Market Trends

Key Emerging Trends in the Pain Relief Medication Market

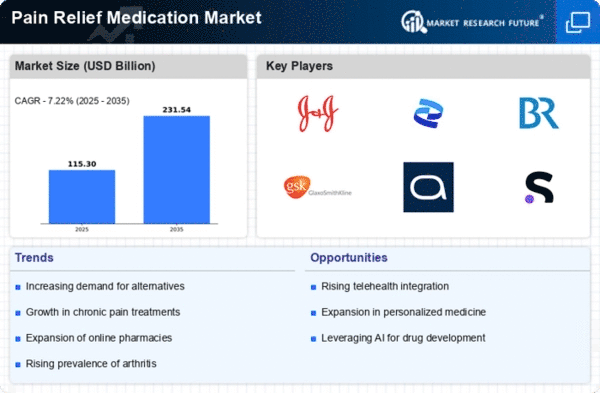

The pain relief medication market is experiencing steady growth due to the rising prevalence of acute and chronic pain conditions worldwide, driven by factors such as aging populations, sedentary lifestyles, and the increasing incidence of injuries and musculoskeletal disorders. The opioid crisis has led to increased scrutiny and regulatory restrictions on opioid pain medications, driving a shift towards safer and more effective non-opioid alternatives for pain management, such as nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, and adjuvant therapies. There is a growing preference for over-the-counter (OTC) pain relief medications, including ibuprofen, aspirin, and naproxen, due to their accessibility, affordability, and perceived safety compared to prescription opioids, driving market growth in the OTC segment. Non-pharmacological approaches to pain management, such as physical therapy, acupuncture, massage therapy, and cognitive-behavioral therapy, are gaining popularity as complementary or alternative treatments to pain relief medications, driving demand for integrative pain management solutions.

Innovations in drug delivery technologies, such as transdermal patches, extended-release formulations, and nasal sprays, are improving the efficacy, safety, and patient adherence of pain relief medications, driving market innovation and product differentiation. There is a growing focus on targeted pain relief therapies that address specific pain pathways and mechanisms, such as nerve blocks, spinal cord stimulation, and radiofrequency ablation, offering personalized treatment options for individuals with chronic and neuropathic pain conditions. Cannabinoid-based therapies, including medical cannabis and cannabidiol (CBD) products, are gaining acceptance as adjunctive treatments for chronic pain management, driving market expansion in the emerging cannabis therapeutics sector. Regulatory frameworks governing the prescription and use of pain relief medications, particularly opioids, vary by region and are subject to evolving guidelines and restrictions aimed at mitigating the risks of addiction, overdose, and misuse, influencing market dynamics and prescribing practices.

The integration of telemedicine and digital health platforms into pain management practices, including virtual consultations, remote monitoring apps, and tele-rehabilitation programs, is expanding access to pain relief medications and multidisciplinary pain care services, driving market growth. There is increasing recognition of the unique pain management needs of pediatric patients, driving demand for pediatric-specific pain relief medications, dosage forms, and treatment protocols tailored to the developmental stages and preferences of children and adolescents.

Geriatric patients represent a growing demographic with unique pain management challenges related to age-related comorbidities, polypharmacy, and physiological changes, driving demand for age-appropriate pain relief medications and geriatric-focused pain management strategies. Healthcare providers and consumers are prioritizing pain relief medications that offer a favorable balance of safety, efficacy, and tolerability, driving demand for evidence-based treatments, standardized protocols, and post-marketing surveillance to monitor adverse events and long-term outcomes. Patient-centric care models, including shared decision-making, patient education, and holistic pain management approaches, are driving demand for personalized pain relief solutions that address the physical, emotional, and psychosocial aspects of pain, fostering patient empowerment and engagement in their treatment. The pain relief medication market is experiencing global expansion, with emerging markets in regions such as Asia-Pacific, Latin America, and the Middle East presenting untapped opportunities for market growth due to increasing healthcare infrastructure development, rising disposable incomes, and expanding access to pain management services. Collaborative research initiatives between academia, industry, and healthcare organizations are driving advancements in pain relief medication development, including novel drug targets, formulations, and combination therapies, leading to the discovery of innovative treatments and improved patient outcomes in the market.

Leave a Comment