Research Methodology on Pallet Racking Market

The primary objective of this research report is to assess the current market trends and developments in the Global Pallet Racking Market and estimate its current market size. The research is based on extensive secondary research and analysis concerning the historical, current and forecasted market state for the considered period. The research process works on the combination of primary and secondary research sources. Secondary research forms the initial stage of market research that acts as the underlying foundation of the entire research process. It is used to ascertain the market size and forecast. For primary research, surveys, interviews and other sources are used.

Secondary Research Sources

Secondary research studies are conducted by the research team to obtain crucial data regarding the Pallet Racking Market such as market dynamics, market landscape, segmentation, and value chain analysis. Secondary data sources consist of published sources such as product brochures, whitepapers, whitepapers, magazine articles and company websites. Other sources include industry organizations, trade associations, trade magazines, print databases and survey studies.

Primary Research Sources

To fulfil the qualitative research criteria, a market survey is conducted to gain insights from the various stakeholders in the market. The survey involves a two-stage process. Firstly, the survey is distributed among Select Market Expertise such as CEOs, CFOs, and many professionals working in the Global Pallet Racking Market. The Contact lists comprise key personnel in the market, who provide qualitatively and quantitatively important data. Secondly, face-to-face interviews are conducted with the selected industry players who gave an in-depth insight into the Global Pallet Racking Market.

Data Collection, Triangulation and Estimation

The secondary sources provide the required information for the compilation of the overall market size. The collected data is then verified and cross-checked with relevant data sources for accuracy. Primary sources are used to obtain a better understanding of the current market dynamics, industry trends, and the competitive landscape. The data collected is then triangulated with the secondary sources, where any discrepancies are rectified and further validated.

The research is conducted using various data triangulation methods like Supply Side Triangulation, Buyer Side Triangulation, Qualitative and Quantitative Triangulation, and Financial Triangulation. The data collected is triangulated using equations to assess and benchmark the collected data to evolve researched estimates. The benchmarking process ensures the soundness and effectiveness of the estimates by his means.

Data Analysis

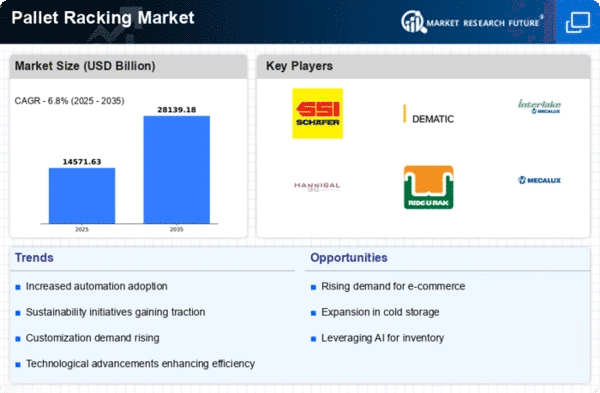

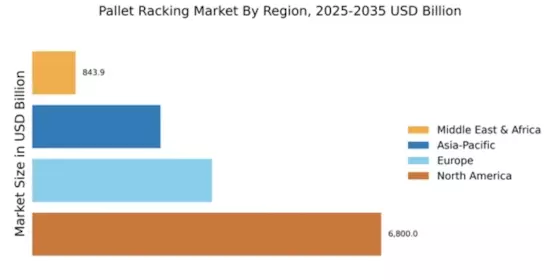

The research team performed a comprehensive analysis of the Global Pallet Racking Market. Included in the analysis are evaluations of current trends, expected trends, opportunities and challenges that are undergone by the market. The analysis is used to estimate the market size and static of the overall market.

Market Validation

The data collected is verified and cross-checked with relevant sources such as trade magazines, trade associations, financial reports, and other primary and secondary sources. The market validation process ensures the accuracy of the data collected and therefore led to an overall impactful analysis.

Final Reports

The research team coalesced all the primary and secondary research to provide an exhaustive picture of the Global Pallet Racking Market. The data is then analysed and leveraged to provide a coherent and clear picture of the market. The research team leveraged various analytical tools such as SWOT analysis, Porter’s Five Force Model, Value Chain Analysis, and Cost Benefit Analysis to provide services to their clients in the best manner. The detailed market research study is presented in the final report.