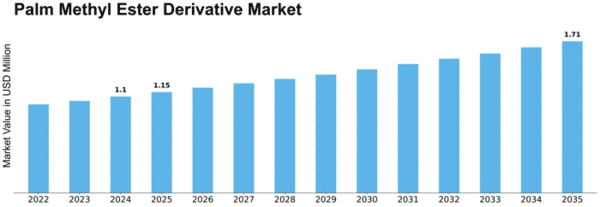

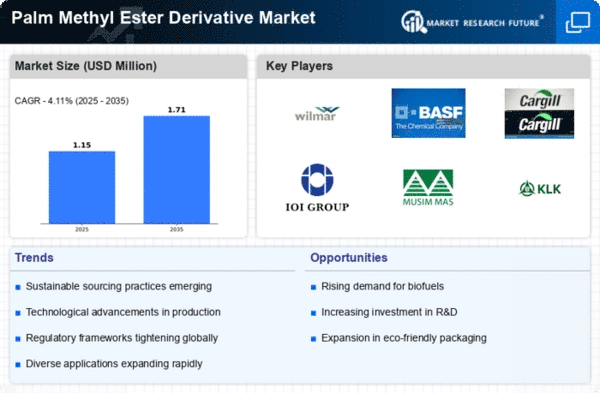

Palm Methyl Ester Derivative Size

Palm Methyl Ester Derivative Market Growth Projections and Opportunities

The global biofuel additives market has been on a steady rise, marked by significant growth and expansion. In 2021, the market soared to a valuation of USD 13,274.13 million, showing remarkable potential. Forecasts suggest that by 2030, it's poised to surge further, reaching a staggering value of USD 27,230.97 million, exhibiting an impressive Compound Annual Growth Rate (CAGR) of 8.90%. In addition to the soaring values, the market's volume stands out, starting at 24,396.25 kilo tons in 2021 and projected to expand to 43,277.70 kilo tons by 2030, with a projected CAGR of 7.05% during this period.

This upward trajectory in the global biofuel additives market owes much to the burgeoning demand for biofuels across various sectors. Specifically, the automotive industry has been a significant driver of this growth, especially in the domain of commercial vehicles. As environmental concerns continue to escalate, the quest for cleaner and more sustainable energy sources has intensified, leading to a notable surge in the demand for biofuels. This trend is further accentuated by the adoption of biofuels as an alternative to traditional fossil fuels in commercial vehicles, reflecting a broader shift toward eco-friendly and renewable energy solutions.

The utilization of biofuel additives, especially in the automotive landscape, has played a pivotal role in enhancing the performance and efficiency of biofuels. These additives serve to improve the overall quality and properties of biofuels, making them more compatible with existing engines while also addressing issues related to stability, corrosion, and emissions. Consequently, the growing incorporation of biofuel additives has not only met the industry's stringent standards but has also spurred the widespread adoption of biofuels, particularly in commercial vehicle operations.

The significant growth projected for the biofuel additives market underscores the transformative role of these additives in optimizing the efficacy of biofuels, catering to the escalating demand for sustainable energy solutions. As industries increasingly prioritize environmental sustainability, the demand for biofuel additives is poised to continue its upward trajectory, reshaping the landscape of the global energy market.

Leave a Comment