Market Trends

Key Emerging Trends in the Oxygen-Free Copper Market

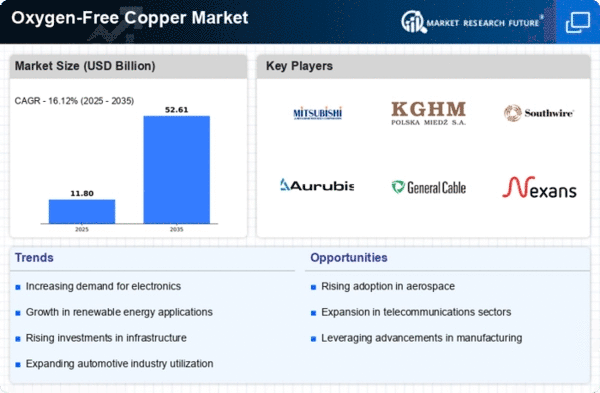

Several things are causing the Oxygen-Free Copper (OFC) Market to change quickly. These things affect its path in the manufacturing and technology industries. These major trends show how the market is changing and what is making people want high-purity copper. The demand for high-quality electrical materials like oxygen-free copper is growing because more and more electronic products are being made, from smartphones to electric cars. Because gadgets are getting smarter, we need copper that has less air in it to make sure it works well and conducts electricity well. 5G technology is making it possible for communication networks to grow, which is increasing the need for oxygen-free copper in the production of wires and connections. Because it makes data transfer more efficient, high-purity copper is the best material for building strong, high-performance communication infrastructure. Solar and wind power are examples of green energy that depends on good electrical transmission to make and send power. Low electrical resistance makes oxygen-free copper useful in green energy uses because it helps move energy around more efficiently and lose less power. The demand for oxygen-free copper in different parts of vehicles is rising because more and more cars are becoming electric, like electric vehicles (EVs) and hybrid vehicles. Copper's good conductivity is a key factor in making sure that electric car power systems work well and are reliable. The demand for high-purity copper in the making of medical products is growing because the healthcare business depends on high-tech medical equipment. Oxygen-free copper makes sure that the electrical parts of medical tools are accurate and reliable, which helps to move healthcare technologies forward. More and more, manufacturers are making oxygen-free copper metals that can be made to fit the needs of a particular purpose. These special metals are used in many different fields, and their electrical, thermal, and mechanical qualities can be tweaked to fit the needs of each one. Issues in the world's supply chain have made it harder to get raw ingredients and make oxygen-free copper. Changes in supply lines, which are often caused by natural disasters and international issues, make markets more volatile and change how prices change. Environmentally friendly methods are being used to make oxygen-free copper because of a focus on long-term industrial processes. To meet the rising demand for sustainable products, businesses are looking into eco-friendly methods such as recycling and responsible buying. The oxygen-free copper market is being affected by the use of digital technologies and Industry 4.0 ideas in production. More efficient, better quality control, and easier tracking are all benefits of using smart manufacturing methods to make high-purity copper. Researchers and developers are still working on ways to make oxygen-free copper work better. Copper has better dynamic qualities, lower resistance to rust, and better conductivity thanks to new material designs and processing methods.

Leave a Comment