenditures reaching over 100 billion dollars in recent years. This investment not only enhances the variety of available content but also attracts subscribers seeking exclusive shows and films. Furthermore, the inclusion of international content is becoming more prevalent, allowing platforms to appeal to diverse demographics. As a result, the OTT TV and Video Market is likely to see continued growth, as consumers are drawn to platforms that provide unique and varied content experiences.

Changing Consumer Behavior

The OTT TV and Video Market is witnessing a notable shift in consumer behavior, with audiences increasingly favoring on-demand content over traditional television. Recent surveys indicate that over 70% of viewers prefer streaming services for their flexibility and variety. This change is driven by the desire for personalized viewing experiences, as consumers seek content that aligns with their interests and schedules. Additionally, the rise of binge-watching culture has led to increased consumption of series and films, further propelling the growth of OTT platforms. As more consumers abandon cable subscriptions in favor of streaming services, the OTT TV and Video Market is likely to expand, attracting new players and fostering innovation in content delivery.

Competitive Pricing Models

The OTT TV and Video Market is evolving with the introduction of competitive pricing models that appeal to a broad audience. Subscription-based services, ad-supported models, and hybrid approaches are becoming increasingly common, allowing consumers to choose options that best fit their budgets. Recent data suggests that ad-supported streaming services are gaining traction, with a projected growth rate of 20% annually. This flexibility in pricing is attracting a wider range of viewers, including those who may have previously been deterred by high subscription costs. As competition intensifies, the OTT TV and Video Market is likely to see further innovation in pricing strategies, which may enhance accessibility and drive subscriber growth.

Technological Advancements

The OTT TV and Video Market is experiencing rapid technological advancements that enhance user experience and content delivery. Innovations such as 5G technology and improved broadband infrastructure are facilitating faster streaming and higher quality video. According to recent data, the adoption of 5G is expected to reach 1.5 billion subscriptions by 2025, which could significantly impact the OTT landscape. Enhanced streaming capabilities allow for seamless viewing experiences, attracting more subscribers. Furthermore, advancements in artificial intelligence and machine learning are enabling personalized content recommendations, which may lead to increased viewer engagement. As technology continues to evolve, the OTT TV and Video Market is likely to benefit from these developments, potentially leading to higher revenue streams and a more competitive environment.

Global Expansion of Streaming Services

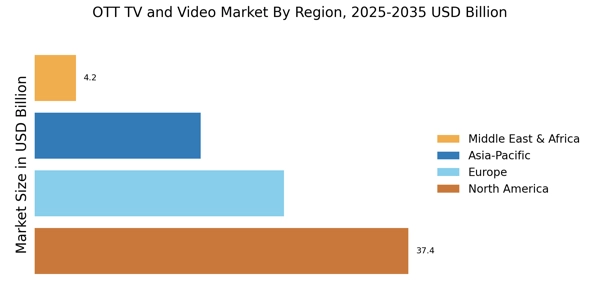

The OTT TV and Video Market is experiencing a significant expansion as streaming services penetrate new markets. Companies are increasingly targeting regions with growing internet access and smartphone penetration, which are projected to reach 80% in many developing areas by 2025. This expansion is not only increasing the subscriber base but also fostering local content production, as platforms seek to cater to regional tastes and preferences. The entry of international players into these markets is likely to intensify competition, driving innovation and improving content quality. As a result, the OTT TV and Video Market is poised for substantial growth, with new opportunities emerging in previously underserved regions.